Get the free Supplemental Life Benefits Enrollment Form

Show details

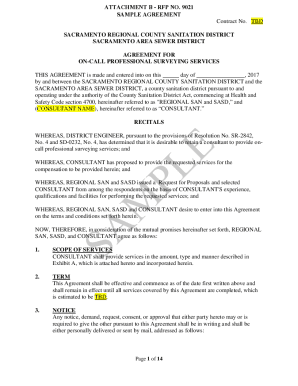

This form is used to enroll in Supplemental Life Insurance benefits for employees and their dependents within the North American Division of Seventh-day Adventists, including details about coverage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental life benefits enrollment

Edit your supplemental life benefits enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental life benefits enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supplemental life benefits enrollment online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit supplemental life benefits enrollment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental life benefits enrollment

How to fill out Supplemental Life Benefits Enrollment Form

01

Obtain the Supplemental Life Benefits Enrollment Form from your HR department or company's benefits portal.

02

Read the instructions carefully, ensuring you understand the coverage options available.

03

Fill in your personal information, including your name, employee ID, and contact details.

04

Indicate the amount of coverage you wish to enroll in by selecting the appropriate option.

05

Complete the section regarding any dependents you wish to cover, if applicable.

06

Review any health-related questions, if required, and provide accurate information.

07

Sign and date the form to confirm that you have provided truthful information.

08

Submit the completed form to your HR department or benefits coordinator by the specified deadline.

Who needs Supplemental Life Benefits Enrollment Form?

01

Employees who wish to enroll in additional life insurance coverage beyond the basic policy provided by the employer.

02

Those who have experienced life changes such as marriage, the birth of a child, or changes in dependent status.

03

Employees who want to ensure financial protection for their beneficiaries in the event of their death.

Fill

form

: Try Risk Free

People Also Ask about

What happens to my supplemental life insurance when I retire?

If you no longer work full-time, your group supplemental life insurance coverage will end on the date you change to less than full-time status. When you retire, your supplemental life insurance and/or any spouse or child supplemental life insurance you had elected will end the last day of the month in which you retire.

Can you cash out supplemental life insurance?

Since most supplemental life policies are term coverage, there is no cash value to remove from the policy. If your policy is permanent life insurance, you may have the option to cash out or surrender the policy, thereby removing its cash value and ceasing the death benefit.

What happens to my life insurance policy when I retire?

What happens to my life insurance when I retire? Individual life insurance policies you have won't be affected by your retirement. However, most employer-provided group life insurance policies end when you retire.

What is the difference between basic life insurance and supplemental life insurance?

What's the difference between basic and supplemental employee life insurance? In short, basic group life insurance is an affordable or free policy offered through an employer's benefits program, while supplemental life insurance lets you to add to that coverage by paying an additional premium.

What happens to my supplemental life insurance when I quit my job?

If you leave your job (or are terminated) your life insurance may or may not be portable, ie continue to cover you. Even if it is portable, you may need to go through underwriting again, meaning your premium could go up - possibly WAY up - or they could even decline you coverage at all.

Is it worth getting supplemental life insurance?

If your existing group life insurance policy doesn't provide enough coverage or the right types of coverage, supplemental life insurance may be worth it. Still, you could get a better deal if you purchase additional life insurance as an individual rather than through your employer.

Who pays the premium for supplemental life?

You can sign up for supplemental insurance during your annual benefits enrollment period (or when you experience a life event such as having a baby or getting married). And your premium payments typically come directly from your paycheck, which can take the sting out of the cost.

What happens to supplemental life insurance when I retire?

If you no longer work full-time, your group supplemental life insurance coverage will end on the date you change to less than full-time status. When you retire, your supplemental life insurance and/or any spouse or child supplemental life insurance you had elected will end the last day of the month in which you retire.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplemental Life Benefits Enrollment Form?

The Supplemental Life Benefits Enrollment Form is a document used by employees to enroll in additional life insurance coverage offered by their employer beyond standard life insurance benefits.

Who is required to file Supplemental Life Benefits Enrollment Form?

Employees who wish to enroll in or adjust their Supplemental Life Insurance coverage are required to file the Supplemental Life Benefits Enrollment Form.

How to fill out Supplemental Life Benefits Enrollment Form?

To fill out the Supplemental Life Benefits Enrollment Form, employees need to provide personal information, select the desired coverage amount, and sign to confirm their enrollment and understanding of the terms.

What is the purpose of Supplemental Life Benefits Enrollment Form?

The purpose of the Supplemental Life Benefits Enrollment Form is to formally document an employee's request for additional life insurance coverage, ensuring they are provided with the benefits they select.

What information must be reported on Supplemental Life Benefits Enrollment Form?

The information that must be reported on the Supplemental Life Benefits Enrollment Form typically includes the employee's name, contact details, Social Security number, coverage amount requested, and any relevant health information as required by the insurer.

Fill out your supplemental life benefits enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Life Benefits Enrollment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.