Get the free Fidelity Individual Retirement Account Disclosure Statement

Show details

Fees and Expenses. Fees and other expenses of maintaining and terminating your Fidelity IRA if any are described in the Schedule of Fees which accompany this Disclosure Statement or in some other manner acceptable to the Custodian and may be changed from time to time as provided in the Custodial Agreement. D I S C L O S U R E S TAT E M E N T Fidelity Individual Retirement Account The following information is generally applicable for tax years beginning after December 31 2001 and is provided...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity individual retirement account

Edit your fidelity individual retirement account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity individual retirement account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fidelity individual retirement account online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fidelity individual retirement account. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity individual retirement account

How to fill out Fidelity Individual Retirement Account Disclosure Statement

01

Obtain the Fidelity Individual Retirement Account Disclosure Statement form from the Fidelity website or by contacting customer service.

02

Read the instructions carefully to understand the purpose of the form and the information required.

03

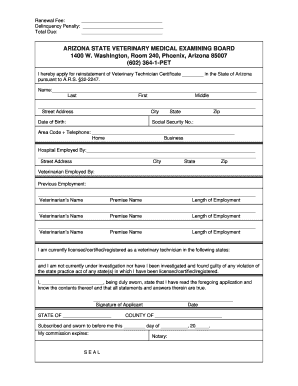

Fill in your personal information, including your name, address, date of birth, and Social Security number.

04

Indicate the type of IRA you are applying for (Traditional or Roth).

05

Provide information about your employment and income, including your employer's name and your annual income.

06

Review the contribution limits for your IRA type and specify the amount you plan to contribute.

07

Read and acknowledge the terms and conditions by signing and dating the form.

08

Submit the completed form online or by mailing it to Fidelity.

Who needs Fidelity Individual Retirement Account Disclosure Statement?

01

Individuals looking to open or manage a Fidelity Individual Retirement Account.

02

Those planning for retirement who need to understand the terms, fees, and investment options associated with their IRA.

03

Investors seeking to assess their financial goals and strategies for retirement savings.

Fill

form

: Try Risk Free

People Also Ask about

Is Fidelity a good place to have an IRA?

Fidelity IRA: Best for Tools and Resources Fidelity's traditional IRAs come with $0 account minimums and commission-free trades on stocks, ETFs, and options. The brokerage also offers several other retirement accounts, including Roth IRAs, rollover IRAs, small business retirement plans, and Roth IRAs for Kids.

Do I need my IRA statement for taxes?

Depending on the type of IRA you have, you may need Form 5498 to report IRA contribution deductions on your tax return. Form 5498: IRA Contributions Information reports to the IRS your IRA contributions for the year along with other information about your IRA account.

What documents does Fidelity need?

What's Needed to Open a Personal Account Name. Tax identification number. Valid government photo identification issued at least 30 days ago. Date of birth. Mailing and physical address (if different) Contact phone number. Mother's maiden name (for additional security) Citizenship/Residency status.

What is required disclosure information?

Disclosure involves providing detailed and transparent information about an organization's performance and position. It is often required to ensure transparency, enable investors and stakeholders to make informed decisions, and maintain trust in financial markets.

What information is needed to open a Fidelity brokerage account?

A brokerage account application will usually ask for personal details, employment info, investment profile, and, if you'll be investing online, bank information. The process could take only a few minutes online. Once you open a brokerage account, you can link it to a bank account and transfer money.

What documents does Fidelity need?

What's Needed to Open a Personal Account Name. Tax identification number. Valid government photo identification issued at least 30 days ago. Date of birth. Mailing and physical address (if different) Contact phone number. Mother's maiden name (for additional security) Citizenship/Residency status.

What is required disclosure information for Fidelity?

Disclosure requirement: Certain service providers, such as Fidelity, must disclose the services being performed and the direct or indirect compensation that is being received. This would include compensation such as consulting fees, brokerage fees, transfer fees, and 12b-1 fees.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fidelity Individual Retirement Account Disclosure Statement?

The Fidelity Individual Retirement Account Disclosure Statement is a document that outlines the terms, conditions, fees, and investment options associated with a Fidelity Individual Retirement Account (IRA). It provides essential information to help investors understand their rights and responsibilities.

Who is required to file Fidelity Individual Retirement Account Disclosure Statement?

Typically, individuals who open a Fidelity Individual Retirement Account are required to review and acknowledge the Fidelity Individual Retirement Account Disclosure Statement. This document is not filed with any regulatory agency but is provided to account holders.

How to fill out Fidelity Individual Retirement Account Disclosure Statement?

To fill out the Fidelity Individual Retirement Account Disclosure Statement, individuals should carefully read the provided information, ensure they understand the terms, and sign or acknowledge receipt as required. Most of the information is already pre-filled by Fidelity; the individual usually needs to provide personal details and confirm their understanding.

What is the purpose of Fidelity Individual Retirement Account Disclosure Statement?

The purpose of the Fidelity Individual Retirement Account Disclosure Statement is to inform account holders about the features, benefits, and risks associated with their IRA, including investment choices and associated fees.

What information must be reported on Fidelity Individual Retirement Account Disclosure Statement?

The information included in the Fidelity Individual Retirement Account Disclosure Statement typically includes details about the account type, investment options, fees and expenses, risks, as well as the rights and obligations of the account holder.

Fill out your fidelity individual retirement account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Individual Retirement Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.