Get the free Mileage Reimbursement Submission Instructions

Show details

A detailed guide on the process of submitting mileage reimbursement requests, including necessary steps, required documents, and tips for successful submission.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mileage reimbursement submission instructions

Edit your mileage reimbursement submission instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mileage reimbursement submission instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mileage reimbursement submission instructions online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mileage reimbursement submission instructions. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mileage reimbursement submission instructions

How to fill out Mileage Reimbursement Submission Instructions

01

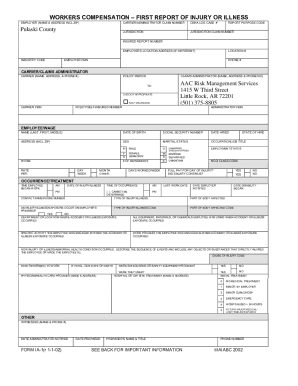

Gather all necessary documentation, such as receipts or mileage logs.

02

Access the Mileage Reimbursement Submission form on your company’s intranet or designated platform.

03

Fill in your personal information, including name, department, and contact details.

04

Enter the date of each trip taken for business purposes.

05

Provide the starting and ending locations of each trip.

06

Calculate the total miles driven for each trip and input the mileage in the appropriate field.

07

Attach any required supporting documents, such as maps or receipts, if applicable.

08

Review all entered information for accuracy.

09

Submit the completed Mileage Reimbursement form as per your company’s guidelines.

Who needs Mileage Reimbursement Submission Instructions?

01

Employees who travel for business purposes and incur mileage expenses.

02

Contractors or freelancers who perform work-related travel.

03

Any staff members needing reimbursement for vehicular expenses related to company business.

Fill

form

: Try Risk Free

People Also Ask about

What is the proper way to calculate mileage reimbursement?

IRS rate for calculating mileage reimbursements You can use the annual official mileage rate the IRS provides to calculate mileage reimbursement or deductions. The 2025 IRS standard rate is 70 cents per mile, and the 2024 rate is 67 cents per mile.

What are the IRS travel reimbursement rules?

What is the IRS rule for expense reimbursement? To be reimbursed for travel expenses, you must be traveling outside your tax home for longer than a workday, and the trip must require rest to continue working. Your tax home is your main place of work, not necessarily where you live.

What are the IRS rules for mileage?

The standard mileage rates for 2025 are: Self-employed and business: 70 cents/mile. Charities: 14 cents/mile. Medical: 21 cents/mile. Moving (military only): 21 cents/mile.

How many cents per mile is the IRS going to pay in 2025?

Effective Jan. 1, 2025, the standard mileage rate is set at 70 cents per mile for business miles driven (up 3 cents from the 2024 rate of 67 cents per mile). The rates apply to electric and hybrid-electric vehicles, as well as gasoline and diesel-powered vehicles.

What are the IRS guidelines for mileage reimbursement?

ing to the IRS, in 2025, the standard mileage rate for businesses is $0.70 per mile, $0.21 per mile for medical, and $0.14 per mile for charities.

What are the rules for mileage reimbursement?

Employment law related to mileage reimbursement On the federal level, there is no requirement for employers to reimburse employees for mileage when workers are using personal vehicles for company purposes. However, all employers are federally required to reimburse employees for any work-related expense to a point.

How do I submit mileage for reimbursement?

To be reimbursed for your business driving, you must provide your employer with consistent mileage records. They should include information for every business trip, including the date, destination, purpose, and total mileage driven.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mileage Reimbursement Submission Instructions?

Mileage Reimbursement Submission Instructions are guidelines provided for employees to submit claims for reimbursement of travel expenses incurred using their personal vehicles for work-related purposes.

Who is required to file Mileage Reimbursement Submission Instructions?

Employees who use their personal vehicles for business purposes and wish to be reimbursed for the mileage they incur during such travel are required to file Mileage Reimbursement Submission Instructions.

How to fill out Mileage Reimbursement Submission Instructions?

To fill out Mileage Reimbursement Submission Instructions, employees must provide details of their trips, including the date of travel, starting and ending locations, purpose of the trip, total miles driven, and any necessary documentation or receipts.

What is the purpose of Mileage Reimbursement Submission Instructions?

The purpose of Mileage Reimbursement Submission Instructions is to ensure that employees are accurately compensated for the costs associated with using their personal vehicles for business purposes while adhering to company policies.

What information must be reported on Mileage Reimbursement Submission Instructions?

The information that must be reported includes the employee's name, dates of travel, starting and ending locations, purpose of the travel, total mileage, and any other specific details as required by the company's reimbursement policy.

Fill out your mileage reimbursement submission instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mileage Reimbursement Submission Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.