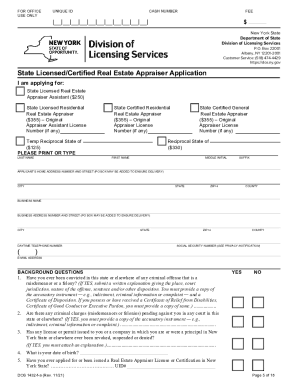

NY 1432-f-a 2014 free printable template

Show details

Is there an exam fee Yes. There is an examination application fee of 25 included in the DOS 1432-a Rev. 12/14 original application fee.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY 1432-f-a

Edit your NY 1432-f-a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY 1432-f-a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY 1432-f-a online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY 1432-f-a. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY 1432-f-a Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY 1432-f-a

How to fill out NY 1432-f-a

01

Gather necessary personal information including your name, address, and social security number.

02

Determine the type of application you are filing and indicate it on the form.

03

Complete the sections regarding income and any deductions you wish to claim.

04

Provide information on your employment status and any applicable businesses.

05

Check for any additional documentation you need to submit along with the form.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form before submission.

Who needs NY 1432-f-a?

01

Individuals applying for a specific tax status or exemption in New York.

02

Business owners seeking special considerations or adjustments in their tax obligations.

03

Anyone who qualifies for benefits outlined by the New York tax code and must report their information.

Fill

form

: Try Risk Free

People Also Ask about

How much experience is required to become a state licensed real estate appraiser quizlet?

Minimum of 3,000 hours obtained cumulatively over a period of not less than 18 months. Must have a minimum of 1,500 hours of non-residential experience.

How much does a real estate appraiser make in NY?

How much does an Appraiser IV (Commercial Real Estate) make in New York, NY? The average Appraiser IV (Commercial Real Estate) salary in New York, NY is $130,596 as of May 01, 2023, but the range typically falls between $112,084 and $151,585.

How do I become an appraiser in NYC?

Education Requirements: Must have an Associate's degree or higher OR 30 semester credit hours in specified courses; 150 hours of qualifying appraisal specific education courses are required from an approved provider (the hours are the same from the trainee license; they are not additional).

What are some reasons an appraisal might be sought on a property?

5 reasons to get a home appraisal, other than when buying Before selling your house. Refinancing your home. Getting a home equity loan. Applying for other loans. Appealing tax assessments.

How long does it take to become a real estate appraiser in NY?

FAQs ClassRequired ExperienceMaximum Credit Allowed for Appraisal ReviewState Licensed Real Estate Appraiser1,000 hours250 hoursState Certified Residential Appraiser1,500 hours375 hoursState Certified General Appraiser3,000 hours750 hours

How long does it take to become an appraiser in Florida?

To begin your real estate appraiser career in Florida, you'll need to complete 100 hours of appraisal education from a DBPR-approved Florida real estate school: Basic Appraisal Principles (30 hours) Basic Appraisal Procedures (30 hours) Appraisal Subject Electives (25 hours)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in NY 1432-f-a without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing NY 1432-f-a and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit NY 1432-f-a on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign NY 1432-f-a. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit NY 1432-f-a on an Android device?

With the pdfFiller Android app, you can edit, sign, and share NY 1432-f-a on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is NY 1432-f-a?

NY 1432-f-a is a specific form used by taxpayers in New York State to report certain tax-related information, specifically related to the state’s tax laws and regulations.

Who is required to file NY 1432-f-a?

Individuals or entities that meet certain criteria set forth by New York State tax regulations must file NY 1432-f-a, typically those involved in specific transactions or activities that require reporting.

How to fill out NY 1432-f-a?

To fill out NY 1432-f-a, taxpayers should provide required personal and financial information, ensuring all sections are completed accurately according to the instructions provided with the form.

What is the purpose of NY 1432-f-a?

The purpose of NY 1432-f-a is to collect necessary information for monitoring compliance with state tax laws and ensuring the correct assessment of taxes owed by taxpayers.

What information must be reported on NY 1432-f-a?

NY 1432-f-a requires reporting details such as taxpayer identification information, financial transactions, amounts owed or paid, and any other relevant information as specified in the form guidelines.

Fill out your NY 1432-f-a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY 1432-F-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.