Get the free Income Clarification Form - lec

Show details

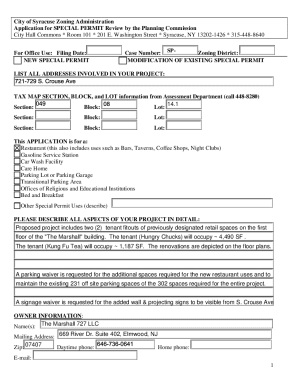

This form is used to clarify income information reported on the FAFSA for the 2011-2012 academic year in order to properly assess financial aid eligibility.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income clarification form

Edit your income clarification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income clarification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income clarification form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income clarification form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income clarification form

How to fill out Income Clarification Form

01

Obtain the Income Clarification Form from the relevant authority or website.

02

Carefully read the instructions provided on the form.

03

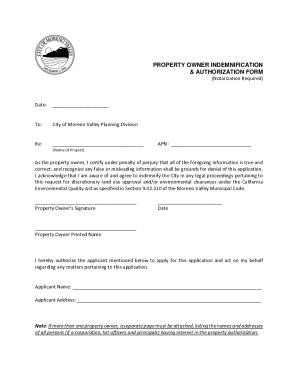

Fill in your personal details in the required sections, such as name, address, and contact information.

04

In the income section, provide accurate information about your current income sources, including wages, benefits, and other earnings.

05

Attach any required supporting documents, such as pay stubs or tax returns, to validate your reported income.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate office or department as instructed.

Who needs Income Clarification Form?

01

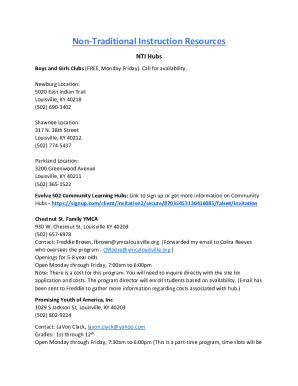

Individuals applying for financial aid or assistance programs.

02

People seeking to verify their income for housing applications.

03

Applicants for government benefits that require income verification.

04

Anyone whose financial situation has changed and needs to clarify their income status.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a proof of income letter?

For example, business owners can provide pay stubs (if they pay themselves the salary), employed individuals can use employment verification letters (which they should request from their employer), and retirees can verify their proof of income through documents like annual pension statements, trust fund income or

How to make a source of income letter?

Supporting Documents Paystubs. W2s or other wage statements. IRS Form 1099s. Tax filings. Bank statements demonstrating regular income. Attestation from a current or former employer.

What is a proof of annual income letter?

A proof of income letter from an employer verifies an individual's income and employment status, and is used in various situations, such as when a person is applying for a lease, home or car, or when looking to take out a credit card or loan.

How do you calculate income for Obamacare?

You can start by using your adjusted gross income (AGI) from your most recent federal income tax return, located on line 11 on the Form 1040. Add any foreign income, Social Security benefits and interest that are tax-exempt. Then, add or subtract any income changes you expect in the next year.

What is proof of income for healthcare marketplace?

If you don't expect your income to change for the year you're seeking coverage: You can provide your most recent tax return or W-2s. If you have a different job than you had last year but expect the same income, don't send documents that show income from your old job. Send recent pay stubs from the new job instead.

What is an example of a proof of income document?

How to write a Proof of Income Letter Add employer and employee names. As the employer, start by providing your name. Provide the employee's work details. Next, include the employee's work details. Add recipient details. Continue by specifying who is receiving the Proof of Income Letter. Provide employer details.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income Clarification Form?

The Income Clarification Form is a document used to verify an individual's income to ensure that they qualify for certain benefits, programs, or services.

Who is required to file Income Clarification Form?

Individuals seeking to access specific financial assistance, benefits, or subsidies are typically required to file the Income Clarification Form, especially if their income status needs to be verified.

How to fill out Income Clarification Form?

To fill out the Income Clarification Form, individuals should accurately provide their personal information, income details, and supporting documents as required, ensuring that all sections are completed clearly and truthfully.

What is the purpose of Income Clarification Form?

The purpose of the Income Clarification Form is to assess an individual's financial situation for eligibility determination in various programs or services, ensuring that benefits are allocated properly based on income.

What information must be reported on Income Clarification Form?

The information that must be reported includes personal identification details, sources of income, amounts earned, and any additional financial documentation that can substantiate the reported income.

Fill out your income clarification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Clarification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.