Get the free Independent Student’s Head of Household Statement - lsus

Show details

This document is used to verify the tax filing status of independent students at Louisiana State University Shreveport as part of the financial aid verification process, ensuring compliance with IRS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent students head of

Edit your independent students head of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent students head of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit independent students head of online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit independent students head of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

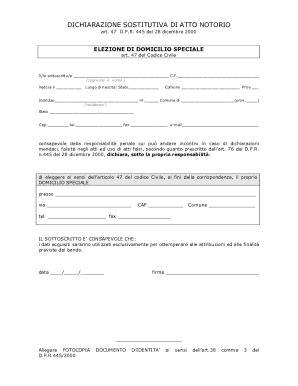

How to fill out independent students head of

How to fill out Independent Student’s Head of Household Statement

01

Obtain the Independent Student’s Head of Household Statement form from the relevant educational institution or their website.

02

Read the instructions carefully to understand the purpose of the statement.

03

Fill in your personal information at the top of the form, including your name, student ID, and contact information.

04

Indicate your current living situation, specifying whether you are living alone or with others.

05

Provide details about your household members, including relationships and their ages.

06

Include information about your income and any assistance you receive that affects your household.

07

Review the completed statement for accuracy and completeness.

08

Sign and date the form to certify that the information provided is true and correct.

09

Submit the statement by the specified deadline to the appropriate office at your educational institution.

Who needs Independent Student’s Head of Household Statement?

01

Independent students applying for financial aid who claim to be household heads.

02

Students who provide financial support to dependents living with them.

03

Individuals who do not rely on parental support for their educational expenses.

Fill

form

: Try Risk Free

People Also Ask about

Am I head of household if I live alone?

No. In order to claim head of household, you have to have a dependent. Without a dependent, if you are not married, you would only be able to file as single. Even if you are providing for your family, it only counts if they are able to be claimed on your tax return as dependents.

How do you declare yourself an independent student?

For the 2025–26 Free Application for Federal Student Aid (FAFSA®) form, an independent student is one of the following: born before Jan. 1, 2002. married (and not separated) a graduate or professional student. a veteran. a member of the U.S. armed forces. an orphan. a ward of the court. a current or former foster youth.

Why do I not qualify for head of household?

You are not eligible to use the Head of Household filing status unless you have a qualifying child or dependent. Only a RELATIVE can be a qualifying child or dependent for HOH. Since neither of those people is your relative, you cannot claim HOH.

Is it better to claim 1 or 0 if head of household?

Head of Household with Dependents You'll most likely get a tax refund if you claim no allowances or 1 allowance. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

How does the IRS verify head of household?

To qualify for Head of Household on your tax return, you must be unmarried or considered unmarried by the IRS. You also have to pay more than half the costs of keeping up a home during the tax year. In addition, a qualifying dependent, such as a child, should live with you for more than half of the year.

What disqualifies you from claiming head of household?

Here are the most common reasons you may be denied the HOH filing status: Your qualifying relative's gross income is above the limit. Your qualifying child's age is 19 years old but under 24 years old and not a full time student. Your qualifying child lived with you less than 183 days.

What determines if you file single or head of household?

Your eligibility for each status hinges largely on your marital and dependents situation. Single filing status usually applies to unmarried taxpayers without dependents who live with them. Head of household is for unmarried taxpayers supporting dependents, like minor children, who live with them for most of the year.

What are the requirements to qualify for head of household?

You must meet all of the following on December 31 of the tax year: You were unmarried, considered unmarried, or not in a registered domestic partnership. You have a qualifying child or relative. Your qualifying person lived with you for more than 183 days in the year. You paid more than ½ the costs for maintaining a home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Independent Student’s Head of Household Statement?

The Independent Student’s Head of Household Statement is a form used by independent students to demonstrate that they qualify as heads of household for financial aid purposes, allowing them to report their household status and potentially access additional financial assistance.

Who is required to file Independent Student’s Head of Household Statement?

Independent students who wish to claim head of household status for financial aid calculations and meet the eligibility criteria set forth by the financial aid office or relevant authorities are required to file this statement.

How to fill out Independent Student’s Head of Household Statement?

To fill out the Independent Student’s Head of Household Statement, students should provide their personal information, indicate their household members, and detail their income and expenses as required by the form. It's important to follow the guidelines provided by the financial aid office.

What is the purpose of Independent Student’s Head of Household Statement?

The purpose of the Independent Student’s Head of Household Statement is to enable independent students to accurately report their household situation for financial aid assessments, thereby ensuring they receive the appropriate level of support.

What information must be reported on Independent Student’s Head of Household Statement?

The information that must be reported includes the student's personal details, household composition (including dependents), income details, household expenses, and any other financial information relevant to assessing the student's head of household status.

Fill out your independent students head of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Students Head Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.