Get the free NYU Tuition Remission Benefit Plan For Dependent Children

Show details

This document outlines the tuition remission benefits for eligible dependent children of NYU faculty, administrators, and professional research staff, detailing coverage, eligibility, proof of relationship,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nyu tuition remission benefit

Edit your nyu tuition remission benefit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyu tuition remission benefit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nyu tuition remission benefit online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nyu tuition remission benefit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

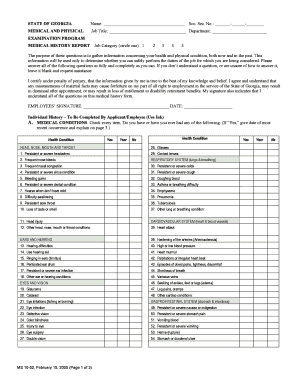

How to fill out nyu tuition remission benefit

How to fill out NYU Tuition Remission Benefit Plan For Dependent Children

01

Obtain the NYU Tuition Remission Benefit Plan application form from the NYU HR website or office.

02

Ensure you are eligible by confirming your employment status and the dependent child's enrollment in an eligible institution.

03

Fill out the personal information section, including your name, employee ID, and contact information.

04

Provide details for the dependent child, including their full name, date of birth, and the institution they are attending.

05

Indicate the degree program the dependent child is enrolled in and the number of credits they are taking.

06

Attach any necessary documentation, such as proof of enrollment and dependent status.

07

Review the application for completeness and accuracy.

08

Submit the completed application to the NYU HR office by the specified deadline.

Who needs NYU Tuition Remission Benefit Plan For Dependent Children?

01

NYU employees who have dependent children attending eligible educational institutions.

02

Employees seeking financial assistance for their dependent children's education expenses through tuition remission.

Fill

form

: Try Risk Free

People Also Ask about

What does tuition remission mean?

A tuition waiver is a form of financial aid some universities offer to reduce or eliminate tuition for students who meet certain requirements. For example, if you owe $10,000 in tuition and a university grants you a tuition waiver of $2,000, you'll only have to pay $8,000.

What is the difference between tuition waiver and remission?

Tuition remission refers to ways that the university pays tuition costs for students. Tuition remission includes tuition waivers and tuition payments. For students receiving tuition remission, the net effect is the same — the university pays a part of or all of your tuition. Tuition Remission covers tuition fees only.

Is tuition remission for dependents taxable?

Tuition Benefits for dependent children can be taxable at the federal and/or state level, depending upon a number of factors.

What is a tuition waiver?

i) Those with a parental income less than Rs. 1 Lakh per annum shall get full remission of the tuition fees ii) Those with a parental income between Rs. 1 Lakh and Rs. 5 Lakhs per annum shall get remission of 2/3rd of the tuition fees.

How long do you have to work at NYU to get free tuition?

Eligibility for this benefit begins after one (1) year of continuous, regular, full-time NYU employment in an eligible job category. Tuition benefits start with the semester after the 1-year waiting period is met. 50% tuition is waived. Spouses and domestic partners are not eligible for non-degree courses.

What is the difference between a waiver and a remission?

The short-term waiver of an open claim means that the entitlement due is not pursued further. The difference between a short-term waiver and a remission is the following: with a short-term waiver, the entitlement itself is not waived, whereas this is the case with a remission.

Does tuition remission mean free?

A qualified tuition reduction means that the educational organization pays some or all the tuition for the employee. It may be in the form of tuition remission, a tuition waiver, or a tuition grant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NYU Tuition Remission Benefit Plan For Dependent Children?

The NYU Tuition Remission Benefit Plan for Dependent Children is a program that allows eligible employees of New York University to have the tuition costs of their dependent children covered or reduced when they enroll in undergraduate courses at NYU.

Who is required to file NYU Tuition Remission Benefit Plan For Dependent Children?

Eligible employees of New York University who wish to utilize the tuition remission benefit for their dependent children are required to file the necessary application forms to participate in the program.

How to fill out NYU Tuition Remission Benefit Plan For Dependent Children?

To fill out the NYU Tuition Remission Benefit Plan for Dependent Children, employees must obtain the appropriate form from NYU's human resources or benefits office, complete all required fields, provide documentation of dependency, and submit the form by the specified deadlines.

What is the purpose of NYU Tuition Remission Benefit Plan For Dependent Children?

The purpose of the NYU Tuition Remission Benefit Plan for Dependent Children is to support employees' families by providing financial assistance for their children's education, helping to make higher education more accessible.

What information must be reported on NYU Tuition Remission Benefit Plan For Dependent Children?

The information that must be reported includes the employee's details, the dependent child's information, the educational institution, the courses being taken, and any additional documentation required to demonstrate eligibility.

Fill out your nyu tuition remission benefit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyu Tuition Remission Benefit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.