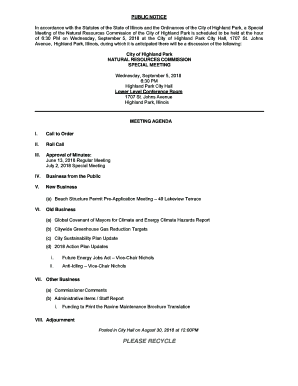

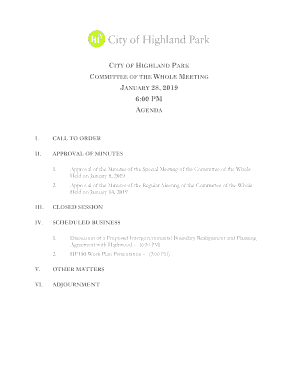

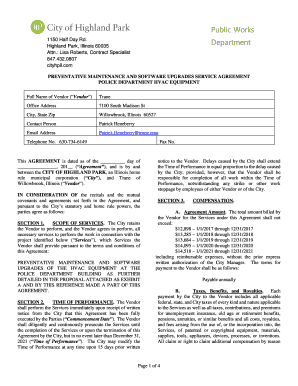

Get the free FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AN...

Show details

This document is an examination for students enrolled in the Income Taxation course focused on individuals, fiduciaries, beneficiaries, and business associations, containing various sections including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final examination for income

Edit your final examination for income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final examination for income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit final examination for income online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit final examination for income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final examination for income

How to fill out FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS

01

Gather all necessary financial documents, including income statements, tax deductions, and credits.

02

Review the exam format and guidelines provided by your institution.

03

Fill in the identification section with your personal details accurately.

04

Answer multiple choice questions by carefully reading each question and selecting the best option.

05

Complete problem-solving sections by showing your work for calculations.

06

Manage your time effectively by keeping track of how long you spend on each section.

07

Review your answers before submitting the examination to ensure accuracy.

Who needs FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS?

01

Individuals filing personal income taxes seeking a comprehensive understanding of tax regulations.

02

Fiduciaries managing estates or trusts for beneficiaries that require knowledge of taxation.

03

Beneficiaries who need to learn about their tax liabilities and responsibilities.

04

Business associations and their representatives needing clarity on taxation matters affecting their operations.

Fill

form

: Try Risk Free

People Also Ask about

Who receives a Schedule K 1 form 1041 typically?

If you're the beneficiary of a trust or estate, you might receive a Schedule K-1. The Schedule K-1 tax form is for inheritance recipients who need to report their share of income, deductions, or credits from the trust or estate.

Do you have to pay income tax on an estate?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

Who needs to file form 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

Do beneficiaries of an estate have to pay taxes?

This income is sometimes known as income "in respect of the decedent." Generally, beneficiaries do not pay income tax on money or property that they inherit, but there are exceptions for retirement accounts, life insurance proceeds, and savings bond interest.

Do you have to pay taxes on money received as a beneficiary?

In general, any inheritance you receive does not need to be reported to the IRS. You typically don't need to report inheritance money to the IRS because inheritances aren't considered taxable income by the federal government. That said, earnings made off of the inheritance may need to be reported.

Are beneficiaries liable for estate taxes?

Aside from the taxes that an estate pays, beneficiaries may be responsible for paying taxes on the property that they inherit. Tax liability attaches to and moves with estate assets. Therefore, beneficiaries will be responsible for any tax liability not already paid by the estate.

Do you have to pay taxes on money given to you when someone dies?

An inheritance tax is paid by the beneficiary on the value of the assets they inherit. Inheritance tax is not a federal tax, so it only affects residents of certain states. Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania are the only states where inheritance tax may apply.

Can the IRS collect from a deceased person?

Can a Deceased Person Owe Taxes? Decedents can remain accountable to creditors, including the IRS, because the person's rights, liabilities, assets and interests transfer to their estate when they pass away. So when a person passes away, the executors or administrators of their estate step into their shoes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS?

The FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS is a comprehensive assessment that encompasses the tax laws and regulations applicable to various entities, including individuals, trusts, estates, and partnerships, in relation to their income tax obligations.

Who is required to file FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS?

Individuals, fiduciaries managing trusts or estates, beneficiaries receiving distributions from trusts, and business associations are required to file the FINAL EXAMINATION FOR INCOME TAXATION based on their income, entity type, and tax obligations.

How to fill out FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS?

To fill out the FINAL EXAMINATION FOR INCOME TAXATION, individuals and entities must gather all relevant financial documents, accurately report income, deductions, and credits, and complete the required forms according to the specific guidelines provided by the tax authorities.

What is the purpose of FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS?

The purpose of the FINAL EXAMINATION is to assess and ensure compliance with tax laws, to determine the correct amount of tax liability owed, and to facilitate the reporting of income and tax obligations pertaining to various entities.

What information must be reported on FINAL EXAMINATION FOR INCOME TAXATION OF INDIVIDUALS, FIDUCIARIES, BENEFICIARIES, AND BUSINESS ASSOCIATIONS?

Information that must be reported includes total income, various types of deductions, credits, and any relevant financial transactions that may impact tax liability, as well as the identification of the filing entity, such as individual names or business identification.

Fill out your final examination for income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Examination For Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.