Get the free Indiana College Credit Schedule CC-40 - saintmeinrad

Show details

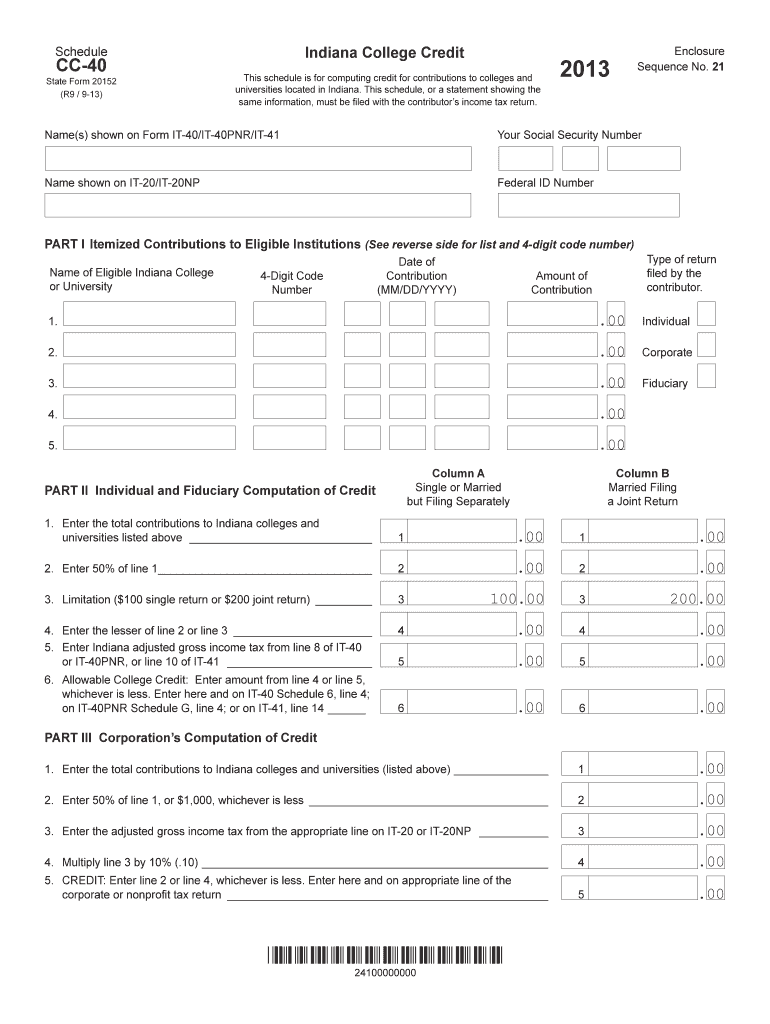

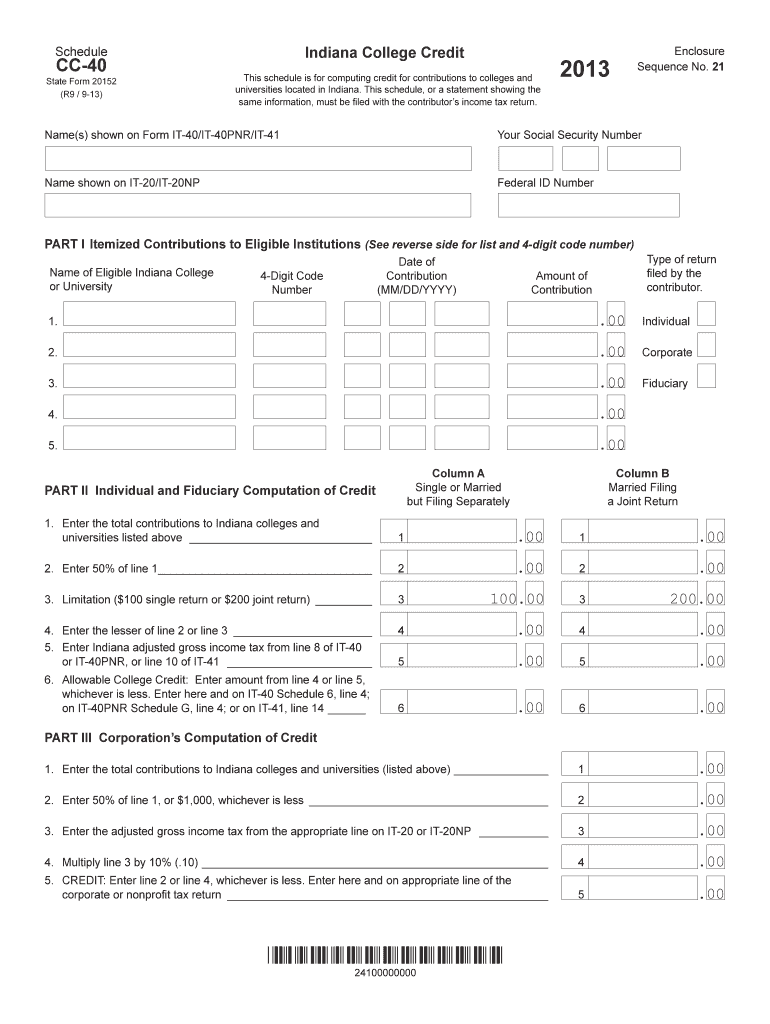

This document is used for computing credit for contributions to eligible colleges and universities in Indiana, filed with the contributor’s income tax return.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indiana college credit schedule

Edit your indiana college credit schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana college credit schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana college credit schedule online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit indiana college credit schedule. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indiana college credit schedule

How to fill out Indiana College Credit Schedule CC-40

01

Begin by downloading the Indiana College Credit Schedule CC-40 form from the Indiana Department of Education's website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide your Indiana student identification number or social security number, if required.

04

List the college/university courses you have taken for dual credit, including course titles, credit hours, and the institution where you completed the courses.

05

Indicate the semester and year in which you completed each course.

06

Calculate the total number of credit hours earned and enter that information in the designated field.

07

Review the form for any errors or omissions before signing and dating it at the bottom.

08

Submit the completed form to your designated school official or the appropriate department.

Who needs Indiana College Credit Schedule CC-40?

01

High school students participating in dual credit courses in Indiana who wish to receive college credit.

02

Schools and educational institutions that are processing college credit for students.

03

Parents and guardians of students seeking to understand the credit process.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax credit for College Choice in Indiana?

Get a 20 percent tax credit The Indiana 529 Direct Savings Plan gives Indiana residents a state income tax credit of up to $1,500 per year.

What is form it 40 in Indiana?

The IT-40 form is used by Indiana residents to file their individual income taxes. Who needs to file the IT-40 form? Full-year residents, part-year residents, and certain nonresidents earning Indiana-source income need to file this form.

What is the college credit deduction in Indiana?

Individual filers receive a $100 credit for the first $200 contributed; joint filers receive a $200 credit for the first $400 contributed. Please check the Indiana Department of Revenue website for the current version of the Indiana College Credit Form (CC-40).

What is the tax credit for Indiana University?

Indiana taxpayers may take a tax credit of 50% of their gift to IU. For a joint return, the maximum credit is $200, based on a gift of $400 or more.

What is the schedule CC 40 for college credit in Indiana?

Indiana College Credit This schedule is used to compute credit for contributions to colleges and universities located in Indiana. This schedule, or a statement showing the same information, must be filed with the contributor's income tax return.

What is the charitable tax credit in Indiana?

When you donate, you can receive a tax credit, worth 50% of your donation, against your 2024 Indiana tax bill for you or for your business. In addition to this brand-new opportunity, Indiana offers tax credits for: Charitable Contributions to Higher Education. Foster Care Donation Credit.

What is the college credit deduction in Indiana?

Individual filers receive a $100 credit for the first $200 contributed; joint filers receive a $200 credit for the first $400 contributed. Please check the Indiana Department of Revenue website for the current version of the Indiana College Credit Form (CC-40).

What is the charitable tax credit in Indiana?

When you donate, you can receive a tax credit, worth 50% of your donation, against your 2024 Indiana tax bill for you or for your business. In addition to this brand-new opportunity, Indiana offers tax credits for: Charitable Contributions to Higher Education. Foster Care Donation Credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Indiana College Credit Schedule CC-40?

Indiana College Credit Schedule CC-40 is a form used by Indiana taxpayers to report 21st Century Scholars, dual credit, and other college credit received by eligible students.

Who is required to file Indiana College Credit Schedule CC-40?

Any taxpayer who claims eligible college credits for their dependent students must file Indiana College Credit Schedule CC-40.

How to fill out Indiana College Credit Schedule CC-40?

To fill out Indiana College Credit Schedule CC-40, taxpayers need to provide personal information about the student, record the course details, and specify the amount of college credit claimed.

What is the purpose of Indiana College Credit Schedule CC-40?

The purpose of Indiana College Credit Schedule CC-40 is to track and report the college credits earned by students that are eligible for tax benefits under Indiana law.

What information must be reported on Indiana College Credit Schedule CC-40?

Information that must be reported includes the student's name, college credit courses taken, the institution attended, and the amount of credit earned.

Fill out your indiana college credit schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana College Credit Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.