Get the free Christian Brothers Employee Retirement Plan Beneficiary Designation Form - lewisu

Show details

This form is used by employees of the Christian Brothers Employee Retirement Plan to designate primary and contingent beneficiaries for their retirement benefits in the event of their death.

We are not affiliated with any brand or entity on this form

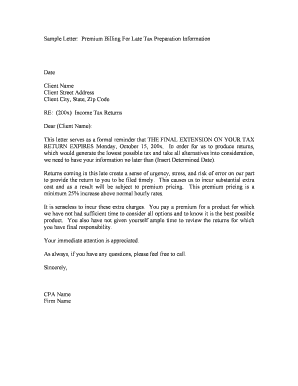

Get, Create, Make and Sign christian brothers employee retirement

Edit your christian brothers employee retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your christian brothers employee retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

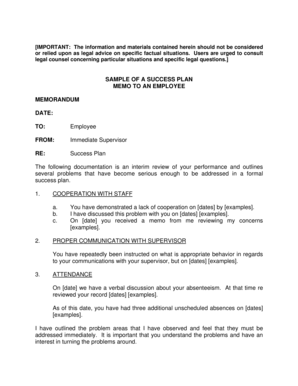

How to edit christian brothers employee retirement online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit christian brothers employee retirement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out christian brothers employee retirement

How to fill out Christian Brothers Employee Retirement Plan Beneficiary Designation Form

01

Obtain the Christian Brothers Employee Retirement Plan Beneficiary Designation Form from your HR department or online portal.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information, including your name, address, employee ID, and any other required identifying details.

04

List your beneficiaries by providing their full names, relationships to you, and any other necessary details such as their social security numbers if required.

05

Indicate the percentage of benefits each beneficiary will receive, ensuring the total adds up to 100%.

06

Sign and date the form to verify that the information provided is accurate and that you understand the terms.

07

Submit the completed form to your HR department or the designated office as instructed.

Who needs Christian Brothers Employee Retirement Plan Beneficiary Designation Form?

01

All employees participating in the Christian Brothers Employee Retirement Plan who wish to designate beneficiaries for their retirement benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the beneficiary designation of a retirement account?

403(b) Beneficiary Designation Someone with a 403(b) plan can designate anyone as a beneficiary. However, 403(b) beneficiary rules require a married person to designate their spouse to receive at least 50% of the plan's vested balance, unless the spouse has signed a waiver relinquishing their portion of the funds.

What is a beneficiary designation for a pension?

A beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an IRA after they die. The owner must designate the beneficiary under procedures established by the plan.

How do I check my FERS beneficiary?

You need to check with your employing agency. OPM does not maintain information on FEGLI designations of beneficiary for employees of other agencies. You need to check with the office that maintains your Official Personnel Folder or equivalent at your agency.

What is an example of beneficiary designation?

Sample: Martha Doe, wife, or, in the event of her death, Richard Doe, cousin, or in the event of his death, Jane Doe, niece. 6.) One Beneficiary Followed by Two Beneficiaries in Equal Shares – Sample: Martha Doe, wife, or, in the event of her death, Jane Doe and Mary Doe, cousins, in equal shares, or their survivors.

What is FERS designation of beneficiary?

This Designation of Beneficiary Form is used to designate who is to receive a lump-sum payment which may become payable under CSRS or FERS. It does not affect the right of any person who is eligible for survivor benefits.

Does Fers pension go to spouse after death?

Surviving Spouse If an employee dies with at least 18 months of creditable civilian service under FERS, a survivor annuity may be payable if: the surviving spouse was married to the deceased for at least nine months, or. the employee's death was accidental, or. there was a child born of the marriage to the employee.

What is a FERS beneficiary?

Lump-Sum Benefit beneficiary designated by the deceased in writing which is signed and witnessed and is received at his/her employing agency (or OPM if the deceased was a retiree or a separated employee) prior to death; spouse of the deceased; children of the deceased (or descendants of deceased children);

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Christian Brothers Employee Retirement Plan Beneficiary Designation Form?

The Christian Brothers Employee Retirement Plan Beneficiary Designation Form is a legal document that allows employees to designate individuals or entities to receive benefits from their retirement plan upon their death.

Who is required to file Christian Brothers Employee Retirement Plan Beneficiary Designation Form?

All employees participating in the Christian Brothers Employee Retirement Plan are required to file this form to ensure that their chosen beneficiaries receive the retirement benefits.

How to fill out Christian Brothers Employee Retirement Plan Beneficiary Designation Form?

To fill out the form, employees need to provide their personal information, specify their primary and contingent beneficiaries, and sign the document. It's important to review the form for accuracy before submission.

What is the purpose of Christian Brothers Employee Retirement Plan Beneficiary Designation Form?

The purpose of the form is to allow employees to clearly express their wishes regarding the distribution of their retirement plan benefits after their death, ensuring the funds are allocated according to their preferences.

What information must be reported on Christian Brothers Employee Retirement Plan Beneficiary Designation Form?

The form typically requires the employee's personal identification information, detail about beneficiaries including their names, relationships, and contact information, as well as any contingent beneficiaries for secondary coverage.

Fill out your christian brothers employee retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Christian Brothers Employee Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.