Get the free Revenue Sources - Unrestricted & Restricted - lsuhsc

Show details

This document outlines the budgeted revenue sources for an educational institution, detailing both unrestricted and restricted funds, broken down by various sources such as state funds, student fees,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue sources - unrestricted

Edit your revenue sources - unrestricted form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue sources - unrestricted form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue sources - unrestricted online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit revenue sources - unrestricted. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue sources - unrestricted

How to fill out Revenue Sources - Unrestricted & Restricted

01

Identify all sources of revenue your organization receives.

02

Classify each source as either unrestricted or restricted.

03

For unrestricted revenue, list income that can be used for general purposes.

04

For restricted revenue, specify the intended use or limitations associated with each income source.

05

Ensure accurate documentation and reporting of each revenue source.

06

Review and update the classification regularly to reflect any changes in funding agreements.

Who needs Revenue Sources - Unrestricted & Restricted?

01

Nonprofit organizations seeking to manage their finances.

02

Accountants and financial planners for budgeting and forecasting.

03

Grant writers to identify appropriate funding sources.

04

Donors wanting transparency on how their contributions are used.

05

Regulatory agencies that require financial reporting compliance.

Fill

form

: Try Risk Free

People Also Ask about

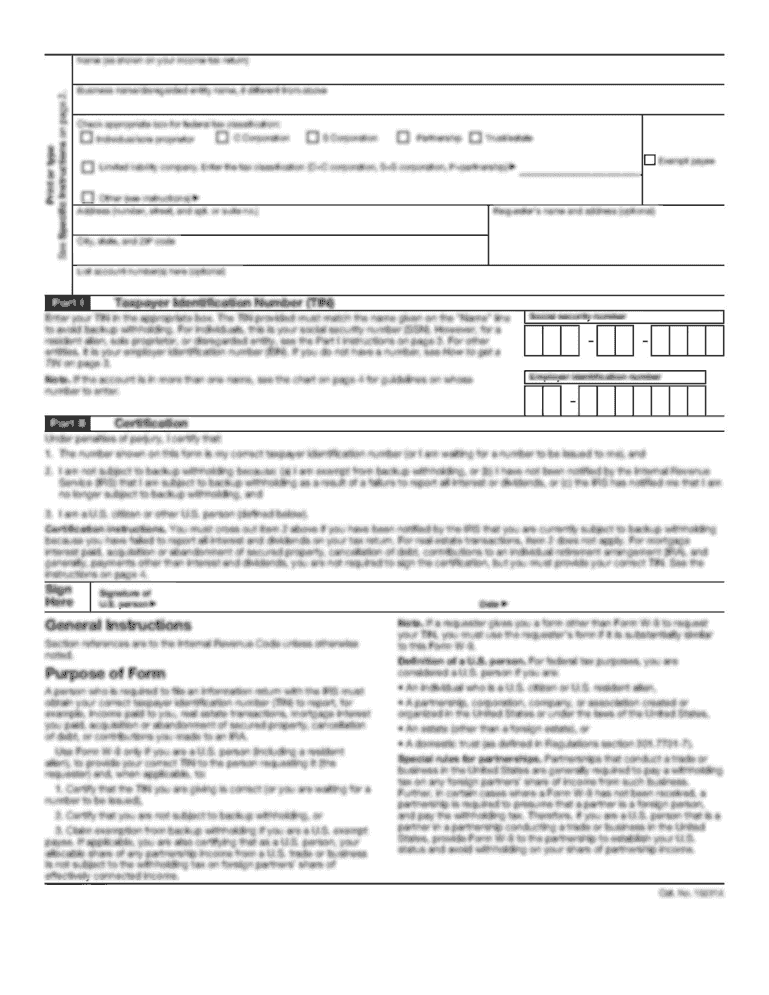

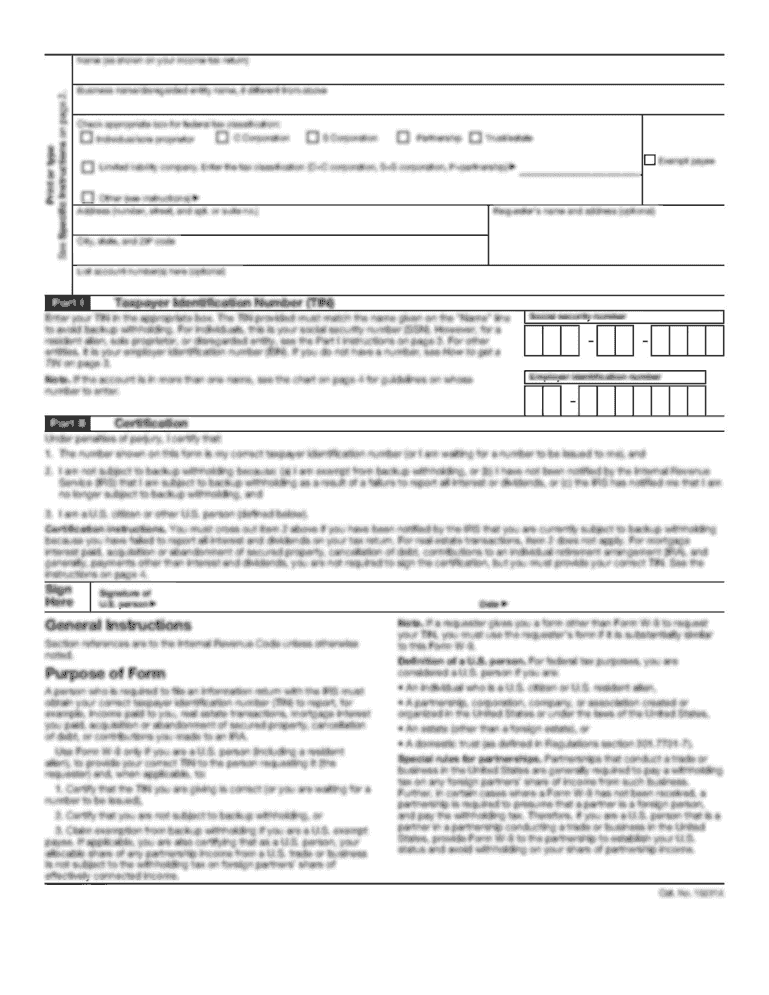

What is the difference between restricted and unrestricted expenses?

These funds carry permanent limitations on their use, requiring allocation to predetermined programs or initiatives. Conversely, unrestricted funds provide organizations with discretionary spending power, allowing allocation based on organizational needs and strategic priorities.

What is the difference between restricted and unrestricted?

At its core, the distinction between restricted vs unrestricted funds lies in how the funds can be used. Restricted grants come with specific conditions, while unrestricted grants offer more flexibility.

What does restricted and unrestricted mean?

Restricted funds are limited in use, while unrestricted funds provide organizations with greater flexibility to meet their needs. Nonprofit organizations must carefully manage and track restricted and unrestricted funds to ensure compliance with donor requirements and accurate financial reporting.

What is the difference between restricted and unrestricted?

At its core, the distinction between restricted vs unrestricted funds lies in how the funds can be used. Restricted grants come with specific conditions, while unrestricted grants offer more flexibility.

What is restricted and unrestricted revenue?

Restricted funds are limited in use, while unrestricted funds provide organizations with greater flexibility to meet their needs. Nonprofit organizations must carefully manage and track restricted and unrestricted funds to ensure compliance with donor requirements and accurate financial reporting.

What is restricted and unrestricted income?

Unrestricted – the donation is made with the understanding that the funds can be used for any purpose that the organisation sees fit. Restricted – the donation is made with the understanding that the funds will be used for a specific, stated purpose.

What is the difference between restricted and unrestricted income?

Unrestricted – the donation is made with the understanding that the funds can be used for any purpose that the organisation sees fit. Restricted – the donation is made with the understanding that the funds will be used for a specific, stated purpose.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Revenue Sources - Unrestricted & Restricted?

Revenue Sources - Unrestricted refers to funds that can be used for any purpose at the discretion of the organization, while Restricted Revenue Sources are funds that can only be used for specific purposes as outlined by the donor or grantor.

Who is required to file Revenue Sources - Unrestricted & Restricted?

Organizations that receive both unrestricted and restricted funds, such as nonprofits and educational institutions, are typically required to file reports detailing these revenue sources to ensure transparency and accountability.

How to fill out Revenue Sources - Unrestricted & Restricted?

To fill out the Revenue Sources report, organizations should list all sources of revenue, categorize them as either unrestricted or restricted, and provide details such as the amount received, purpose of the restricted funds, and any conditions attached to them.

What is the purpose of Revenue Sources - Unrestricted & Restricted?

The purpose of documenting Revenue Sources - Unrestricted & Restricted is to provide a clear overview of the organization's funding, ensure compliance with donor requirements, and help in financial planning and decision-making.

What information must be reported on Revenue Sources - Unrestricted & Restricted?

Essential information that must be reported includes the sources of revenue (e.g., donations, grants), amounts received, whether the funds are unrestricted or restricted, any specific conditions or purposes for restricted funds, and the period during which the funds were received.

Fill out your revenue sources - unrestricted online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Sources - Unrestricted is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.