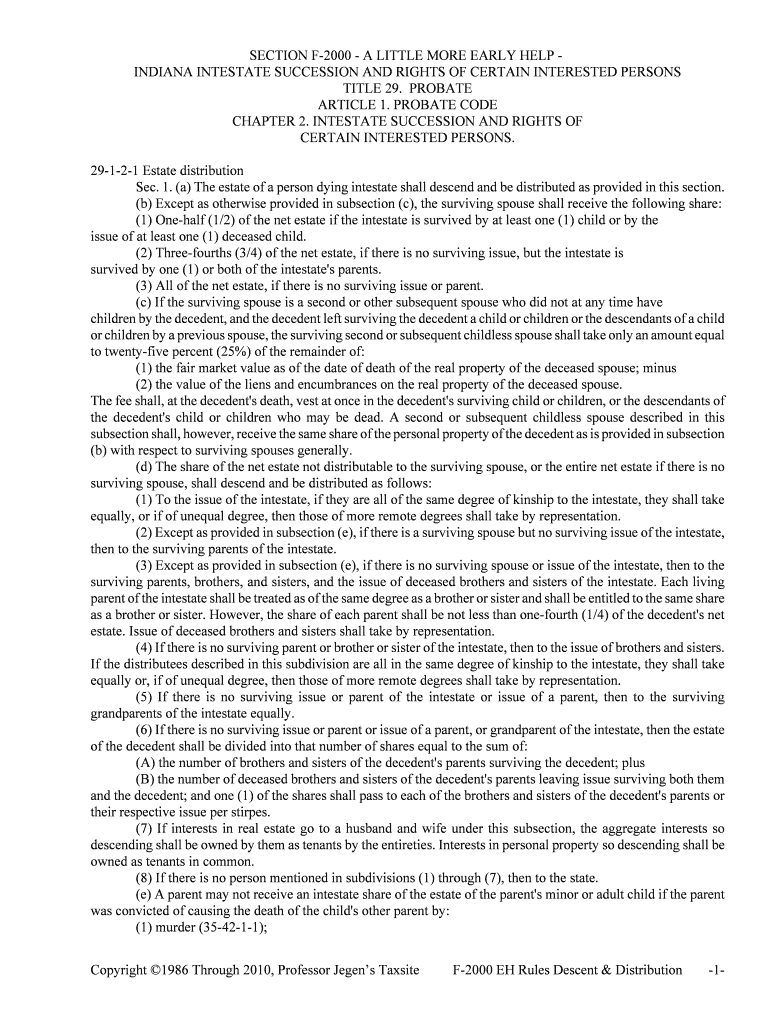

Get the free SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF...

Show details

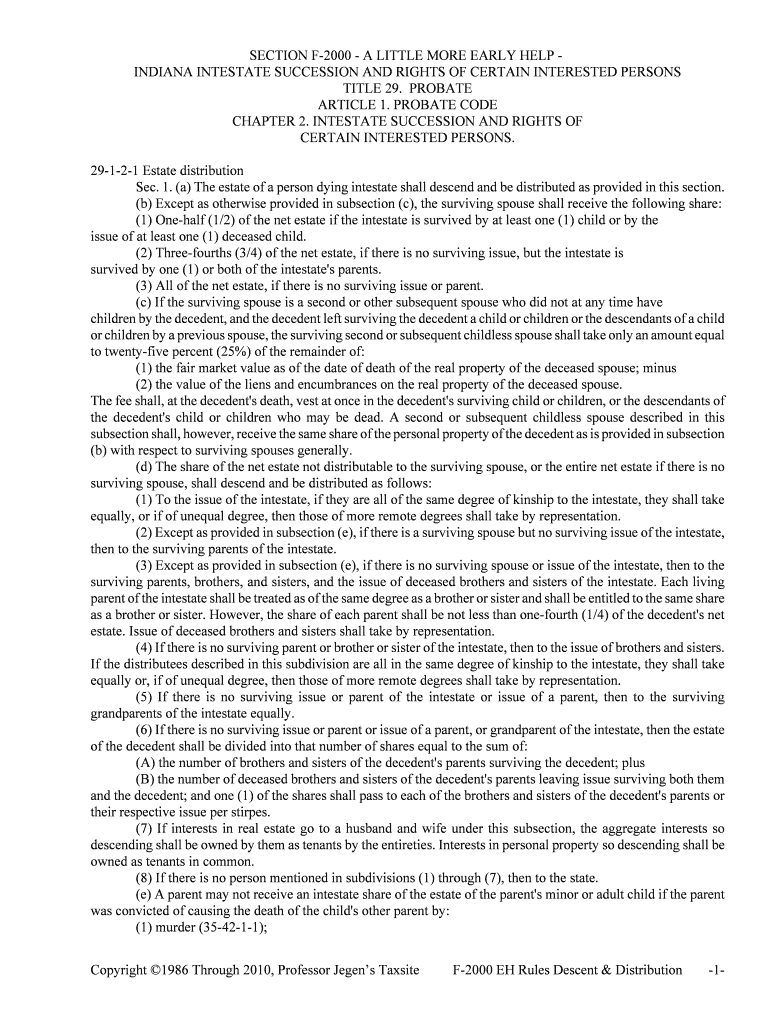

This document outlines the intestate succession laws in Indiana, detailing how a deceased person's estate is to be distributed among surviving family members when there is no valid will.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section f-2000 - a

Edit your section f-2000 - a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section f-2000 - a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit section f-2000 - a online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit section f-2000 - a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section f-2000 - a

How to fill out SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF CERTAIN INTERESTED PERSONS

01

Start by obtaining the SECTION F-2000 form from the appropriate Indiana government website or office.

02

Review the instructions provided with the form to understand the requirements.

03

Fill in the name and contact information of the decedent at the top of the form.

04

Provide the date of death and other relevant details about the decedent's estate.

05

List all heirs and beneficiaries as required by the form, including their names and relationship to the decedent.

06

Indicate any known assets and debts of the decedent's estate.

07

Sign and date the form where indicated, verifying the accuracy of the information provided.

08

Submit the completed form to the appropriate court or agency as instructed.

Who needs SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF CERTAIN INTERESTED PERSONS?

01

Individuals who are dealing with the estate of a deceased person who died intestate (without a will).

02

Potential heirs or beneficiaries seeking to understand their rights in the intestate succession process.

03

Lawyers and legal representatives assisting clients in navigating intestate succession in Indiana.

Fill

form

: Try Risk Free

People Also Ask about

What is the next of kin order in Indiana?

Spouses in Indiana Inheritance Law In this case, the spouse receives half of the decedent's personal property and one-quarter of his or her real property, although any monetary claims against the real estate will need to be subtracted, ing to Indiana inheritance laws.

How much can you inherit without paying taxes in Indiana?

Only assets in your own name, with no joint owners or named beneficiaries, pass through probate. Joint and pay on death bank and brokerage accounts pass directly to the joint owner or the named beneficiary by operation of law at your death.

How much does an estate have to be worth to go to probate in Indiana?

Joint tenancy with right of survivorship: This form of co-ownership means that when one owner dies, their share automatically passes to the surviving owner(s). In Indiana, joint tenancy can help avoid probate for the property, as the transfer of ownership is immediate.

What is the intestate succession in Indiana?

If you die without a will in Indiana, your children will receive an "intestate share" of your property. The size of each child's share depends on how many children you have, whether or not you are married, and whether your spouse is also their parent.

What is the right of survivorship in Indiana?

Since Indiana is not a state that imposes an inheritance tax, the inheritance tax in 2025 is 0% (zero). As a result, you won't owe Indiana inheritance taxes.

How much does an estate have to be worth to go to probate in Indiana?

The statute describes the following order for determining legal next-of-kin: Surviving spouse. Surviving adult children. Surviving parents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF CERTAIN INTERESTED PERSONS?

SECTION F-2000 is a form used in Indiana to assist in clarifying the intestate succession laws and the rights of individuals who may have a claim to the estate of a deceased person who died without a will.

Who is required to file SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF CERTAIN INTERESTED PERSONS?

Individuals who have an interest in the estate of a deceased person who died intestate (without a will) are typically required to file SECTION F-2000 to establish their rights.

How to fill out SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF CERTAIN INTERESTED PERSONS?

To fill out SECTION F-2000, gather all relevant personal and estate information, including the deceased's details, beneficiaries, and any claims to the estate. Follow the provided instructions on the form carefully.

What is the purpose of SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF CERTAIN INTERESTED PERSONS?

The purpose of SECTION F-2000 is to provide a structured format for individuals to report their claims and rights regarding the intestate estate, ensuring that the distribution of assets is handled according to Indiana law.

What information must be reported on SECTION F-2000 - A LITTLE MORE EARLY HELP INDIANA INTESTATE SUCCESSION AND RIGHTS OF CERTAIN INTERESTED PERSONS?

Information that must be reported includes the deceased person's name, date of death, details of the surviving beneficiaries, any known debts or claims against the estate, and the relationship of the claimants to the deceased.

Fill out your section f-2000 - a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section F-2000 - A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.