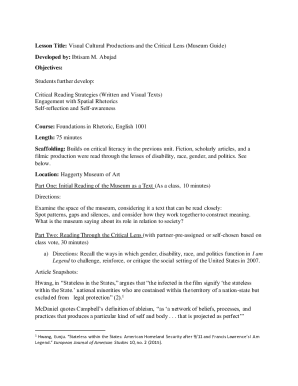

Get the free Transit Benefit Information and Programs - northwestern

Show details

This document outlines the transit benefits program available to Northwestern University staff, including payroll deduction options for transit fares and shuttle bus services for commuting staff members.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transit benefit information and

Edit your transit benefit information and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transit benefit information and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transit benefit information and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit transit benefit information and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transit benefit information and

How to fill out Transit Benefit Information and Programs

01

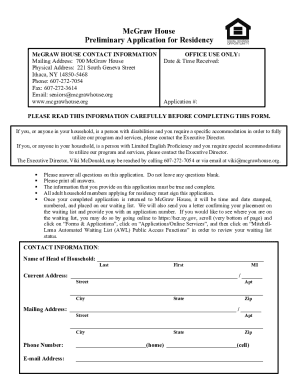

Obtain the Transit Benefit Information form from your employer or organization's transit program webpage.

02

Fill in your personal details such as name, employee ID, and department.

03

Indicate your preferred mode of transit (e.g., bus, train, etc.) by selecting the relevant option.

04

Provide the details of your regular transit route, including starting point and destination.

05

Specify the amount of benefit you are requesting based on your monthly commuting expenses.

06

Submit the completed form to your HR or benefits coordinator by the specified deadline.

07

Keep a copy of the form for your records.

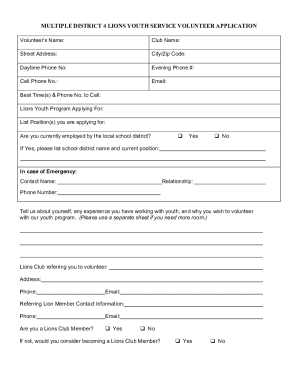

Who needs Transit Benefit Information and Programs?

01

Employees commuting to work using public transportation.

02

Employers looking to provide transit benefits to their staff.

03

Organizations aiming to promote eco-friendly commuting practices.

04

Individuals seeking to reduce their transportation costs and expenses.

Fill

form

: Try Risk Free

People Also Ask about

What are the benefits of being a commuter?

Benefits: Cheaper than owning a car Commute can be productive time to read, work, chat on the phone, or sleep The quietest and most pleasant of the public transportation options Basically just the usual litany of public transportation drawbacks: Doesn't operate exactly on your schedule.

What is an example of a commuter benefit?

Transit passes A transit pass allows commuters to use buses, rail, or ferries either free of charge or with a discount. The benefit provides up to $315 per month tax-free and may be combined with commuter highway allowances.

Are transit benefits use it or lose it?

This rule does NOT apply to Parking and Transit Benefits. As long as you are an active employee of your company, balances remaining in your account can be carried forward and used for future expenses.

What are commuter expenses?

Commuting expenses are costs that are incurred as a result of the taxpayer's regular means of getting back and forth to his or her place of employment. Commuting expenses can include car expenses, biking expenses, and public transportation costs.

Who is eligible for commuter benefits?

Generally, you are eligible to participate in the Commuter Benefit Program if you are an active employee, either full-time or part-time, with an appointment of more than 90 days, and have eligible parking expenses.

What is the VA transit benefit program?

VA's TBP will reimburse employees for commuting costs for qualified modes of transportation. Eligible VA employees may receive the lesser of their monthly commuting cost or the maximum amount allowable by the Internal Revenue Service (IRS).

What is the USAID transit benefit Program?

Under the program, Federal employees may receive transit passes in amounts approximately equal to employee commuting costs, not to exceed the maximum level allowed by law. The transit subsidy program was fully implemented throughout DOI in October 2000. OFAS manages the program for all OS staff.

What are commuter benefits?

Under the US federal tax code section 132(f), commuter benefits are a type of fringe benefit that is not taxed as income. Commuter benefits allow employees to pay for commuting expenses with non-taxed dollars.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Transit Benefit Information and Programs?

Transit Benefit Information and Programs refer to initiatives designed to provide financial assistance and incentives for individuals using public transportation services. These programs often include subsidies, discounts, or reimbursement for transit expenses incurred by employees commuting to work.

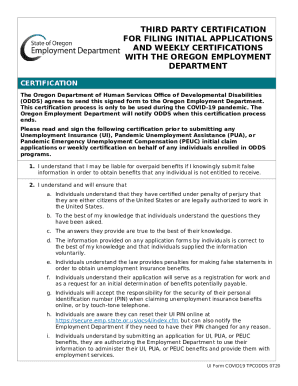

Who is required to file Transit Benefit Information and Programs?

Employers who provide transit benefits to their employees are required to file Transit Benefit Information and Programs. This includes organizations that offer transit reimbursement or subsidized passes as part of their employee compensation and benefits packages.

How to fill out Transit Benefit Information and Programs?

To fill out Transit Benefit Information and Programs, employers must gather data on the amount spent on transit benefits for each employee. This includes documenting the type of benefits offered, the total costs incurred, and ensuring compliance with relevant tax regulations. The completed form must be submitted as part of the required reporting process to the appropriate regulatory body.

What is the purpose of Transit Benefit Information and Programs?

The purpose of Transit Benefit Information and Programs is to promote the use of public transportation, reduce traffic congestion, and decrease the environmental impact of commuting. These programs also aim to provide financial relief for employees by helping to offset commuting costs.

What information must be reported on Transit Benefit Information and Programs?

Information that must be reported includes the total amount of transit benefits provided, the number of employees participating in the program, the types of transit benefits offered, and any relevant expenditures related to administering the program.

Fill out your transit benefit information and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transit Benefit Information And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.