Get the free Financial Planning Registration Form - gvsu

Show details

This form is for registering for the FPC 399 Review Course, a CFP Board-Registered review course meant as preparation for the CFP® Examination. It includes details for payment, deadlines, and course

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial planning registration form

Edit your financial planning registration form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial planning registration form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial planning registration form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial planning registration form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

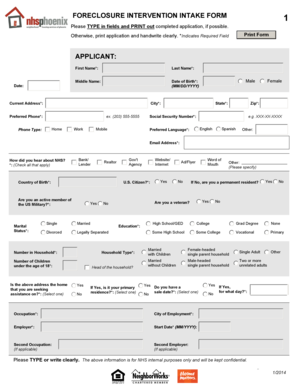

How to fill out financial planning registration form

How to fill out Financial Planning Registration Form

01

Start by downloading the Financial Planning Registration Form from the official website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide your financial details, such as income, expenses, assets, and liabilities.

05

Include any relevant financial goals or objectives you wish to achieve.

06

Review all the information you provided to ensure accuracy.

07

Sign the form where indicated to certify the information is true.

08

Submit the completed form as instructed, either online or by mailing it to the designated address.

Who needs Financial Planning Registration Form?

01

Individuals seeking professional financial advice and planning services.

02

Families looking to organize their financial goals and investments.

03

Small business owners needing guidance on financial management.

04

Students aiming to plan for future financial stability.

05

Anyone interested in retirement planning and wealth management.

Fill

form

: Try Risk Free

People Also Ask about

What is financial planning in English?

While 1.5% is on the higher end for financial advisor services, if that's what it takes to get the returns you want, then it's not overpaying, so to speak. Staying around 1% for your fee may be standard, but it certainly isn't the high end. You need to decide what you're willing to pay for what you're receiving.

What is financial planning in simple words?

The four main types of financial planning are cash flow planning, tax planning, investment planning, and retirement planning. Each of these types of financial planning has different goals, concerns, and objectives.

Is 2% fee high for a financial advisor?

Definition of Financial Planning It includes analyzing the current financial situation, setting short and long-term goals, developing and implementing strategies to achieve these goals and continuously monitoring and adjusting financial strategies.

What is a red flag for a financial advisor?

Look for financial planners who are fiduciaries, which means they have a legal duty to look out for your best interests. "If a 'financial planner' offers the same advice or products without tailoring their recommendations to your individual goals, that's a red flag," says Lawrence. Want to earn more money at work?

What are the four main 4 types of financial planning?

Financial planners provide money management services and financial guidance to clients. They assess their clients' finances and develop plans to help them invest their money, accumulate savings for retirement and preserve their existing wealth.

What exactly does a financial planner do?

Financial Planning Steps – From Start To Finish Establish Clear Goals. Gather and Organize Financial Information. Analyzing Your Current Financial Situation. Develop a Comprehensive Financial Plan. Put Your Financial Plan into Action. Monitor Your Progress and Make Adjustments. Revise and Update Your Financial Plan Over Time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Planning Registration Form?

The Financial Planning Registration Form is a document used by individuals or firms to formally register their financial planning services with relevant authorities or regulatory bodies.

Who is required to file Financial Planning Registration Form?

Individuals or firms providing financial planning services, including financial advisors, planners, or firms offering investment advice, are typically required to file the Financial Planning Registration Form.

How to fill out Financial Planning Registration Form?

To fill out the Financial Planning Registration Form, provide accurate personal and professional information, including qualifications, work experience, services offered, and any relevant disclosures as required by the regulatory authority.

What is the purpose of Financial Planning Registration Form?

The purpose of the Financial Planning Registration Form is to ensure compliance with regulatory standards, provide transparency in the financial planning industry, and protect consumers by allowing them to verify the credentials of financial planners.

What information must be reported on Financial Planning Registration Form?

The Financial Planning Registration Form typically requires information such as the applicant's personal details, business structure, educational background, professional experience, types of services provided, fee structures, regulatory history, and any potential conflicts of interest.

Fill out your financial planning registration form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Planning Registration Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.