Get the free FR 2502Q - federalreserve

Show details

The FR 2502q collects data quarterly on the geographic distribution of the assets and liabilities of major foreign branches and subsidiaries of U.S. banks. Proposed revisions include updating the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fr 2502q - federalreserve

Edit your fr 2502q - federalreserve form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fr 2502q - federalreserve form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fr 2502q - federalreserve online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fr 2502q - federalreserve. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fr 2502q - federalreserve

How to fill out FR 2502Q

01

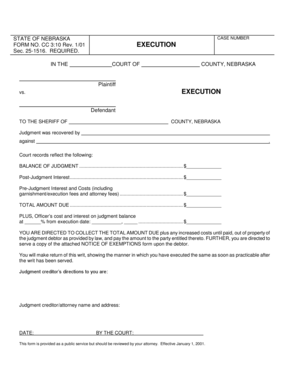

Gather all necessary documents related to your financial information.

02

Open the FR 2502Q form on your device or print it out.

03

Read the instructions provided with the form carefully.

04

Start by filling out your personal information, including name, address, and contact details.

05

Provide details on your financial situation, including income, debts, and expenses.

06

Review the sections regarding assets and liabilities; ensure all numbers are accurate.

07

Double-check that all required fields are completed.

08

Sign and date the form at the bottom.

09

Submit the form according to the instructions provided, ensuring to keep a copy for your records.

Who needs FR 2502Q?

01

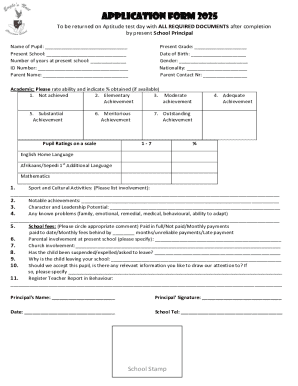

Individuals or businesses applying for financial assistance or reporting their financial status.

02

People seeking to resolve tax issues or disputes with the IRS.

03

Anyone required to report their financial situation as part of a loan application process.

Fill

form

: Try Risk Free

People Also Ask about

What is relevé d'identité bancaire translation to English?

RIB is an acronym that stands for “relevé d'identité bancaire” in French (or “bank identity statement” in English).

Who is responsible for filing reserve reports to the Federal Reserve?

All depository institutions, whether maintaining reserves directly with the Federal Reserve or in a pass-through arrangement, must submit their deposit reports to the Reserve Bank for the District in which they are located.

What is the Federal Reserve's main goal?

The Federal Reserve works to promote a strong U.S. economy. Specifically, Congress has assigned the Fed to conduct the nation's monetary policy to support the goals of maximum employment and stable prices. Those two goals are often referred to as the Fed's "dual mandate."

What is Federal Reserve in simple terms?

The Federal Reserve is the U.S. central bank, created by the Federal Reserve Act of 1913 to establish a monetary system that could respond effectively to stresses in the banking system.

What are the federal deposit reporting requirements?

Banks must report cash deposits of $10,000 or more. Don't think that breaking up your money into smaller deposits will allow you to skirt reporting requirements. Small business owners who often receive payments in cash also have to report cash transactions exceeding $10,000.

What is Federal Reserve reporting?

The Federal Reserve uses reporting forms to collect data from bank holding companies, depository institutions, other financial and nonfinancial entities and consumers. Submission of the forms is required in some cases, voluntary in others. Some data are collected frequently, others only occasionally.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FR 2502Q?

FR 2502Q is a financial reporting form used by certain financial institutions to report their quarterly consolidated financial statements to the Federal Reserve.

Who is required to file FR 2502Q?

Entities that are required to file FR 2502Q include holding companies and bank holding companies that meet specific asset thresholds and regulatory requirements set by the Federal Reserve.

How to fill out FR 2502Q?

To fill out FR 2502Q, filers need to provide accurate financial data according to specified categories, including balance sheet items and income statement information. Instructions for completion can be found in the official reporting guidelines published by the Federal Reserve.

What is the purpose of FR 2502Q?

The purpose of FR 2502Q is to provide the Federal Reserve with relevant information about the financial condition and performance of the reporting entities, aiding in regulatory oversight and economic research.

What information must be reported on FR 2502Q?

Information that must be reported on FR 2502Q includes the institution's assets, liabilities, equity, income, expenses, and other financial data as prescribed in the reporting instructions.

Fill out your fr 2502q - federalreserve online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fr 2502q - Federalreserve is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.