Get the free The Parents’ Guide to Shaping Up Your Financial Future - sjsu

Show details

This guide aims to help parents engage in their children's financial education through family activities related to economics and personal finance concepts, reinforcing lessons learned in school.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form parents guide to

Edit your form parents guide to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form parents guide to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form parents guide to online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form parents guide to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

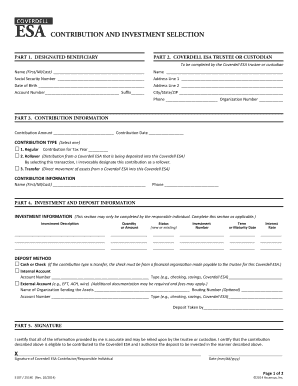

How to fill out form parents guide to

How to fill out The Parents’ Guide to Shaping Up Your Financial Future

01

Begin by reading the introduction to understand the purpose of the guide.

02

Gather all financial documents including income statements, expenses, and debts.

03

Follow the sections sequentially, starting with budgeting basics.

04

Use the provided templates to track monthly income and expenses.

05

Set financial goals using the sections dedicated to savings and investments.

06

Review the tips for managing debt and implement strategies outlined.

07

Read the resources at the end for additional financial literacy.

08

Regularly revisit and update your financial plan as circumstances change.

Who needs The Parents’ Guide to Shaping Up Your Financial Future?

01

Parents looking to improve their financial literacy.

02

Families wanting to create a budget.

03

Individuals seeking to manage debt effectively.

04

New parents planning for future expenses related to children.

05

Anyone wanting to save for educational purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the 70/30 rule in finance?

The 70/30 Rule is simple: Live on 70% of your income, save 20%, and give 10% to your Church, or favorite charity. This has many benefits in addition to saving 20% of your income.

How do I set my child up financially for the future?

Make them invest at least half of any money received. We don't want to teach our kids to live pay to pay. They must always set something aside for their future, and learning that concept starts from their first payday. With the money in their bank account, they get to budget it and choose how it is spent and shared.

How do I prepare my child for the financial future?

Saving For Your Child's Future Start with a Solid Foundation: Build Your Own Financial Health. Saving for Your Child's Future through Financial Literacy. Build an Education Fund. Create a Trust or Will. Life Insurance Can Protect Your Plans for Saving for Your Child's Future. Encourage Saving and Investing.

What is the 50 30 20 rule for kids?

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

What is the best investment for a child's future?

529 savings and investing accounts If saving for a child's education is the goal, a 529 account is tax-advantaged for education expenses. Investments grow tax-free and can be withdrawn for qualified expenses like textbooks, tuition and room and board.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is The Parents’ Guide to Shaping Up Your Financial Future?

The Parents’ Guide to Shaping Up Your Financial Future is a resource designed to help parents understand and improve their financial planning, savings, and investment strategies to secure a stable financial future for themselves and their children.

Who is required to file The Parents’ Guide to Shaping Up Your Financial Future?

Parents or guardians who are seeking guidance on financial planning and wish to create a structured approach to managing their finances for the benefit of their families are encouraged to fill out The Parents’ Guide to Shaping Up Your Financial Future.

How to fill out The Parents’ Guide to Shaping Up Your Financial Future?

To fill out The Parents’ Guide to Shaping Up Your Financial Future, parents should gather their financial information, including income, expenses, savings goals, and investment plans, and follow the step-by-step instructions provided in the guide to accurately report and assess their financial situation.

What is the purpose of The Parents’ Guide to Shaping Up Your Financial Future?

The purpose of The Parents’ Guide to Shaping Up Your Financial Future is to provide parents with the tools and knowledge needed to create a comprehensive financial plan that addresses immediate needs, long-term goals, and prepares for their children's financial education and welfare.

What information must be reported on The Parents’ Guide to Shaping Up Your Financial Future?

The information that must be reported includes details about household income, monthly expenses, savings allocations, financial goals, debts, and any current investments, which help in evaluating overall financial health and planning for the future.

Fill out your form parents guide to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Parents Guide To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.