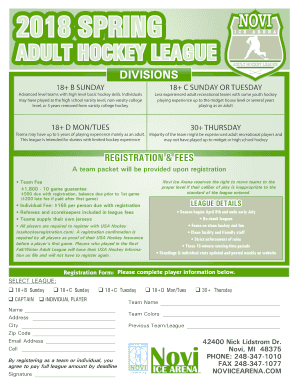

Get the free Business Travel Accident Coverage Booklet - scripps

Show details

This booklet outlines the benefits and coverage details for Business Travel Accident Insurance provided for eligible employees of The Scripps Research Institute.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business travel accident coverage

Edit your business travel accident coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business travel accident coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business travel accident coverage online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business travel accident coverage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business travel accident coverage

How to fill out Business Travel Accident Coverage Booklet

01

Obtain the Business Travel Accident Coverage Booklet from your employer or the insurance provider.

02

Review the booklet for the coverage details, including benefits and exclusions.

03

Fill out your personal information, including name, job title, and contact details.

04

Provide details of your travel itinerary, including destination, dates of travel, and purpose of the trip.

05

Indicate any pre-existing medical conditions or relevant health information.

06

Sign and date the form to confirm the accuracy of the information provided.

07

Submit the completed booklet to the HR department or designated person in charge of travel insurance.

Who needs Business Travel Accident Coverage Booklet?

01

Employees who travel for business purposes, including attending meetings, conferences, or client visits.

02

Employers who want to provide coverage for their employees while they are traveling for work.

03

Individuals who are required to travel as part of their job duties and want to ensure they are protected in case of accidents.

Fill

form

: Try Risk Free

People Also Ask about

Is business travel accident insurance an Erisa plan?

BTA provides benefits for accidents resulting in death, dismemberment or total permanent disability while traveling on company business, away from your normal place of work. The plan pays two times your annual salary with a maximum benefit of $1,000,000.

What is the difference between travel insurance and accident insurance?

Personal Accident Plan offers broader coverage, including accidents and infectious diseases unrelated to travel. As long as you're paying for the plan, you will be covered for the clauses under the plan, although some plans may cover you for only a certain number of days when overseas.

What is a business travel policy?

A corporate travel policy, also called a travel and expense policy, is a set of official guidelines for work-related trips. Business leaders create this type of policy to explain to employees the proper procedures for arranging their flights, hotels and other travel-related plans.

What does a travel accident policy cover?

Some travel accident insurance policies offer coverage for accidental death and dismemberment. For policies like these, covered losses may include accidental loss of life, limb, sight, speech and hearing.

What does a business travel accident policy cover?

The core components of BTA insurance is accidental death and dismemberment however medical benefits (Accident & Sickness) may also be included. Some policies can even be amended to cover on-premises (at the office/factory) coverage.

What is a business travel accident plan?

Chubb Accident & Health's Business Travel Accident Insurance provides accidental death and dismemberment benefits for directors and employees while traveling on company business, at the work site during their job, or on a 24-hour basis for those key employees who must be available at all times to represent their

What does an accident policy cover?

Accident insurance covers injuries like fractures, burns, concussions, sprains, lacerations, and paralysis. It also provides benefits for accidental death. This insurance complements major medical plans by covering out-of-pocket costs like copayments, deductibles, and non-medical expenses such as rent or utilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Travel Accident Coverage Booklet?

The Business Travel Accident Coverage Booklet is a document that outlines the insurance coverage provided for employees while they are traveling on behalf of their company. It details the benefits, terms, and conditions of the insurance.

Who is required to file Business Travel Accident Coverage Booklet?

Typically, employees who travel for business purposes are required to file the Business Travel Accident Coverage Booklet to ensure they are covered for any accidents that may occur during their travel.

How to fill out Business Travel Accident Coverage Booklet?

To fill out the Business Travel Accident Coverage Booklet, individuals should provide their personal information, travel details, and any relevant accident-related information as specified in the booklet instructions.

What is the purpose of Business Travel Accident Coverage Booklet?

The purpose of the Business Travel Accident Coverage Booklet is to provide employees with information regarding their insurance coverage during business travel, ensuring they understand their rights and the claims process.

What information must be reported on Business Travel Accident Coverage Booklet?

The information that must be reported includes the employee's name, travel dates, destination, nature of the business trip, and any accidents or incidents that occurred during the travel.

Fill out your business travel accident coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Travel Accident Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.