Get the free Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spous...

Show details

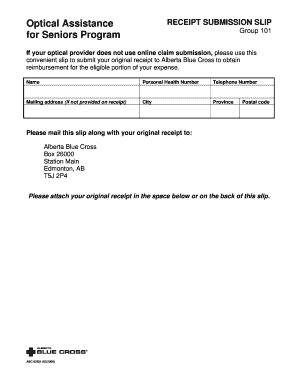

This form is used by civilian spouses of U.S. armed forces servicemembers to apply for an exemption from Maryland income tax withholding, affirming eligibility under the Military Spouses Residency

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form mw507m - exemption

Edit your form mw507m - exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form mw507m - exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form mw507m - exemption online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form mw507m - exemption. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form mw507m - exemption

How to fill out Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember

01

Obtain Form MW507M from the Maryland Comptroller's website or relevant tax office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate your spouse's military status by providing their name, service branch, and duty station.

04

Check the appropriate box to identify yourself as a qualified civilian spouse.

05

Complete the section confirming your eligibility for exemption from Maryland withholding tax.

06

If applicable, provide any additional information as requested in the form.

07

Sign and date the form to validate the information provided.

08

Submit the completed form to your employer's payroll department.

Who needs Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember?

01

Qualified civilian spouses of U.S. Armed Forces servicemembers who reside in Maryland and wish to claim exemption from Maryland withholding tax.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to be exempt from withholding as a military spouse?

The spouse of a servicemember is exempt from income taxation. by a state when he or she: (1) Currently resides in a state different than the state of domicile; (2) Resides in the state solely in order to live with the servicemember; (3) The servicemember is present in the state in compliance with military orders.

What should I put for exemption from withholding?

ing to the IRS Tax Topic 751 on withholding, to claim exempt, you must have had no federal income tax liability last year and expect to have no federal income tax liability this year.

Is it better to claim an exemption or not?

Tax exemptions help reduce the taxable income you owe taxes on, lowering your overall tax liability. Whether you're claiming the standard deduction, applying for property tax exemptions, or supporting a tax-exempt organization, understanding how these exemptions work can help you maximize your tax savings.

Who qualifies for exemption from withholding?

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

What is the tax exemption form for military spouse in Maryland?

If you are a civilian spouse of an active duty U.S. armed forces servicemember, you need to complete Form MW507M if you meet all of the following conditions: You maintain domicile in a state other than Maryland. See “Domicile outside Maryland” below, and Administrative Release No.

What is the form MW507 exemptions in Maryland?

Form MW507 is the state of Maryland's Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Form MW507 is the same as the W-4 document Americans complete for federal withholding of their working wages.

What are personal exemptions for Maryland taxes?

EXEMPTION AMOUNT CHART The personal exemption is $3,200. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head of Household, or Qualifying Widow(er) with Dependent Child).

What is an exemption on MW507?

Students and Seasonal Employees whose annual income will be below the mini- mum filing requirements should claim exemption from withholding. This provides. more income throughout the year and avoids the necessity of filing a Maryland. income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember?

Form MW507M is a document used by qualified civilian spouses of U.S. Armed Forces servicemembers to claim an exemption from Maryland state income tax withholding.

Who is required to file Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember?

Qualified civilian spouses of U.S. Armed Forces servicemembers who are residents of Maryland and who meet specific eligibility criteria are required to file Form MW507M.

How to fill out Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember?

To fill out Form MW507M, the applicant must provide their personal information, including name, address, and Social Security number, as well as information about their spouse's military service. The form must be signed and dated before submission.

What is the purpose of Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember?

The purpose of Form MW507M is to allow qualified civilian spouses of military personnel to formally claim an exemption from state income tax withholding, thereby ensuring that their income is not unduly taxed while they are living in Maryland.

What information must be reported on Form MW507M - Exemption from Maryland Withholding Tax for a Qualified Civilian Spouse of a U.S. Armed Forces Servicemember?

Form MW507M requires the reporting of personal identification information, factual details regarding the applicant's spouse's military service, and any other relevant data needed to substantiate the claim for exemption.

Fill out your form mw507m - exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form mw507m - Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.