Get the free Saint Mary's College of California Tax-Deferred Annuity Plan - stmarys-ca

Show details

This document outlines the terms and provisions of the Saint Mary's College of California Tax-Deferred Annuity Plan designed for employees, detailing contributions, eligibility, benefits, loans, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign saint marys college of

Edit your saint marys college of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your saint marys college of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit saint marys college of online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit saint marys college of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out saint marys college of

How to fill out Saint Mary's College of California Tax-Deferred Annuity Plan

01

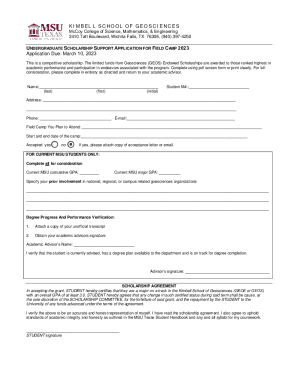

Step 1: Review the eligibility criteria for the Tax-Deferred Annuity Plan provided by Saint Mary's College of California.

02

Step 2: Gather necessary personal and employment information, including your Social Security number and details about your employment at the college.

03

Step 3: Obtain the enrollment forms from the Human Resources department or the college's benefits portal.

04

Step 4: Fill out the enrollment application completely, ensuring all sections are completed accurately.

05

Step 5: Specify your contribution amount and how you want your contributions allocated among the available investment options.

06

Step 6: Review your completed form for any errors or omissions.

07

Step 7: Submit the completed form to the designated HR representative or through the college's benefits portal.

08

Step 8: Confirm your enrollment and contribution details with the college's HR department after submission.

Who needs Saint Mary's College of California Tax-Deferred Annuity Plan?

01

Employees of Saint Mary's College of California looking to save for retirement in a tax-advantaged manner.

02

Faculty and staff who want to supplement their retirement savings beyond what is offered through the standard retirement plans.

03

Individuals seeking long-term financial security and who have a desire to invest in a tax-deferred account.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax-deferred annuity plan?

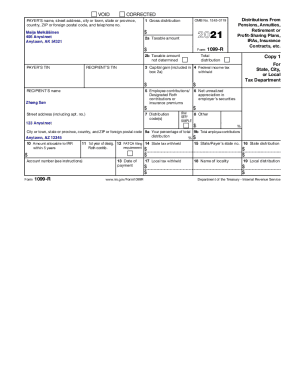

The Tax-Deferred Annuity Plan, Section 403(b) of the Internal Revenue Code allows you to postpone paying income tax on contributions towards an annuity until after you retire.

What is the tax-deferred annuity TDA program?

The Tax-Deferred Annuity (TDA) Plan allows you to save for retirement through the convenience of easy payroll deduction and reduce your taxable income – now or in retirement. You decide how much to save, up to the limits set by the IRS, and how you want to invest your contributions from among the available options.

What is the University of California tax-deferred 403 B plan?

What it is. The 403(b) Plan is a retirement plan that lets you add to your retirement account with pretax and Roth contributions. With pretax contributions, taxes on your contributions and any investment earnings are deferred until you withdraw the money.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Saint Mary's College of California Tax-Deferred Annuity Plan?

The Saint Mary's College of California Tax-Deferred Annuity Plan is a retirement savings plan that allows eligible employees to save for retirement on a tax-deferred basis, with contributions deducted before taxes are taken out of their pay.

Who is required to file Saint Mary's College of California Tax-Deferred Annuity Plan?

Eligible employees of Saint Mary's College of California who wish to enroll and contribute to the Tax-Deferred Annuity Plan are required to complete the necessary paperwork.

How to fill out Saint Mary's College of California Tax-Deferred Annuity Plan?

To fill out the plan, employees need to complete an enrollment form provided by the college, indicating their desired contribution amount and selecting investment options, if applicable.

What is the purpose of Saint Mary's College of California Tax-Deferred Annuity Plan?

The purpose of the plan is to help employees save for retirement while providing tax advantages. Contributions grow tax-deferred until withdrawal during retirement.

What information must be reported on Saint Mary's College of California Tax-Deferred Annuity Plan?

Participants must report their contribution amounts, investment choices, beneficiary designation, and any changes to personal information or contribution levels.

Fill out your saint marys college of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Saint Marys College Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.