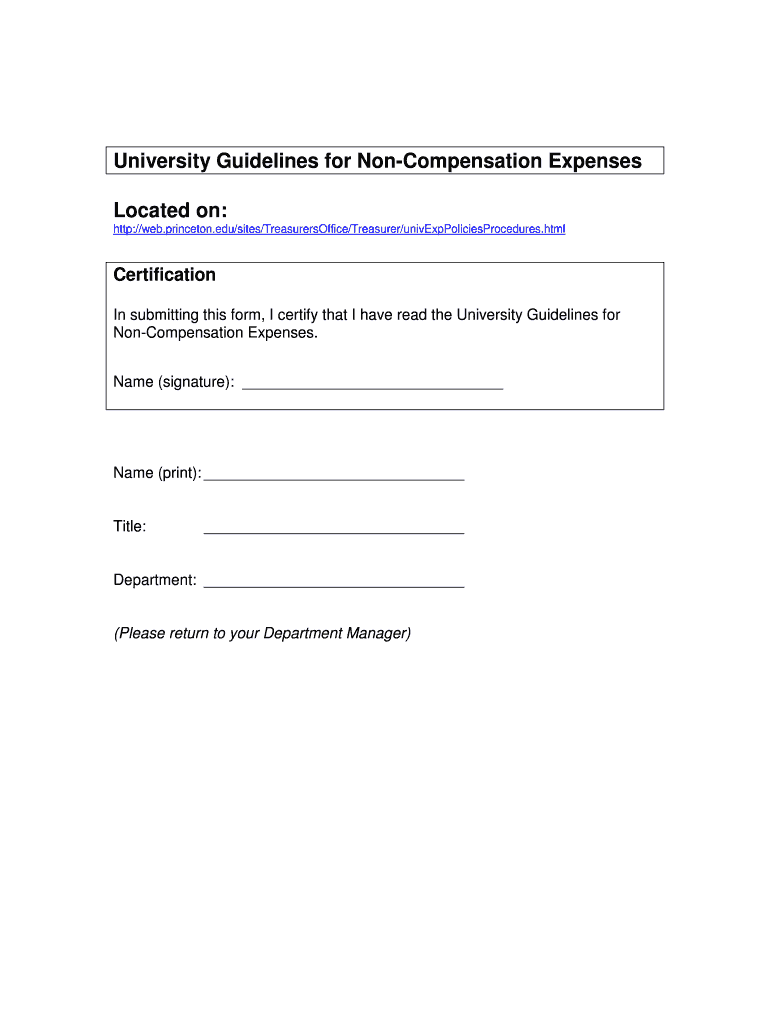

Get the free University Guidelines for Non-Compensation Expenses - princeton

Show details

This document provides certification that the individual has read the university's guidelines regarding non-compensation expenses, to be submitted to the Department Manager.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign university guidelines for non-compensation

Edit your university guidelines for non-compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your university guidelines for non-compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing university guidelines for non-compensation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit university guidelines for non-compensation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out university guidelines for non-compensation

How to fill out University Guidelines for Non-Compensation Expenses

01

Gather all necessary documentation related to the non-compensation expenses.

02

Review the university’s specific guidelines for what qualifies as a non-compensation expense.

03

Complete the required forms provided by the university, ensuring all fields are filled out accurately.

04

Attach all relevant receipts and supporting documents to substantiate the expenses claimed.

05

Double-check the calculations and ensure that the total expenses match the documentation provided.

06

Submit the completed forms and documents to the appropriate department as outlined by the university guidelines.

Who needs University Guidelines for Non-Compensation Expenses?

01

Faculty members requesting reimbursement for non-compensation expenses.

02

Staff involved in projects that incur non-compensation expenses.

03

Students engaging in university-sanctioned activities that require out-of-pocket expenditures.

Fill

form

: Try Risk Free

People Also Ask about

What is the per diem rate for NYU?

If you are traveling within the US, you should use the US government per diem rates, up to a maximum of $75 per day. If you are traveling outside the US, your per diem should be $75 a day for each full day of business travel. For travel days (first and last day of business travel), your per diem should be $55 a day.

What is the policy of expense reimbursement?

An expense reimbursement policy is a formal set of guidelines that outlines how employees are compensated for business-related expenses they incur while performing their job duties. These expenses can include travel, office supplies, meals, professional development, and other expenses that occur while on the job.

What is considered a salary expense?

Classification in Financial Statements. Salaries and wages expense is typically classified as an operating expense on the income statement. It's often one of the largest expense items for many businesses, directly impacting the company's profitability.

What is a non-salary expense?

Examples of Non-Salary Administrative Expenses Mail stop charges. Memberships and subscriptions. Networking costs -- routine, behind the wall. General administrative supplies. Postage for office correspondence and delivery of proposals.

What are direct non-salary expenses?

Direct Non-Salary Costs will be reimbursed at the Actual Cost to the CONSULTANT. These charges may include, but are not limited to, the following items: travel, printing, long distance telephone, supplies, computer charges and fees of sub-consultants.

What are non salary expenses?

Nonsalary compensation expenses should include the cost of insurance premiums (health, disability, etc.), unemployment compensation, retirement benefits, awards or gifts (e.g., tickets to sporting events, gift certificates, etc.), relocation costs, vehicle or housing allowances, and any other nonmonetary compensation (

What are examples of non-operating income expenses?

Examples of Non-Operating Expenses Interest expense. Obsolete inventory charges. Derivatives expense. Restructuring expense. Loss on disposition of assets. Damages Caused to Fire. Floatation cost. Lawsuit settlement expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is University Guidelines for Non-Compensation Expenses?

University Guidelines for Non-Compensation Expenses provide a framework for identifying, categorizing, and managing expenses that do not fall under employee compensation, ensuring they adhere to university policies.

Who is required to file University Guidelines for Non-Compensation Expenses?

All departments, faculty, and staff involved in financial transactions or budgeting within the university are required to file under the University Guidelines for Non-Compensation Expenses.

How to fill out University Guidelines for Non-Compensation Expenses?

To fill out the guidelines, individuals should gather relevant receipts, provide detailed descriptions of expenses, categorize them appropriately, and submit the documents as per the university's financial administration requirements.

What is the purpose of University Guidelines for Non-Compensation Expenses?

The purpose is to provide clear instructions and standards for managing non-compensation expenses which ensure transparency, accountability, and compliance with financial regulations.

What information must be reported on University Guidelines for Non-Compensation Expenses?

Required information includes the date of the expense, amount, description of the expense, category, related project or program code, and any supporting documentation such as receipts.

Fill out your university guidelines for non-compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

University Guidelines For Non-Compensation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.