Get the free Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisition...

Show details

This document is a registration form for attendees of the 7th Annual Institute on Tax Aspects of Mergers and Acquisitions, detailing fees, registration methods, and information related to Continuing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registration form for 7th

Edit your registration form for 7th form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registration form for 7th form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registration form for 7th online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit registration form for 7th. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registration form for 7th

How to fill out Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisitions

01

Visit the official website for the 7th Annual Institute on Tax Aspects of Mergers and Acquisitions.

02

Locate the 'Registration' section on the homepage.

03

Select the appropriate registration type (e.g., attendee, speaker, sponsor).

04

Fill in the required personal information, including name, email address, and contact number.

05

Provide information about your organization and job title.

06

Select the payment method and fill in any payment details if necessary.

07

Review the form for accuracy and completeness.

08

Submit the registration form and check for a confirmation email.

Who needs Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisitions?

01

Professionals and practitioners in the fields of tax, law, and finance.

02

Individuals involved in mergers and acquisitions.

03

Companies looking to understand tax implications of M&A transactions.

04

Students and academics interested in tax law and corporate finance.

Fill

form

: Try Risk Free

People Also Ask about

Are merger costs tax deductible?

Companies often pay substantial transaction costs when acquiring or selling a business. Fees paid to investment bankers, lawyers, accountants, and consultants to implement a transaction may be deductible for federal income tax purposes depending on the nature and timing of the services.

How do I notify the IRS of a merger?

What should you do? Most organizations that merge into another organization or otherwise terminate will notify the IRS of the changes by filing a final Form 990, Form 990-EZ or the e- Postcard (Form 990-N). Which form your organization uses depends on its gross income and assets.

How is a merger treated for tax purposes?

Merger: A merger occurs when two companies combine to form a single entity. Depending on the structure of the merger, it can be taxable or tax-free. In a tax-free merger, shareholders of the target company exchange their shares for shares in the acquiring company, deferring the recognition of any gains.

What are the different forms and types of mergers and acquisitions?

The four most basic types of merger are horizontal, vertical, congeneric, and conglomerate mergers. Beyond these core types, there are also market or product extension mergers and numerous types of acquisitions that are also in some sense mergers.

How do I report a merger on my taxes?

What should you do? Most organizations that merge into another organization or otherwise terminate will notify the IRS of the changes by filing a final Form 990, Form 990-EZ or the e- Postcard (Form 990-N). Which form your organization uses depends on its gross income and assets.

What are the income tax implications on merger?

While mergers are tax neutral, the transfer of shares attracts capital gains taxes in the hands of the transfer or shareholders. As an anti-avoidance measure, ITA provides minimum valuation rules for the transfer of shares.

What is the law that requires a business to gain federal approval when considering a merger or acquisition with another company?

Benefits of M&A in the Restaurant Industry Increased Buying Power: Larger restaurant groups gain better negotiating leverage with suppliers, reducing costs. Brand Diversification: M&A allows restaurants to diversify their offerings, reducing risk by targeting different customer segments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisitions?

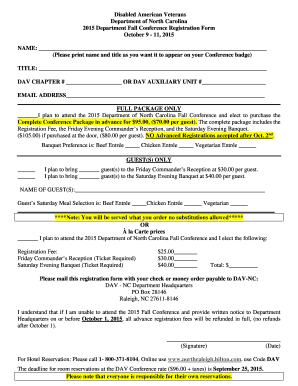

The Registration Form for the 7th Annual Institute on Tax Aspects of Mergers and Acquisitions is a document used to enroll participants for the event, which focuses on the tax implications associated with mergers and acquisitions.

Who is required to file Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisitions?

Individuals and organizations interested in attending the event, including tax professionals, accountants, lawyers, and corporate executives involved in mergers and acquisitions, are required to file the Registration Form.

How to fill out Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisitions?

To fill out the Registration Form, participants should provide their personal details such as name, contact information, organization, and relevant experience in mergers and acquisitions, followed by submitting the form along with any required payment.

What is the purpose of Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisitions?

The purpose of the Registration Form is to facilitate the organization of the event by collecting necessary information from participants, ensuring that the event can accommodate all attendees and provide them with relevant resources.

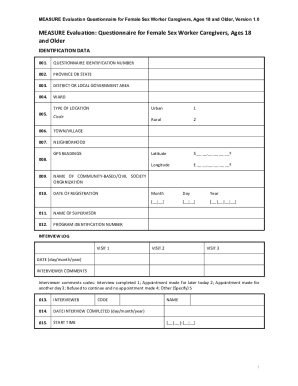

What information must be reported on Registration Form for 7th Annual Institute on Tax Aspects of Mergers and Acquisitions?

The Registration Form must include information such as the participant's name, job title, organization, email address, phone number, and any specific dietary or accommodation requirements for the event.

Fill out your registration form for 7th online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registration Form For 7th is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.