Get the free Gifts-In-Kind Policies, Procedures and General Information - gbcnv

Show details

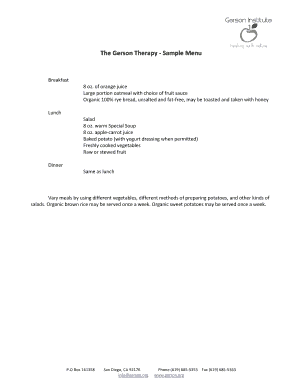

This document outlines the policies and procedures for accepting and managing gifts-in-kind for Great Basin College, including evaluation, documentation, and donor correspondence requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts-in-kind policies procedures and

Edit your gifts-in-kind policies procedures and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts-in-kind policies procedures and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gifts-in-kind policies procedures and online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gifts-in-kind policies procedures and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifts-in-kind policies procedures and

How to fill out Gifts-In-Kind Policies, Procedures and General Information

01

Begin by reviewing the organization's mission and values to align the policy with its goals.

02

Outline the definition of Gifts-In-Kind and provide examples relevant to the organization.

03

Specify eligibility criteria for accepting Gifts-In-Kind, including types of items and conditions.

04

Detail the procedures for staff and donors on how to offer Gifts-In-Kind, including any necessary forms or documentation.

05

Establish a process for reviewing and approving Gifts-In-Kind, including responsible parties.

06

Include guidelines for the valuation of Gifts-In-Kind and provide resources for donors to assess value.

07

Describe the record-keeping requirements, including how and where gifts will be documented.

08

Outline the acknowledgment process for donors, including any tax receipts or letters of thanks.

09

Review policies periodically to ensure they remain compliant with laws and relevant regulations.

Who needs Gifts-In-Kind Policies, Procedures and General Information?

01

Nonprofit organizations that accept donations of goods or services.

02

Donors who wish to understand how their in-kind donations will be utilized.

03

Board members and staff responsible for fundraising and financial management.

04

Auditors and compliance officers who need to ensure proper recording and valuation of gifts.

05

Volunteers who may be involved in the acceptance and distribution of donations.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an in-kind gift?

An in-kind donation is the transfer of any other type of asset. In-kind gifts are contributions of goods or services, other than cash grants. Examples of in-kind gifts include: Goods, like computers, software, furniture, and office equipment, for use by your organization or for special event auctions.

What are examples of gifts in kind?

An in-kind donation is the transfer of any other type of asset. In-kind gifts are contributions of goods or services, other than cash grants. Examples of in-kind gifts include: Goods, like computers, software, furniture, and office equipment, for use by your organization or for special event auctions.

What are the IRS guidelines for gifts in kind?

Provide a written acknowledgment to the item's donor. In-kind donations of property are typically tax deductible, but the IRS will not allow taxpayers to deduct contributions of $250 or more unless they obtain a written acknowledgment from the recipient charitable organization.

How do you document in-kind donations?

Here is a simple example of an acknowledgment statement to an in-kind donation: “Thank you for your contribution of [detailed description of goods/services] that [name nonprofit] received on _ [date of receipt]. No goods or services were provided in exchange for your contribution.

What is an example of in-kind support?

There are a few types of in-kind donations, some of which your nonprofit may find more valuable than others. Goods. These are tangible donations — they can be items for your constituents, such as clothing and toys, or goods for your nonprofit's use, such as office equipment.

What is the in-kind gift policy?

In short, in-kind donations generally refer to any non-monetary contributions made to a nonprofit organization. Instead of providing cash, donors give goods, services, or other tangible and intangible resources that support the nonprofit's work — and reduce their expenses.

What are the rules for gifts-in-kind?

Standards for gifts in kind The principles include: Need driven: Driven by a genuine and thorough understanding of the needs of the recipients. Quality controlled: Goods are carefully chosen, of appropriate quality, and in consultation with the recipient. Determined by informed choices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Gifts-In-Kind Policies, Procedures and General Information?

Gifts-In-Kind Policies, Procedures and General Information refers to the guidelines and processes that organizations must follow to properly accept, manage, and report non-cash donations, such as goods and services, ensuring compliance with legal and accounting standards.

Who is required to file Gifts-In-Kind Policies, Procedures and General Information?

Organizations that receive non-cash donations or gifts, including nonprofits, charities, and educational institutions, are required to file Gifts-In-Kind Policies, Procedures and General Information.

How to fill out Gifts-In-Kind Policies, Procedures and General Information?

To fill out Gifts-In-Kind Policies, Procedures and General Information, organizations should gather details about the gifts received, categorize the type of gift, assign a fair market value, document the donor's information, and ensure all required signatures are obtained for proper acknowledgment.

What is the purpose of Gifts-In-Kind Policies, Procedures and General Information?

The purpose of Gifts-In-Kind Policies, Procedures and General Information is to provide a structured approach for organizations to manage non-cash donations effectively, ensuring transparency, compliance with regulations, and accurate financial reporting.

What information must be reported on Gifts-In-Kind Policies, Procedures and General Information?

The information that must be reported includes the donor's name, description of the gift, value of the gift, date of the gift, and any terms or conditions associated with the gift.

Fill out your gifts-in-kind policies procedures and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts-In-Kind Policies Procedures And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.