Get the free PROPERTY LOAN DOCUMENT - stanford

Show details

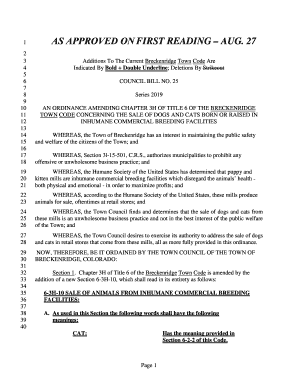

This document outlines the terms and conditions under which property is loaned from Stanford University to a borrower, specifying responsibilities, property details, and insurance requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property loan document

Edit your property loan document form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property loan document form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property loan document online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit property loan document. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property loan document

How to fill out PROPERTY LOAN DOCUMENT

01

Gather all necessary personal and financial information, including identification and income details.

02

Obtain the PROPERTY LOAN DOCUMENT form from your lender or online.

03

Fill in your personal details in the designated sections, such as name, address, and contact information.

04

Provide information about the property you intend to purchase, including its address, purchase price, and type.

05

Fill in financial details, including your income, assets, and liabilities to assess your financial eligibility.

06

Review the loan terms and conditions provided by the lender and fill in any required information about desired loan amounts and repayment terms.

07

Sign the document where required, usually at the end of the form.

08

Submit the completed PROPERTY LOAN DOCUMENT to your lender along with any required supporting documents.

Who needs PROPERTY LOAN DOCUMENT?

01

Individuals or families looking to purchase a home or property.

02

Real estate investors seeking financing for property acquisitions.

03

Anyone refinancing an existing property loan.

Fill

form

: Try Risk Free

People Also Ask about

What is minimum documentation loan?

Here is a list of personal loan documents required to apply for a loan: Passport/ voter's ID/ driving license/ Letter of National Population Register/ NREGA job card. PAN card. Employee ID card. Salary slips of the last 3 months. Bank account statements of the previous 3 months. Piped gas bill. Pension order.

How to write a loan document?

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

What is a loan agreement in English?

A loan agreement (sometimes called a loan contract) is an contract between a lender and a borrower whereby the lender agrees to lend a certain amount of money to the borrower. By making use of a loan agreement, the lender and the borrower can document their arrangement on, amongst other terms: purpose of the loan.

What documentation must be supplied when obtaining a loan?

Documents required for loan approval vary. Generally, you'll need to provide proof of income, such as pay stubs or tax returns, and employment verification. Lenders will likely ask for bank statements to assess your financial health and credit reports to check your history of paying bills on time.

What documentation is required for a loan?

A set of loan documents should include the following terms and conditions: Parties to the loan. Loan amount. Repayment terms, including applicable interest rate, method of interest accrual, payment type (interest-only or principal and interest), payment amount, payment due dates, required method of payment.

What is documentation for loan?

Documents required. Identity proof / address proof (copy of passport/voter ID card/driving license/Aadhaar Card) Bank statement of previous 3 months (Passbook of previous 6 months) Two latest salary slip/current dated salary certificate with the latest Form 16.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PROPERTY LOAN DOCUMENT?

A PROPERTY LOAN DOCUMENT is a legal agreement between a borrower and a lender that outlines the terms and conditions of a loan secured by real property.

Who is required to file PROPERTY LOAN DOCUMENT?

Typically, the borrower (property owner) must file the PROPERTY LOAN DOCUMENT with the lender prior to the disbursement of funds.

How to fill out PROPERTY LOAN DOCUMENT?

To fill out a PROPERTY LOAN DOCUMENT, you need to provide necessary details such as the names of the borrower and lender, the loan amount, interest rate, repayment terms, property description, and signatures of both parties.

What is the purpose of PROPERTY LOAN DOCUMENT?

The purpose of a PROPERTY LOAN DOCUMENT is to legally bind the borrower and lender to the loan terms, protecting the lender's interests while allowing the borrower to obtain needed funds.

What information must be reported on PROPERTY LOAN DOCUMENT?

The information that must be reported includes the loan amount, interest rate, repayment schedule, property description, borrower and lender information, and any applicable fees or conditions.

Fill out your property loan document online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Loan Document is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.