Get the free THE FIDELITY SIMPLE-IRA PLAN

Show details

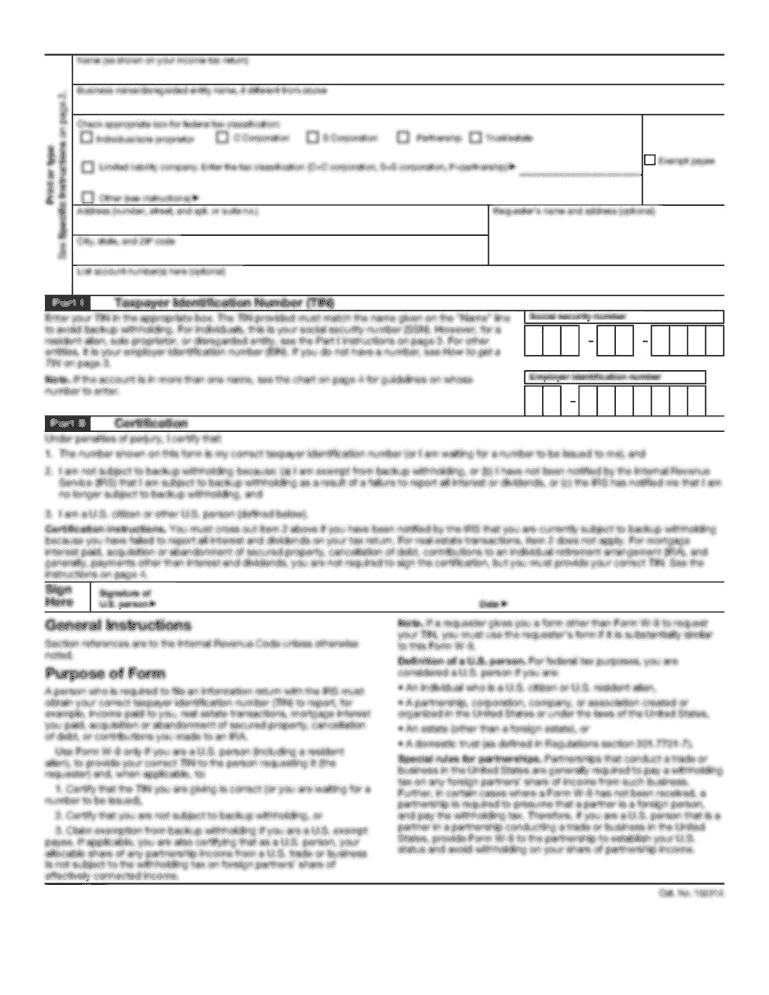

Types of IRAs. The following account types are available under the Fidelity SIMPLE-IRA Custodial Agreement and Disclosure Statement SIMPLE-IRA. B Agreement means the Fidelity SIMPLE-IRA Custodial Agreement and Disclosure Statement as may be amended from time to time including the information and provisions set forth in any Application that goes with this Agreement. Account Information. receive the balance of your SIMPLE-IRA upon your death. The Beneficiary ies must be designated on your...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form fidelity simple-ira plan

Edit your form fidelity simple-ira plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form fidelity simple-ira plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form fidelity simple-ira plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form fidelity simple-ira plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form fidelity simple-ira plan

How to fill out THE FIDELITY SIMPLE-IRA PLAN

01

Obtain the Fidelity SIMPLE-IRA Plan documents from Fidelity's website or your employer.

02

Review the plan details, including eligibility requirements and contribution limits.

03

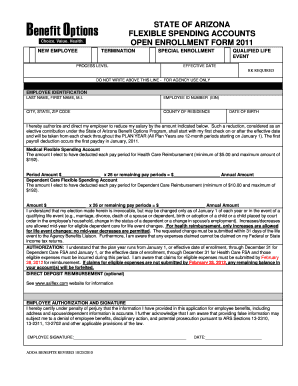

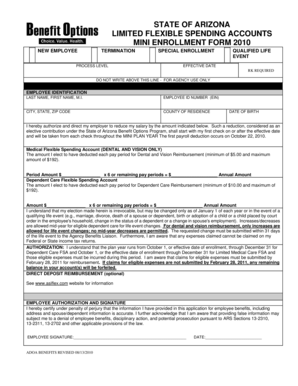

Complete the enrollment form provided in the plan documents.

04

Choose your contribution amount, adhering to the annual limits set by the IRS.

05

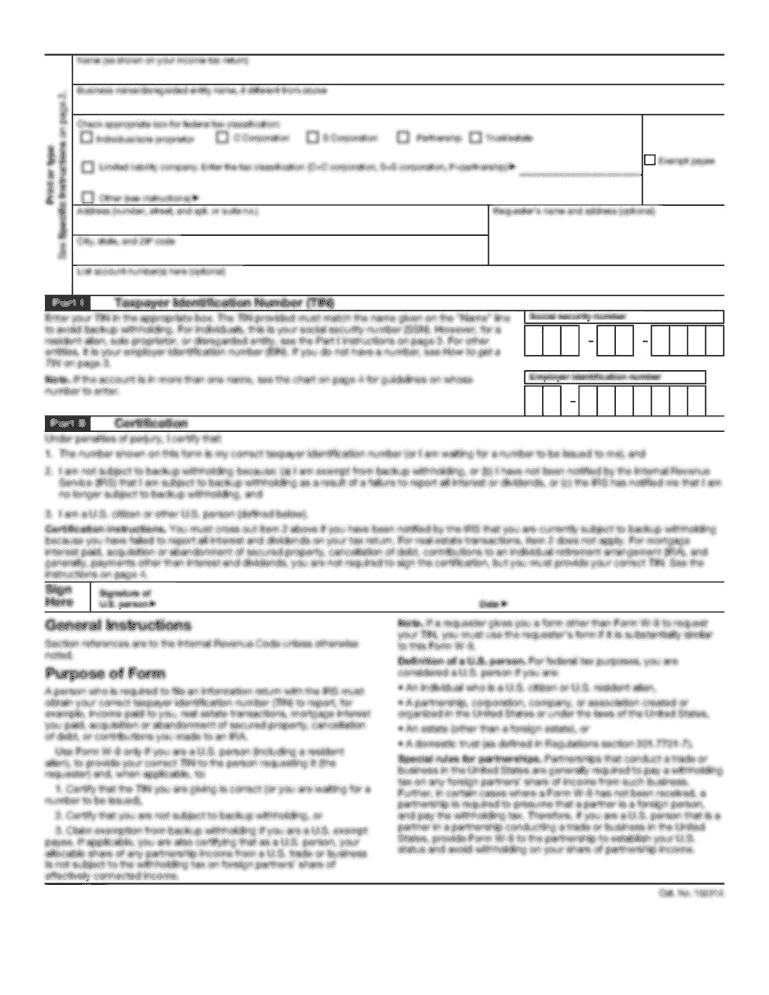

Provide your personal information, including Social Security Number, address, and date of birth.

06

Designate a beneficiary by filling out the beneficiary section of the application.

07

Review and sign the plan agreement to confirm your acceptance of the terms.

08

Submit your completed enrollment form to Fidelity or your employer as instructed.

Who needs THE FIDELITY SIMPLE-IRA PLAN?

01

Individuals who are self-employed or own a small business.

02

Employees of small businesses that offer the Fidelity SIMPLE-IRA Plan.

03

Workers looking for a tax-advantaged way to save for retirement.

04

Those seeking a streamlined and easy-to-manage retirement savings option.

Fill

form

: Try Risk Free

People Also Ask about

What is the 5 year rule for IRAs?

Drawbacks of a SIMPLE IRA Lower contribution limits: SIMPLE IRAs have considerably lower contribution limits than other options for self-employed people, such as 401(k)s or SEP IRAs. Participant loan restrictions: Unlike 401(k) plans, participants cannot borrow against their account balance with SIMPLE IRAs.

What is the Fidelity SIMPLE IRA plan?

Fidelity's Savings Incentive Match Plan for Employees (SIMPLE IRA) makes it easier for self-employed individuals and small-business owners with 100 or fewer employees to offer tax-advantaged retirement plans. With Fidelity, you have no account fees and no minimums to open an account.

At what age can you withdraw from a SIMPLE IRA without penalty?

The Internal Revenue Service (IRS) requires a waiting period of 5 years before withdrawing balances converted from a traditional IRA to a Roth IRA, or you may pay a 10% early withdrawal penalty on the conversion amount in addition to the income taxes you pay in the tax year of your conversion.

How do I withdraw money from my Fidelity SIMPLE IRA?

Withdrawal options Withdrawals from a SIMPLE IRA can be initiated using our separate form (PDF) or by calling us for assistance at 800-343-3548. You'll have the following choices of how to receive your money: Electronic funds transfer (EFT) to your bank (instructions must already be on file). EFT Form (PDF)

What are the disadvantages of a SIMPLE IRA?

Drawbacks of a SIMPLE IRA Lower contribution limits: SIMPLE IRAs have considerably lower contribution limits than other options for self-employed people, such as 401(k)s or SEP IRAs. Participant loan restrictions: Unlike 401(k) plans, participants cannot borrow against their account balance with SIMPLE IRAs.

What is the 5 year rule for SIMPLE IRAs?

However, the percentage can only be reduced for 2 years within any given 5-year period. If the employer chooses the nonelective contribution, the percentage cannot be changed or reduced unless switching back to a matching option. The SECURE Act 2.0 also introduced changes to contribution limits for SIMPLE IRA plans.

What are the downsides of a SIMPLE IRA?

SIMPLE IRA withdrawal rules You also have to wait two years if you'd like to roll your SIMPLE IRA funds over into a traditional IRA without paying any taxes. However, you can roll these funds over to another SIMPLE IRA at any time without worrying about tax penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is THE FIDELITY SIMPLE-IRA PLAN?

The Fidelity SIMPLE-IRA Plan is a retirement savings plan designed for small businesses and their employees, allowing them to save for retirement with tax advantages. It enables participants to contribute a portion of their salary and receive employer matching contributions.

Who is required to file THE FIDELITY SIMPLE-IRA PLAN?

Employers who offer the SIMPLE-IRA Plan are required to file certain documents with the IRS and provide information to their employees about the plan and its benefits. Employees who participate in the plan must also meet specific eligibility criteria.

How to fill out THE FIDELITY SIMPLE-IRA PLAN?

To fill out the Fidelity SIMPLE-IRA Plan, employers need to complete the plan adoption agreement, which includes details about plan eligibility, contribution limits, and employer matching contributions. Participants must complete their enrollment forms, indicating their contribution amounts.

What is the purpose of THE FIDELITY SIMPLE-IRA PLAN?

The purpose of the Fidelity SIMPLE-IRA Plan is to provide an accessible and straightforward retirement saving option for small businesses and their employees, encouraging individuals to save for retirement while providing tax advantages.

What information must be reported on THE FIDELITY SIMPLE-IRA PLAN?

Information that must be reported on the Fidelity SIMPLE-IRA Plan includes the employer's eligibility criteria, contribution details, employee enrollment information, and any annual contributions made on behalf of participants.

Fill out your form fidelity simple-ira plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Fidelity Simple-Ira Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.