Get the free NYU Domestic Partner Declaration of Federal Tax Status - nyu

Show details

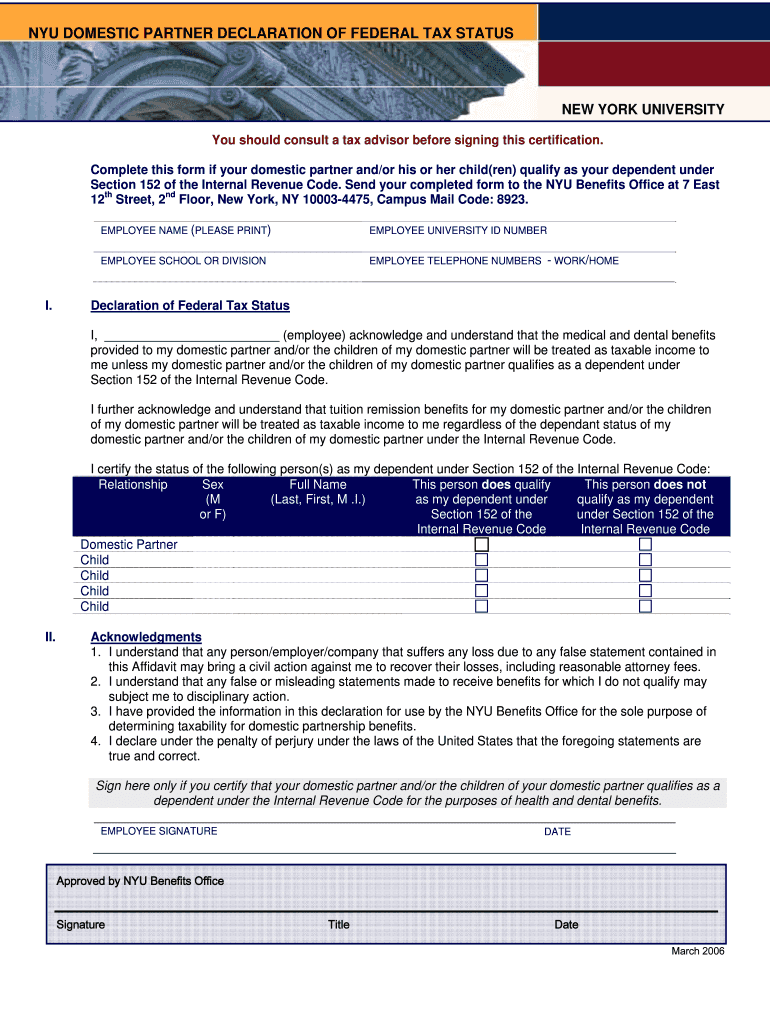

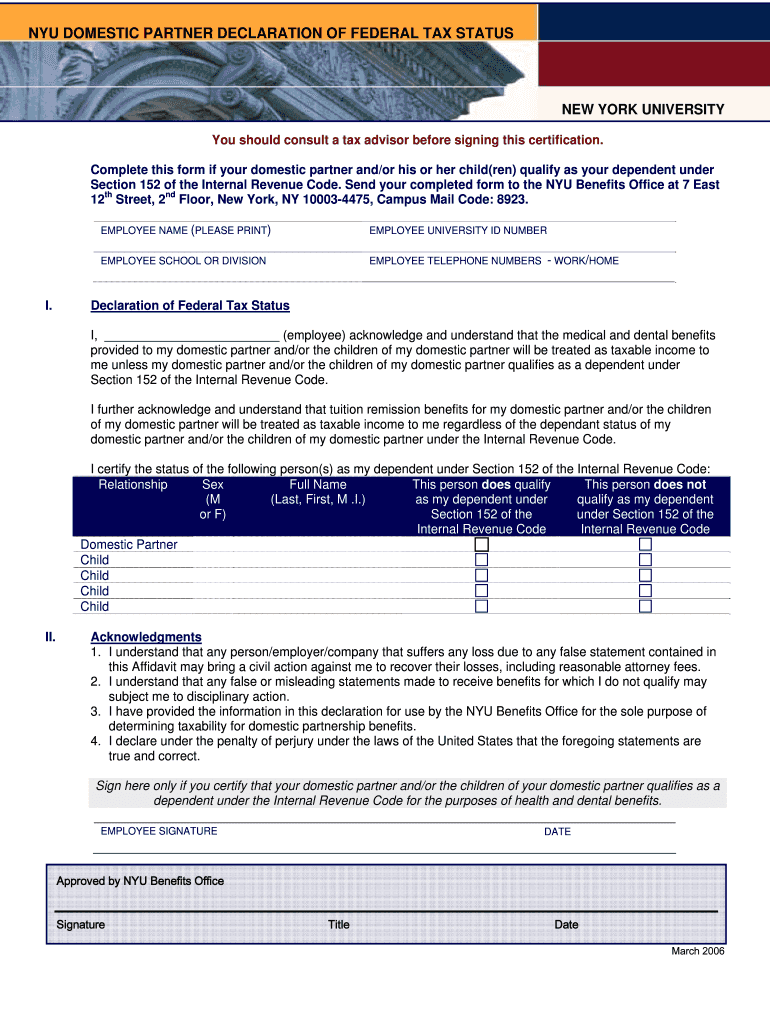

This form is used by employees of New York University to declare the federal tax status of their domestic partner and/or children for benefits eligibility and tax implications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nyu domestic partner declaration

Edit your nyu domestic partner declaration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyu domestic partner declaration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nyu domestic partner declaration online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nyu domestic partner declaration. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nyu domestic partner declaration

How to fill out NYU Domestic Partner Declaration of Federal Tax Status

01

Obtain a copy of the NYU Domestic Partner Declaration of Federal Tax Status form.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including your name, address, and employee ID.

04

Provide information about your domestic partner, including their name and relationship to you.

05

Indicate the date your domestic partnership began.

06

Complete any additional sections that apply to your situation, such as tax filing status.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the designated section.

09

Submit the form according to NYU's submission guidelines, either electronically or in person.

Who needs NYU Domestic Partner Declaration of Federal Tax Status?

01

Employees of NYU who have a domestic partner and wish to declare their federal tax status for benefits purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do you file taxes if you are not married but living together?

While married couples may choose whether to file their income taxes "jointly" or "separately," unmarried individuals must generally file separately, regardless of their living arrangement.

Does the federal government recognize domestic partners?

A registered domestic partner has a right not to testify against her or his partner in any state court or administrative proceeding. Because the federal government does not recognize domestic partnerships, however, this protection likely will not apply in a federal court or federal administrative proceeding.

How do domestic partners file federal taxes?

The IRS doesn't recognize registered domestic partnerships (RDPs) as marriages. Because of this, RDPs must file their federal and California tax returns using two separate accounts. If this applies to you, RDP couples must file a federal return as Single or Head of Household.

Does NY recognize a domestic partnership?

A Domestic Partnership is a legal relationship permitted under the laws of the State and City of New York for couples that have a close and committed personal relationship. The Domestic Partnership Law recognizes the diversity of family configurations, including , , and other non-traditional couples.

Does the federal government recognize domestic partners?

A registered domestic partner has a right not to testify against her or his partner in any state court or administrative proceeding. Because the federal government does not recognize domestic partnerships, however, this protection likely will not apply in a federal court or federal administrative proceeding.

How do I tax my domestic partner benefits?

TAXATION - DOMESTIC PARTNERSHIP BENEFIT Internal Revenue Service guidelines establish that adding a domestic partner to your benefits will result in taxable income to the employee for Federal tax purposes only. The state of California no longer taxes the imputed value of domestic partner health related benefits.

How do registered domestic partners file federal taxes?

Under California law, RDPs must file their California income tax returns using either the married/RDP filing jointly or married/RDP filing separately filing status. RDPs are not allowed to use a married filing status on their federal tax returns.

What is the best way to file taxes when a married couple lives apart?

You should file your federal return as a joint return. It is the best option for married couples. However you should file your State as separate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NYU Domestic Partner Declaration of Federal Tax Status?

The NYU Domestic Partner Declaration of Federal Tax Status is a form that individuals in domestic partnerships must complete to report their tax status to the university for benefits and tax purposes.

Who is required to file NYU Domestic Partner Declaration of Federal Tax Status?

Employees of NYU who are in domestic partnerships and wish to declare their status for university benefits and tax implications are required to file this form.

How to fill out NYU Domestic Partner Declaration of Federal Tax Status?

To fill out the form, individuals should provide personal information such as names, dates of birth, addresses, and legal definitions pertaining to their domestic partnership, followed by signatures and dates.

What is the purpose of NYU Domestic Partner Declaration of Federal Tax Status?

The purpose of the declaration is to ensure that the university has accurate records of employees' domestic partnerships, which can affect benefits eligibility and tax withholding.

What information must be reported on NYU Domestic Partner Declaration of Federal Tax Status?

The form requires reporting information such as the names and addresses of both partners, details of their domestic partnership, and any relevant tax identification numbers or Social Security numbers.

Fill out your nyu domestic partner declaration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyu Domestic Partner Declaration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.