JM Application for Taxpayer Registration (Individuals) 2002 free printable template

Show details

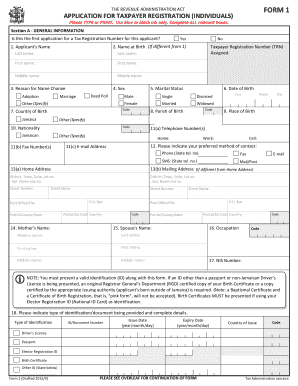

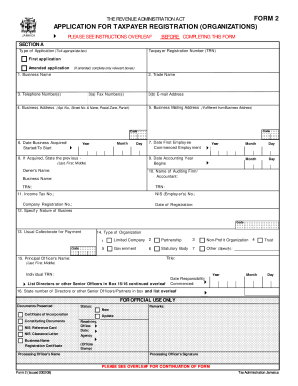

APPLICATION FOR TAXPAYER REGISTRATION (INDIVIDUALS). FORM 1 ... (a) IS Number: ... PLEASE SEE OVERLEAF FOR CONTINUATION OF FORM ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign JM Application for Taxpayer Registration Individuals

Edit your JM Application for Taxpayer Registration Individuals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your JM Application for Taxpayer Registration Individuals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing JM Application for Taxpayer Registration Individuals online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit JM Application for Taxpayer Registration Individuals. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

JM Application for Taxpayer Registration (Individuals) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out JM Application for Taxpayer Registration Individuals

How to fill out JM Application for Taxpayer Registration (Individuals)

01

Gather required documents such as ID, proof of address, and any other necessary identification.

02

Obtain the JM Application for Taxpayer Registration form from the relevant tax authority or their website.

03

Fill in personal details, including your full name, date of birth, and contact information.

04

Provide your residential address and any other required address details.

05

Complete the section regarding your occupation and income details as needed.

06

Review the application for accuracy and completeness.

07

Sign and date the application form.

08

Submit the completed application to the local tax authority office or as instructed.

Who needs JM Application for Taxpayer Registration (Individuals)?

01

Individuals who need to register for tax purposes.

02

New residents and expatriates who are required to obtain a taxpayer identification.

03

Self-employed individuals seeking to formalize their tax registration.

04

Students who earn income and are required to file taxes.

Fill

form

: Try Risk Free

People Also Ask about

Can I apply for my Jamaican TRN online?

Register and log in to your account. Log in to the editor with your credentials or click on Create free account to examine the tool's capabilities. Add the Trn application form online jamaica for redacting.

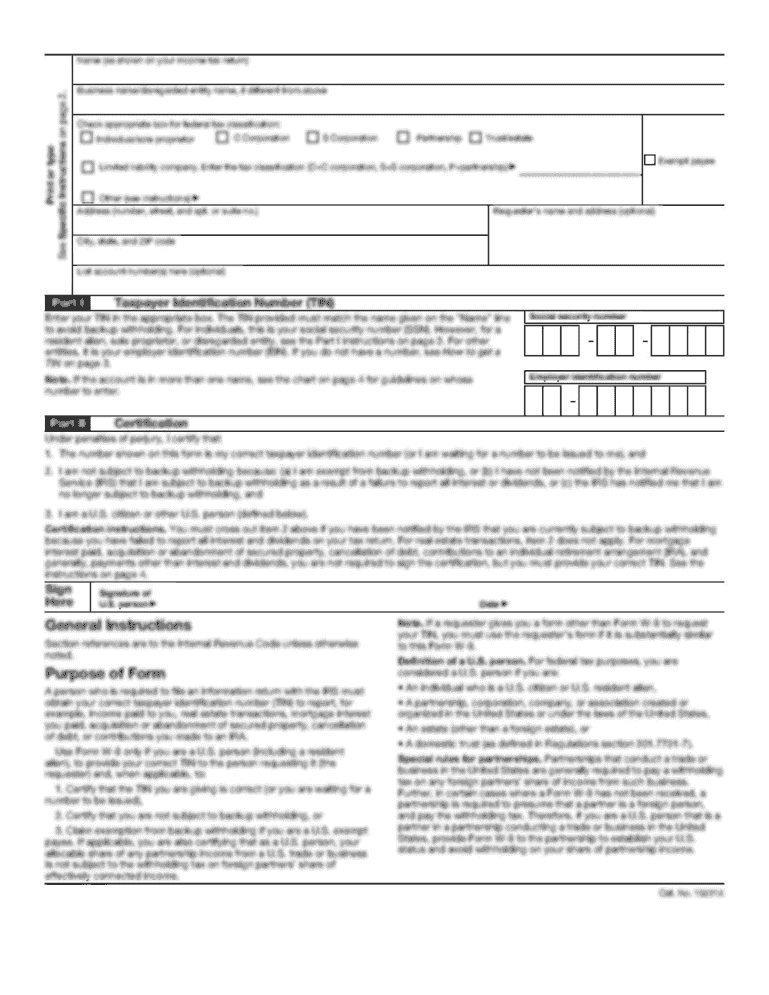

What do I need to apply for my TRN?

Requirements for Individuals (Submitting applications from overseas) Completed and signed TRN application form (click here for application) A copy of applicant's Passport OR Driver's Licence (notarized by a Notary Public, High Commission or Consulate).

How do I apply for TRN UK?

To apply for your TRN, you will be required to complete an application using the form - Application for taxpayer registration (individuals). This can be done in office or online.

Where can I get my TRN in Jamaica?

Taxpayer Registration Centre Tax Administration Jamaica (TAJ) 116 East Street, Kingston Telephone: 1-876-924-9280/1 Home. Introduction & Eligibility.

How can I get TRN number?

A Tax Registration Number (TRN) is issued by Revenue when you register for tax as a sole trader, trust, partnership or company. You must use your TRN when trading and filing your tax returns as a sole trader, trust, partnership or company.

What is the importance of TRN?

tRNAs are important players in the protein synthesis pathway, linking the genetic code with the amino acid sequence of proteins. tRNAs are composed of 73–90 nucleotides and have a characteristic cloverleaf secondary structure made up of the D-loop, T loop, variable loop, and the anticodon loop.

How do you take TRN?

Procedure to Apply for TRN Click on Sign up and furnish the details such as e-mail Id, password, security code and security question in the sign-up form. You will receive an email at your registered email address asking you to verify your email address. Log in to your account with your credentials (User Name and password)

What are the requirements to get a TRN in Jamaica?

Certified copy of their passport or driver's licence; National identification, Work ID or School ID; Certified passport-sized photograph; Any other photographic identification accompanied by a birth certificate.

How do I apply for a child's TRN?

Applications for minors should be completed and signed and/or co-signed by either a parent or guardian. Application signed by a parent should be submitted with the following: Child's birth certificate. Professionally produced, certified passport size photograph or picture identification for child.

How long does it take to get TRN?

When the application is received by the Taxpayer Registration Centre, a TRN will be assigned and an email will be sent to the client advising him/her of the TRN assigned. A letter will then be prepared in approximately two weeks and subsequently mailed to the applicant.

What is needed to get a TRN in Jamaica?

Certified copy of their passport or driver's licence; National identification, Work ID or School ID; Certified passport-sized photograph; Any other photographic identification accompanied by a birth certificate.

How long does it take to get TRN in Jamaica?

When the application is received by the Taxpayer Registration Centre, a TRN will be assigned and an email will be sent to the client advising him/her of the TRN assigned. A letter will then be prepared in approximately two weeks and subsequently mailed to the applicant.

What do I need to get my TRN in Jamaica?

Certified copy of their passport or driver's licence; National identification, Work ID or School ID; Certified passport-sized photograph; Any other photographic identification accompanied by a birth certificate.

How do I apply for a TRN for a minor in Jamaica?

The parent/guardian is required to submit a complete application form with their identification and TRN, accompanied by the child's birth certificate and a form of identification (ID). A passport, school ID or certified passport-sized photograph are acceptable forms of ID for the child.

Can a US citizen get a TRN in Jamaica?

Anyone can apply for a TRN, including non-Jamaicans and non-residents.

How long does it take to get a TRN number in Jamaica?

When the application is received by the Taxpayer Registration Centre, a TRN will be assigned and an email will be sent to the client advising him/her of the TRN assigned. A letter will then be prepared in approximately two weeks and subsequently mailed to the applicant.

Can you apply for a Jamaican TRN online?

To apply for your TRN, you will be required to complete an application using the form - Application for taxpayer registration (individuals). This can be done in office or online.

How much does it cost to get a TRN in Jamaica?

TRN Frequently Asked Questions A No, there is no fee involved in obtaining a TRN.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send JM Application for Taxpayer Registration Individuals for eSignature?

JM Application for Taxpayer Registration Individuals is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit JM Application for Taxpayer Registration Individuals on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as JM Application for Taxpayer Registration Individuals. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out JM Application for Taxpayer Registration Individuals on an Android device?

On Android, use the pdfFiller mobile app to finish your JM Application for Taxpayer Registration Individuals. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is JM Application for Taxpayer Registration (Individuals)?

The JM Application for Taxpayer Registration (Individuals) is a form used by individual taxpayers to register for a taxpayer identification number with the tax authorities.

Who is required to file JM Application for Taxpayer Registration (Individuals)?

Individuals who are seeking to establish their tax identity for the purpose of reporting income, claiming deductions, or fulfilling tax obligations are required to file the JM Application.

How to fill out JM Application for Taxpayer Registration (Individuals)?

To fill out the JM Application, individuals need to complete the required fields with their personal details, including name, address, date of birth, and any identification numbers needed as specified in the form instructions.

What is the purpose of JM Application for Taxpayer Registration (Individuals)?

The purpose of the JM Application is to formally register individuals as taxpayers to ensure compliance with tax laws and to facilitate the payment of taxes.

What information must be reported on JM Application for Taxpayer Registration (Individuals)?

The application typically requires reporting personal information such as full name, address, date of birth, nationality, and identification numbers such as Social Security Number or National ID, depending on the jurisdiction.

Fill out your JM Application for Taxpayer Registration Individuals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

JM Application For Taxpayer Registration Individuals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.