Get the free Permanent Fund Increase Form - isu

Show details

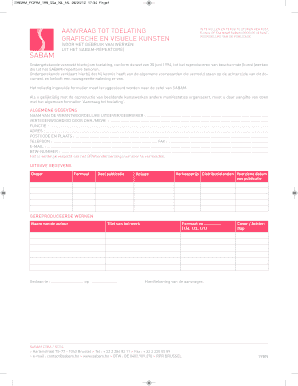

A form used to request an increase in the designated change fund or petty cash fund for a department, specifying the authorized amount and reasons for the increase.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign permanent fund increase form

Edit your permanent fund increase form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your permanent fund increase form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing permanent fund increase form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit permanent fund increase form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out permanent fund increase form

How to fill out Permanent Fund Increase Form

01

Obtain the Permanent Fund Increase Form from the official website or office.

02

Read the instructions carefully before starting to fill out the form.

03

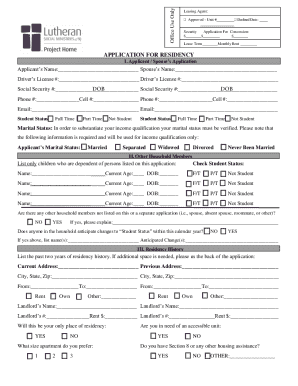

Provide your personal information in the designated sections (name, address, social security number, etc.).

04

Indicate your reason for requesting the increase in the appropriate field.

05

Gather any necessary supporting documentation required for your request.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form through the designated submission method (online, mail, or in-person).

Who needs Permanent Fund Increase Form?

01

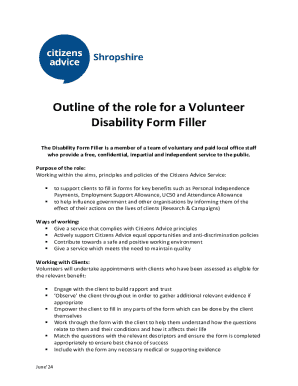

Individuals who are currently enrolled to receive dividends from the Permanent Fund and believe they are eligible for an increase.

02

Residents who have experienced changes in their financial situation that warrant a review of their Permanent Fund dividends.

Fill

form

: Try Risk Free

People Also Ask about

How much of the PFD is taxable?

You can file online or by submitting a paper application. You will be required to submit an original birth certificate, passport or naturalization certificate, and other required information as requested from the PFD Division after we receive your application.

Can the IRS take my PFD?

Your PFD can only be garnished to pay a child support debt, a tax debt, or a court judgment. Chances are, if your PFD was garnished, you have one of these outstanding obligations.

How much is the PFD in Alaska 2025?

The entire $1,702 Alaska Permanent Fund Dividend payment for 2024 is taxable for federal income tax purposes and should be reported as income on Schedule 1 (Form 1040), line 8g.

How much is the Alaska 2025 dividend?

The $1702 PFD Stimulus Check 2025 includes two parts: $1,403.83 as the standard dividend and an additional $298.17 in energy relief. This payout stems from Alaska's oil fund investments and reflects the state's commitment to sharing the wealth from its natural resources with residents.

Is dividend income taxable to the state?

Outside of tax-exempt interest from California state and municipal tax-exempt bonds, all interest, dividends and realized capital gains are taxed as ordinary income.

Is the Alaska PFD energy relief payment taxable?

Is a Permanent Fund Dividend or a Resource Rebate payment received by a resident of Alaska taxable? Alaska Permanent Fund Dividends and Resource Rebate payments are taxable to either an adult or a child recipient and must be reported on a federal income tax return.

How much is the Alaska PFD in 2025?

Sen. Lyman Hoffman, D-Bethel, the Senate's chief budgeter, speaks on the floor of the Alaska Senate on Wednesday, May 7, 2025. The Alaska Senate approved its version of the state budget Wednesday, including a $1,000 Permanent Fund dividend and, for now, a $150 million surplus.

Do I have to claim my PFD on my taxes?

If you fail to report the PFD on your federal income tax return, a negligence penalty or other sanctions may be imposed on you. The 2024 Permanent Fund Dividend (PFD) amount is $1,702. The state's Federal Tax Identification number is 92-6001185.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Permanent Fund Increase Form?

The Permanent Fund Increase Form is a document used to request an increase in the amount of funds allocated to an individual's permanent fund, typically related to investment or savings programs managed by government entities.

Who is required to file Permanent Fund Increase Form?

Individuals or entities that wish to increase their allocated amounts in a permanent fund, usually those receiving benefits from such funds, are typically required to file this form.

How to fill out Permanent Fund Increase Form?

To fill out the Permanent Fund Increase Form, individuals should provide their personal identification details, specify the desired increase amount, and submit any required supporting documentation as directed on the form.

What is the purpose of Permanent Fund Increase Form?

The purpose of the Permanent Fund Increase Form is to formally document and process requests for increases in the amounts held in permanent funds to ensure proper record-keeping and allocation of resources.

What information must be reported on Permanent Fund Increase Form?

The information that must be reported on the Permanent Fund Increase Form typically includes personal information such as name, address, account number, the requested increase amount, and any relevant financial documentation or identification numbers.

Fill out your permanent fund increase form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Permanent Fund Increase Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.