Get the free HEALTH INSURANCE POLICY - jsu

Show details

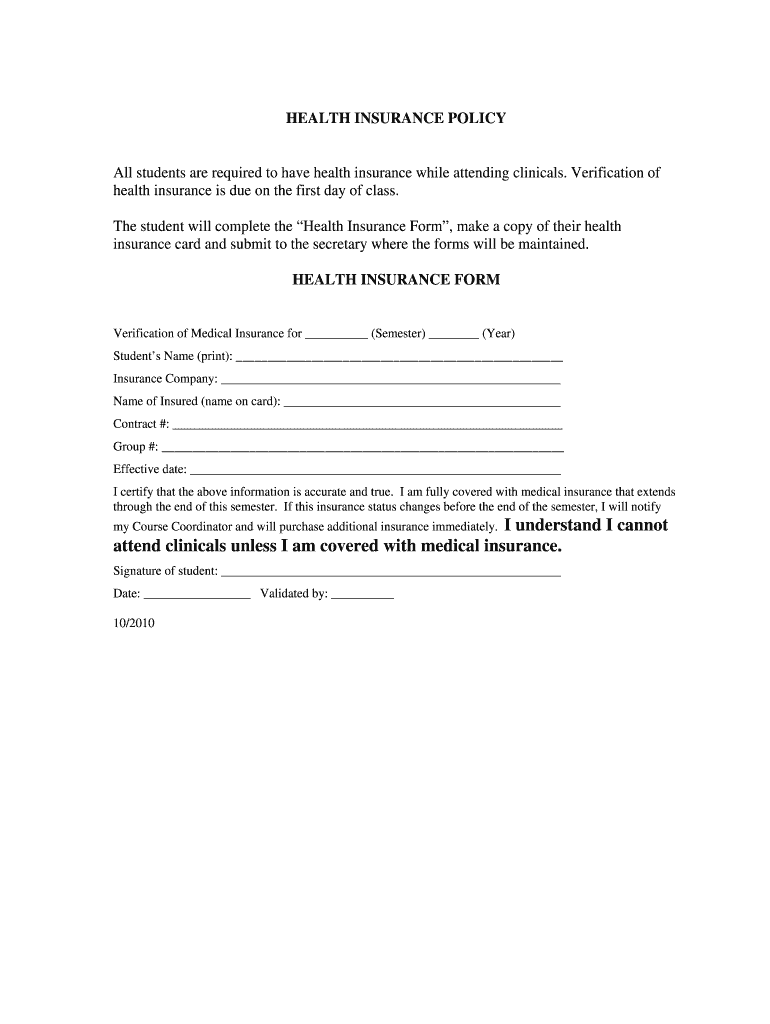

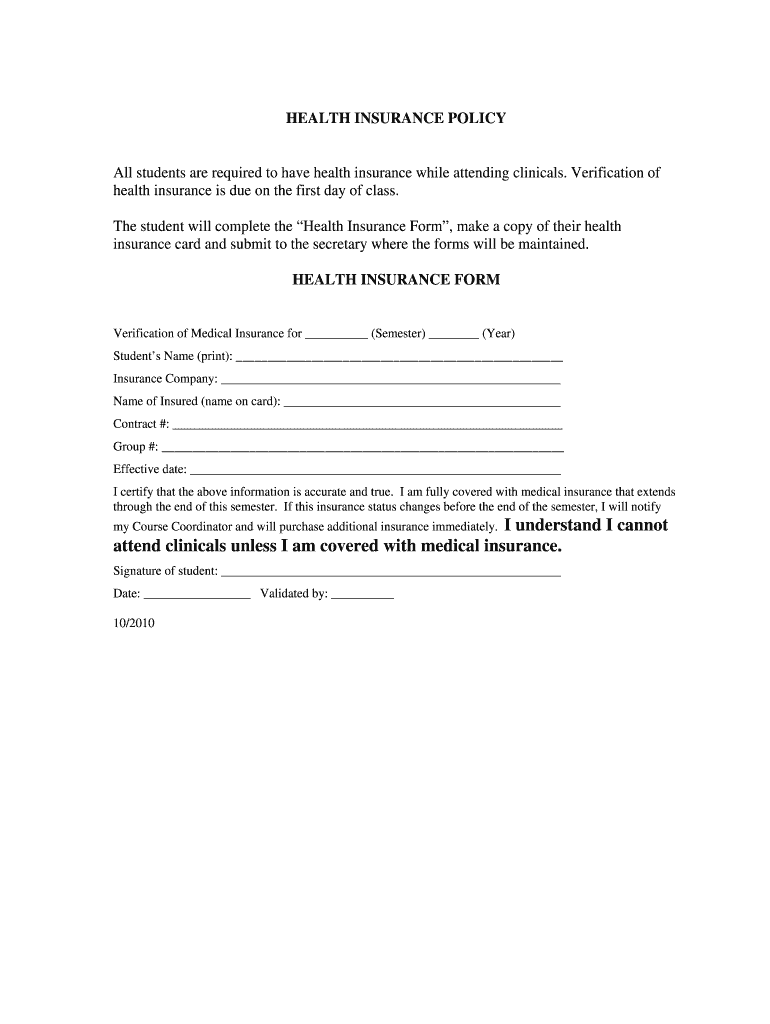

A form that students must complete to verify their health insurance coverage as a requirement for attending clinical sessions during their studies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health insurance policy

Edit your health insurance policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health insurance policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit health insurance policy online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit health insurance policy. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health insurance policy

How to fill out HEALTH INSURANCE POLICY

01

Gather necessary personal information: Collect details such as your name, address, date of birth, and Social Security number.

02

Choose the type of health insurance policy: Decide between individual, family, or group health insurance plans based on your needs.

03

Review plan options: Compare various plans offered by different insurers, checking for coverage limits, premiums, deductibles, and network providers.

04

Provide medical history: Complete any required sections detailing past medical conditions, surgeries, prescriptions, and ongoing treatments.

05

Fill out the application form: Enter all gathered information accurately in the application form provided by the insurance company.

06

Select coverage options: Decide on additional benefits or riders that might be relevant, such as dental, vision, or maternity coverage.

07

Confirm payment details: Choose a payment method for the premiums and provide relevant financial information if needed.

08

Review and submit the application: Double-check all submitted information for accuracy before sending it to the insurance provider.

Who needs HEALTH INSURANCE POLICY?

01

Individuals seeking protection against high medical costs.

02

Families looking to ensure health coverage for all members.

03

Employed individuals whose workplace does not offer health insurance.

04

Students who want to cover health expenses while studying.

05

Self-employed professionals requiring health coverage.

06

Individuals with chronic health conditions needing regular treatment.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of insurance policy?

Common personal insurance policy types are auto, health, homeowners, and life insurance. Most individuals in the United States have at least one of these types of insurance, and car insurance is required by state law.

What is a policy in medical insurance?

The purpose of a medical policy is to provide guidelines for determining coverage criteria for specific medical and behavioral health technologies, including procedures, equipment, and services. The same process is used to evaluate medical and behavioral health technologies.

What is the meaning of policy term in health insurance?

Policy term is the length of your insurance policy. In other words, it is the duration for which you are covered under the insurance policy and during which your loved ones receive the sum assured if something were to happen to you.

Is $200 a month good for health insurance?

What is a Health Insurance Plan (also called a health plan or policy)? A health insurance plan includes a package of covered health care items and services and sets how much it will pay for those items and services.

What is a policy in health insurance?

Common personal insurance policy types are auto, health, homeowners, and life insurance. Most individuals in the United States have at least one of these types of insurance, and car insurance is required by state law.

What is a health policy example?

Examples of public health policies include vaccination mandates, nutrition labeling regulations, environmental health laws, and drug policies that safeguard public well-being.

What are the 4 types of insurance policies?

Life insurance will help provide financially for your survivors. Health insurance protects you from catastrophic bills in case of a serious accident or illness. Long-term disability protects you from an unexpected loss of income. Auto insurance prevents you from bearing the financial burden of an expensive accident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HEALTH INSURANCE POLICY?

A health insurance policy is a contract between an individual and an insurance company that provides financial coverage for medical expenses incurred due to illness or injury.

Who is required to file HEALTH INSURANCE POLICY?

Individuals who wish to have health insurance coverage or those who are mandated by law, such as those under certain government programs, are required to file a health insurance policy.

How to fill out HEALTH INSURANCE POLICY?

To fill out a health insurance policy, an applicant should provide personal information, details about previous medical history, choose the desired coverage options, and review policy terms before submission.

What is the purpose of HEALTH INSURANCE POLICY?

The purpose of a health insurance policy is to protect individuals from high medical costs by covering a portion of their healthcare expenses, thus providing financial security and access to necessary medical care.

What information must be reported on HEALTH INSURANCE POLICY?

Information that must be reported on a health insurance policy includes personal identification details, medical history, current health status, preferred coverage options, and payment details.

Fill out your health insurance policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Insurance Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.