Get the free 2012/2013 Business/Farm Clarification Form - northeastern

Show details

This form is used to clarify financial information regarding a business or farm for the purpose of financial aid applications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 20122013 businessfarm clarification form

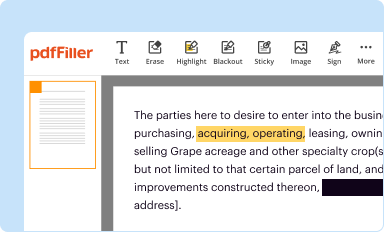

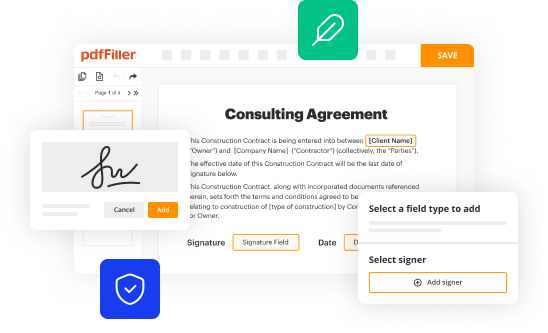

Edit your 20122013 businessfarm clarification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

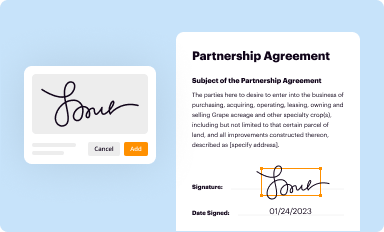

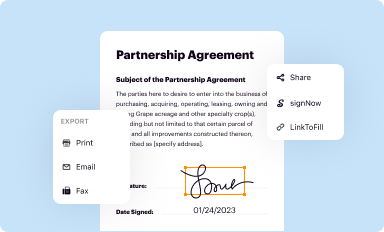

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 20122013 businessfarm clarification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 20122013 businessfarm clarification form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 20122013 businessfarm clarification form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 20122013 businessfarm clarification form

How to fill out 2012/2013 Business/Farm Clarification Form

01

Obtain the 2012/2013 Business/Farm Clarification Form from the relevant authority or website.

02

Read the instructions on the form thoroughly to understand the required information.

03

Gather all necessary documentation related to your business or farm operations for the specified tax year.

04

Fill out the form starting with your personal information, including your name, address, and contact information.

05

Complete sections related to your business or farm income, expenses, and any other relevant financial details.

06

Ensure all figures are accurate and match your documentation.

07

Review the entire form for completeness and accuracy before submission.

08

Sign and date the form as required.

09

Submit the completed form to the appropriate tax authority by the designated deadline.

Who needs 2012/2013 Business/Farm Clarification Form?

01

Business owners who received a clarification request regarding their tax filings.

02

Farm operators needing to provide additional information to the tax authorities for the 2012/2013 tax year.

03

Individuals and entities whose business or farming activities may affect their tax status and filings.

Fill

form

: Try Risk Free

People Also Ask about

How to show farm income?

The entire amount a farmer receives, including money and the fair market value of any property or services, is reported on Schedule F, Profit or Loss From Farming.

Which federal farmland protection program is the result of the 2014 farm bill?

The 2014 Farm Bill consolidated FRPP with two other programs, GRP and WRP, into the Agricultural Conservation Easement Program (ACEP).

How is farm income reported to the IRS?

Farming - Report income and expenses from farming on Schedule F (Form 1040), Profit or Loss From Farming. Additionally, use Schedule SE (Form 1040), Self-Employment Tax to figure self-employment tax if your net earnings from farming are $400 or more.

What is the farm business survey in England?

The FBS is a fully anonymised national study on the financial position and performance of farmers and growers in England commissioned by DEFRA. Since 1936, the FBS has been the primary source of farm financial data in England.

How do I report farm income?

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-SS, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other requirements such as business licenses and fees. Check with your state and local governments for more information.

Is a farmer an entrepreneur?

In many ways, farmers are the ultimate entrepreneurs, constantly innovating, growing businesses by themselves and taking full responsibility for all aspects of product delivery. Entrepreneurs could learn a lot from America's farmers.

How many acres is considered a farm for taxes?

Another question that frequently comes up in this discussion is “how big does my farm have to be to be considered a farm?” Since property taxes are handled at the local level rather than the federal level, the answer will vary from state to state. Generally speaking, there is no minimum acreage for farm tax exemption.

Does farm income count as earned income?

Earned income includes all the taxable income and wages you get from working for someone else, yourself or from a business or farm you own.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012/2013 Business/Farm Clarification Form?

The 2012/2013 Business/Farm Clarification Form is a document used by businesses and farms to provide additional information for tax assessment or compliance purposes. It helps the tax authorities clarify and verify income, expenses, and other financial details specific to that period.

Who is required to file 2012/2013 Business/Farm Clarification Form?

Individuals or entities engaged in business or farming activities that need to report information for the tax years 2012 and 2013 are required to file the form. This includes sole proprietors, partnerships, corporations, and any operations that derive income from farming or business operations.

How to fill out 2012/2013 Business/Farm Clarification Form?

To fill out the form, taxpayers should provide accurate financial information regarding their business or farming operations, including income earned, expenses incurred, and any other relevant financial data. Instructions accompanying the form should be followed for specific sections, ensuring all information is truthful and complete.

What is the purpose of 2012/2013 Business/Farm Clarification Form?

The purpose of the form is to assist tax authorities in gathering necessary information to assess taxes accurately and to ensure compliance with tax regulations. It serves to clarify tax situations that may be complex or require additional documentation.

What information must be reported on 2012/2013 Business/Farm Clarification Form?

The form typically requires reporting of gross income, deductibles, expenses, any credits claimed, and other pertinent financial details that can affect tax liabilities. Specific line items and data requirements can vary, so referencing the form's instructions is crucial.

Fill out your 20122013 businessfarm clarification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

20122013 Businessfarm Clarification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.