Get the free UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES - princeton

Show details

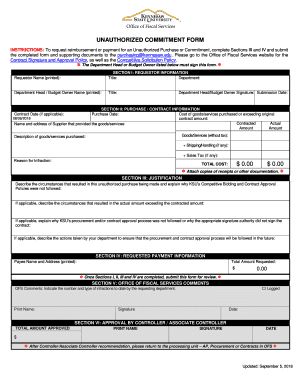

This document outlines the procedures and certification required for submitting non-compensation expenses as per the university's Business Expense Policy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign university guidelines for non-compensation

Edit your university guidelines for non-compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your university guidelines for non-compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit university guidelines for non-compensation online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit university guidelines for non-compensation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out university guidelines for non-compensation

How to fill out UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES

01

Read the UNIVERSITY GUIDELINES carefully to understand the scope of non-compensation expenses.

02

Gather all relevant documents and receipts that pertain to your non-compensation expenses.

03

Identify the specific categories your expenses fall into as outlined in the guidelines.

04

Fill out the expense report form provided in the guidelines, ensuring to provide accurate details.

05

Attach the gathered documents as supporting evidence for your expenses.

06

Review your filled-out form for completeness and accuracy.

07

Submit the completed expense report to the designated department or individual as stated in the guidelines.

Who needs UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES?

01

Faculty members seeking reimbursement for non-compensation related expenses.

02

Administrative staff managing budgets and expense reports.

03

Graduate students and research assistants who incur approved non-compensation expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the per diem rate for West Point New York?

The lodging per-diem rate of $123.00 is intended to cover the costs of one night's lodging at a hotel in West Point, based on the average daily rate in the local lodging industry.

What is the per diem rate for NYU?

If you are traveling within the US, you should use the US government per diem rates, up to a maximum of $75 per day. If you are traveling outside the US, your per diem should be $75 a day for each full day of business travel. For travel days (first and last day of business travel), your per diem should be $55 a day.

What is the per diem meal allowance?

A per diem is a daily allowance given to employees by a company to pay for certain expenses while traveling for business. These expenses include lodging, meals, and incidentals. Companies will sometimes issue a credit card to employees to pay their per diem expenses.

What is the grace period for NYU employees?

If the employee clocks in/out before or after the grace period, then the employee's pay calculation will be based on the actual clocked time. For Local 1 employees, the grace period is 15 minutes before and 3 minutes after the scheduled start time and 10 minutes after the scheduled end time.

What is student reimbursement at NYU?

Students may request reimbursement for University business expenses and other payments (e.g., awards, gifts, etc.) using the Student Expense Reimbursement Online Form. This process is managed in the NYU Albert Student Information System (SIS).

What are non salary expenses?

Nonsalary compensation expenses should include the cost of insurance premiums (health, disability, etc.), unemployment compensation, retirement benefits, awards or gifts (e.g., tickets to sporting events, gift certificates, etc.), relocation costs, vehicle or housing allowances, and any other nonmonetary compensation (

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES?

The University Guidelines for Non-Compensation Expenses provide a framework for the proper approval, documentation, and reimbursement of expenses that are not related to employee compensation.

Who is required to file UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES?

All university employees and affiliates who incur non-compensation expenses and seek reimbursement or approval for those expenses are required to adhere to the guidelines.

How to fill out UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES?

To fill out the guidelines, individuals must provide detailed information about the expense, including the purpose, date, amount, supporting documentation, and required signatures for approval.

What is the purpose of UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES?

The purpose of these guidelines is to ensure transparency, accountability, and compliance with university policies and regulations regarding the reimbursement and tracking of non-compensation related expenses.

What information must be reported on UNIVERSITY GUIDELINES FOR NON-COMPENSATION EXPENSES?

The reported information must include the date of the expense, amount, category of the expense, description of the purpose, vendor information, and any attached receipts or relevant documentation.

Fill out your university guidelines for non-compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

University Guidelines For Non-Compensation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.