Get the free 2010-2011 Income Expense Declaration - pmc

Show details

This form is used by students at Pine Manor College to declare their income and expenses for financial aid assessment for the year ending in 2009.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2010-2011 income expense declaration

Edit your 2010-2011 income expense declaration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010-2011 income expense declaration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2010-2011 income expense declaration online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2010-2011 income expense declaration. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2010-2011 income expense declaration

How to fill out 2010-2011 Income Expense Declaration

01

Gather all necessary financial documents, including income statements, receipts for expenses, and tax forms.

02

Begin with the Income section, filling in all sources of income such as wages, business income, and rental income.

03

Next, proceed to the Expense section, itemizing all deductible expenses, like business costs, medical bills, and charitable contributions.

04

Ensure accuracy in each entry, double-check calculations, and make sure totals are correct.

05

Review the completed form for any missing information or errors.

06

Sign and date the declaration, then submit it according to the guidelines provided by the relevant authority.

Who needs 2010-2011 Income Expense Declaration?

01

Individuals or businesses required to report their income and expenses for the tax year 2010-2011.

02

Taxpayers seeking to claim deductions or credits based on their financial activities during that period.

03

Self-employed persons who need to document their earnings and expenditures for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to fill out an income and expense declaration?

An Income and Expense Declaration is a standardized four-page form required by California law in divorce cases. Both parties (the spouse filing for divorce and the other spouse) must fill out this form to provide a clear picture of their financial status, including their income and expenses.

Do you have to fill out a declaration?

You will need to complete a customs declaration (CN22 or CN23) for any gifts and goods sent abroad. Items sent without a customs declaration (CN22 or CN23), associated electronic pre advice, or are incorrectly or partially completed may be delayed or returned to sender.

Do I have to complete an income and expenditure form?

If you're struggling to pay a debt, have tried to extend your credit but were rejected, or have tried to negotiate a payment with a creditor or the bank, you may have been told to complete an income and expenditure form. We ask you to fill in one of these forms so we have a better understanding of your situation.

What is the purpose of an income and expense declaration?

Give your financial information to the court and to your spouse or domestic partner. The court uses the information to make orders for support, attorneys fees, and other costs.

What do I do if the opposing party refuses to provide their declaration of disclosure?

(1) File a motion to compel a further response. (2) File a motion for an order preventing the noncomplying party from presenting evidence on issues that should have been covered in the declaration of disclosure.

How do I fill out a FL 150 form?

0:05 17:43 And the approximate date your job. Started um you will also attach two months worth of payubs toMoreAnd the approximate date your job. Started um you will also attach two months worth of payubs to this form. Make sure to redact. The social security numbers for your own privacy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

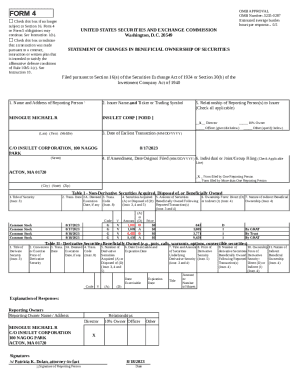

What is 2010-2011 Income Expense Declaration?

The 2010-2011 Income Expense Declaration is a financial document that individuals or entities use to report their income and expenses for the fiscal year 2010-2011.

Who is required to file 2010-2011 Income Expense Declaration?

Individuals or entities who have earned income during the fiscal year 2010-2011 and are subject to tax obligations are required to file the 2010-2011 Income Expense Declaration.

How to fill out 2010-2011 Income Expense Declaration?

To fill out the 2010-2011 Income Expense Declaration, one must gather all relevant income and expense documentation, complete the designated forms accurately, and submit them to the appropriate tax authority by the specified deadline.

What is the purpose of 2010-2011 Income Expense Declaration?

The purpose of the 2010-2011 Income Expense Declaration is to provide a clear and accurate account of financial activities to ensure compliance with tax regulations and calculate any tax liabilities.

What information must be reported on 2010-2011 Income Expense Declaration?

The information that must be reported includes total income, allowable deductions, business expenses, and any other relevant financial data related to income sources during the fiscal year.

Fill out your 2010-2011 income expense declaration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2010-2011 Income Expense Declaration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.