Get the free Flexible Spending Plan Enrollment and Salary Reduction Agreement - slu

Show details

This document is a salary reduction agreement for enrolling in the Flexible Spending Plan (FSA) at Saint Louis University, detailing the enrollment process, contribution amounts, and plan year specifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible spending plan enrollment

Edit your flexible spending plan enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible spending plan enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flexible spending plan enrollment online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit flexible spending plan enrollment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

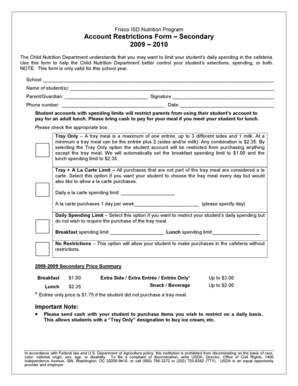

How to fill out flexible spending plan enrollment

How to fill out Flexible Spending Plan Enrollment and Salary Reduction Agreement

01

Obtain the Flexible Spending Plan Enrollment and Salary Reduction Agreement form from your HR department or company website.

02

Read the instructions and plan details carefully to understand the program limits and eligible expenses.

03

Fill out your personal information, including your name, employee ID, and contact details.

04

Specify the amount you wish to contribute to your Flexible Spending Account (FSA) for the plan year.

05

Indicate your salary reduction amount, which is how much will be deducted from each paycheck.

06

Review the available options for health care or dependent care FSA, and select the one that applies to you.

07

Sign and date the agreement to confirm your enrollment and salary reduction preferences.

08

Submit the completed form to your HR department or benefits administrator by the specified deadline.

Who needs Flexible Spending Plan Enrollment and Salary Reduction Agreement?

01

Employees who wish to set aside pre-tax dollars for eligible medical expenses or dependent care costs.

02

Individuals looking to reduce their taxable income while covering out-of-pocket health care expenses.

03

Employees with dependents that require childcare services may benefit from a dependent care FSA.

04

Those seeking to manage health care costs in a tax-advantaged way should consider this enrollment.

Fill

form

: Try Risk Free

People Also Ask about

What is a salary reduction agreement?

Facts about Flexible Spending Accounts (FSA) They are limited to $3,300 per year per employer. If you're married, your spouse can put up to $3,300 in an FSA with their employer too. You can use funds in your FSA to pay for certain medical and dental expenses for you, your spouse if you're married, and your dependents.

What is the meaning of salary reduction?

A salary cut is what happens when your employer reduces your pay. The amount of a salary cut can vary depending on your job position and the situation responsible for the pay decrease. Salary cuts can mean a reduction in pay without a change in your work responsibilities.

What is true of a salary reduction plan?

Employee salary reduction means that money is automatically deducted from an employee's paycheck and contributed to a retirement plan. Money moves into a plan such as a 401(k), 403(b), or a SIMPLE IRA.

What does it mean when an employer offers a Flexible Spending Account?

A Flexible Spending Account or FSA is a tax-advantaged benefit program estab- lished by an employer for their employees. This consumer driven account allows employees to use pre-tax money for eligible Section 213d healthcare and dependent care expenses.

Can your employer legally reduce your salary?

However, employees must be paid their original rate for all the hours they already completed. can an employer lower your pay in california? Yes, it is legal for employers to issue pay cuts.

How does a salary reduction agreement work?

These voluntary agreements allow a company, at the discretion of the employee, to reduce the employee's compensation so the company can contribute that reduced amount to their selected retirement accounts.

What are the rules for Flexible Spending Accounts?

The IRS determines which expenses can be reimbursed by an FSA. To find out which expenses are covered by FSAFEDS, select the account type you have from the list below: Health Care FSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Flexible Spending Plan Enrollment and Salary Reduction Agreement?

A Flexible Spending Plan Enrollment and Salary Reduction Agreement is a document that allows employees to set aside a portion of their pre-tax earnings to pay for eligible medical and dependent care expenses, thereby reducing their taxable income.

Who is required to file Flexible Spending Plan Enrollment and Salary Reduction Agreement?

Typically, employees who wish to participate in a flexible spending account (FSA) offered by their employer are required to file this agreement during the enrollment period.

How to fill out Flexible Spending Plan Enrollment and Salary Reduction Agreement?

To fill out the agreement, employees must provide personal information, indicate the amount they wish to contribute, specify the type of flexible spending account (medical or dependent care), and sign the agreement.

What is the purpose of Flexible Spending Plan Enrollment and Salary Reduction Agreement?

The purpose of this agreement is to allow employees to allocate part of their salary towards medical or dependent care expenses before taxes are deducted, thus saving money on eligible costs.

What information must be reported on Flexible Spending Plan Enrollment and Salary Reduction Agreement?

The information that must be reported includes the employee's personal details, the amount to be contributed to the flexible spending account, the type of account (medical or dependent care), and the employee's signature.

Fill out your flexible spending plan enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Spending Plan Enrollment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.