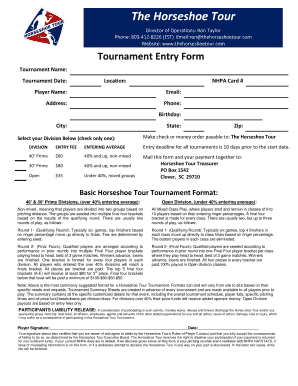

Get the free Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and...

Show details

This document serves as the final examination for students enrolled in the Income Taxation course, comprising multiple-choice questions assessing knowledge of tax laws and their applications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final examination in income

Edit your final examination in income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final examination in income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing final examination in income online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit final examination in income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final examination in income

How to fill out Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648)

01

Gather all necessary documents, including income statements, deductions, and tax credits.

02

Review the instructions provided with the Final Examination (DN 648) to understand the specific requirements.

03

Complete the identification section with accurate personal and financial information.

04

List all sources of income accurately in the designated section.

05

Calculate and itemize all allowable deductions and credits.

06

Ensure that all calculations are correct and reflect the financial data provided.

07

Review your answers for clarity and completeness before submission.

08

Submit the Final Examination in the required format and by the deadline specified.

Who needs Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648)?

01

Individuals required to report their personal income.

02

Fiduciaries managing assets for someone else and reporting income on their behalf.

03

Beneficiaries receiving income that needs to be reported.

04

Business associations that need to report income and deductions for their business activities.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I don't file a 1041?

The late filing penalty for Form 1041 is 5% of the tax due for each month (or part of a month) that the tax return is late, up to a maximum of 25%.

Does a fiduciary have to file a tax return?

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100. An alternative minimum tax liability.

Do I need to file a fiduciary tax return?

The fiduciary (or one of the joint fiduciaries) must file Form 1041 for a domestic estate that has: Gross income for the tax year of $600 or more, or. A beneficiary who is a nonresident alien.

Who must file a Virginia fiduciary tax return?

The fiduciary of a resident estate or trust must file a return if the estate or trust is required to file a federal fiduciary income tax return (Form 1041), or if it had any Virginia taxable income.

What is the advanced writing requirement for IU Mckinney?

Advanced Research and Writing Requirement The paper must be supervised by a faculty member and must receive a grade of at least B-. The ARWR is intended to be a capstone experience that enables each student to engage a legal issue to a greater extent than is possible in other course settings.

What is the minimum income to file form 1041?

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

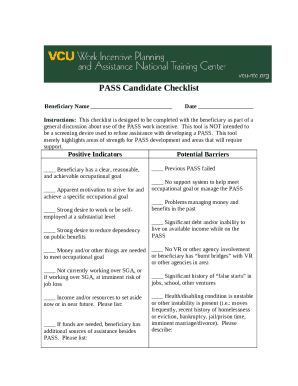

What is Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648)?

The Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648) is a comprehensive assessment used to determine the final tax obligations of various entities and individuals for the tax year.

Who is required to file Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648)?

All individuals, fiduciaries, beneficiaries, and business associations who meet the income thresholds and other criteria set by tax regulations are required to file DN 648.

How to fill out Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648)?

To fill out DN 648, taxpayers must provide accurate information regarding their income, deductions, credits, and any other financial information relevant to their tax situation as prescribed by the instructions accompanying the form.

What is the purpose of Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648)?

The purpose of DN 648 is to finalize the tax liabilities for the fiscal year, ensuring proper tax assessment, compliance with tax laws, and accurate reporting of financial activities.

What information must be reported on Final Examination in Income Taxation of Individuals, Fiduciaries, Beneficiaries, and Business Associations (DN 648)?

The information that must be reported includes total income, allowable deductions, credits, and any other relevant financial data that could affect tax liability for individuals and entities.

Fill out your final examination in income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Examination In Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.