NYC DoF NYC-RPT 2009 free printable template

Show details

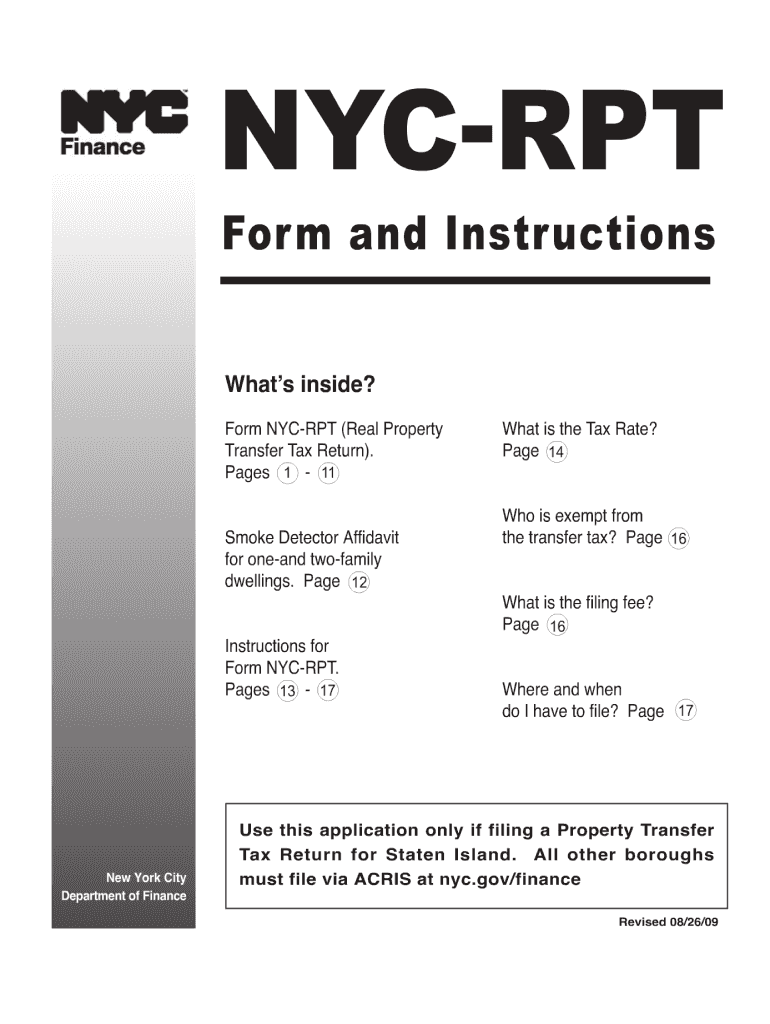

NYC-RPT Form and Instructions What's inside? Form NYC-RPT (Real Property Transfer Tax Return). Pages 1 11 Smoke Detector Affidavit for one-and two-family dwellings. Page 12 Instructions for Form NYC-RPT.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC DoF NYC-RPT

Edit your NYC DoF NYC-RPT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC DoF NYC-RPT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NYC DoF NYC-RPT online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NYC DoF NYC-RPT. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC DoF NYC-RPT Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC DoF NYC-RPT

How to fill out NYC DoF NYC-RPT

01

Acquire the NYC-RPT form from the NYC Department of Finance website or office.

02

Enter the property identification information, including the Block and Lot numbers.

03

Fill in the owner's information, including name, address, and contact details.

04

Provide detailed information about the property, such as its use, size, and any changes or renovations.

05

Report the property’s estimated market value and any income generated if applicable.

06

Complete sections regarding exemptions or abatements that may apply to the property.

07

Sign and date the form, certifying that all information is accurate.

08

Submit the completed form by the designated deadline to the NYC Department of Finance.

Who needs NYC DoF NYC-RPT?

01

Any property owner in New York City is required to fill out the NYC DoF NYC-RPT form for property tax assessment.

02

Real estate professionals, landlords, and property managers who own or manage properties in NYC also need to complete this form.

03

Individuals seeking property tax exemptions, abatements, or to report changes to their property status must file the NYC-RPT form.

Fill

form

: Try Risk Free

People Also Ask about

What is an IT 2663 form?

Income Tax Payment Form, to compute the gain (or loss) and. pay the full amount of estimated tax due, if applicable. Use 2023. Form IT‑2663 for sales or transfers of real property that occur after December 31, 2022, but before January 1, 2024.

Do I have to pay NY taxes if I work remotely?

This rule requires taxpayers who switch from commuting across state lines into New York to working remotely in their home state to continue paying taxes to New York — so long as their switch to remote work was a matter of “convenience” and not absolute necessity.

How is NYC real property transfer tax calculated?

The combined NYC and NYS Transfer Tax for sellers is between 1.4% and 2.075% depending on the sale price. Sellers pay a combined NYC & NYS Transfer Tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less.

What is the standard deduction for 2023 in NY?

What is New York state's standard deduction? The standard deduction allows taxpayers to reduce their taxable income by a fixed amount. The New York state standard deductions for tax year 2022 (taxes filed in 2023) are: Single: $8,000.

When must all New York real property transfers taxes be paid?

If the deed or document isn't being recorded, file Form TP-584 or TP-584-NYC and pay any tax due directly to the Tax Department no later than the 15th day after the delivery of the document. Mail Form TP-584 or TP-584-NYC with any attachments and payment to the address indicated on the form.

What is the filing fee for NYC RPT?

There is a $100 fee to file the RPTT for non-deed transfers.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NYC DoF NYC-RPT from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including NYC DoF NYC-RPT. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit NYC DoF NYC-RPT in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing NYC DoF NYC-RPT and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the NYC DoF NYC-RPT in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NYC DoF NYC-RPT and you'll be done in minutes.

What is NYC DoF NYC-RPT?

NYC DoF NYC-RPT stands for New York City Department of Finance Real Property Transfer Tax. It is a form used to report the transfer of property ownership in New York City.

Who is required to file NYC DoF NYC-RPT?

Individuals or entities involved in the sale, transfer, or conveyance of real property in New York City are required to file NYC DoF NYC-RPT.

How to fill out NYC DoF NYC-RPT?

To fill out NYC DoF NYC-RPT, one must provide details about the property, the parties involved in the transfer, the purchase price, and any applicable exemptions or deductions.

What is the purpose of NYC DoF NYC-RPT?

The purpose of NYC DoF NYC-RPT is to document and assess the transfer of real property ownership for tax purposes and to ensure compliance with local tax laws.

What information must be reported on NYC DoF NYC-RPT?

Information that must be reported on NYC DoF NYC-RPT includes the names and addresses of the buyer and seller, the property description, the sale price, and information regarding any applicable exemptions.

Fill out your NYC DoF NYC-RPT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC DoF NYC-RPT is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.