Get the free INCOME CHANGE FORM - alfredstate

Show details

This form is used by students at Alfred State College to report income changes that may affect their financial aid eligibility. It requires detailed information about the income change and supporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income change form

Edit your income change form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income change form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income change form online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income change form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

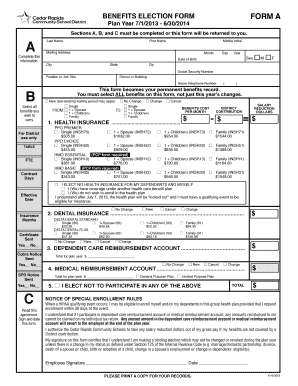

How to fill out income change form

How to fill out INCOME CHANGE FORM

01

Gather necessary income documents such as pay stubs, tax returns, and other relevant financial statements.

02

Obtain the INCOME CHANGE FORM from the relevant agency or website.

03

Fill out your personal information at the top of the form, including your name, address, and contact information.

04

Specify the type of income change you are reporting, such as a new job, loss of income, or changes in benefits.

05

Provide detailed information about your previous income and the new income, including amounts and dates.

06

Double-check the accuracy of all information provided on the form.

07

Sign and date the form to confirm the information is correct.

08

Submit the completed form to the relevant agency by mail, fax, or online as instructed.

Who needs INCOME CHANGE FORM?

01

Individuals who have experienced a change in income due to employment changes, retirement, disability, or other financial circumstances.

02

People receiving government assistance or benefits that require reporting income changes.

03

Anyone applying for a loan, grant, or financial aid that necessitates updated financial information.

Fill

form

: Try Risk Free

People Also Ask about

How do I notify medical of income change?

To speak with someone about changes to your income, address or household situation, call 888-472-4463 Monday–Friday, 8 a.m.–5 p.m. or fax your changes to 805-658-4530.

What happens if you forget to report income to Social Security?

WHAT HAPPENS IF YOU DO NOT REPORT CHANGES TIMELY AND ACCURATELY? You may be underpaid and not receive the benefits due to you, as quickly as you otherwise could, if you do not report changes on time. We may overpay you and you may have to pay us back.

Do you have to report marriage to Social Security?

The Social Security Administration reviews income information each year and recalculates benefits as needed. So if you continue to work after you start receiving benefits and you earn more than at least one of those 35 years, your benefits will increase.

What is the time limit for correcting Social Security earnings?

An earnings record can be corrected at any time up to three years, three months, and 15 days after the year in which the wages were paid or the self-employment income was derived. “Year” means “calendar year” for wages and “taxable year” for self-employment income.

How long do you have to report an income change to Social Security?

Report any changes that may affect your SSI as soon as possible and no later than 10 days after the end of the month in which the change occurred. Please see the Spotlight on Reporting Your Earnings to SSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INCOME CHANGE FORM?

The INCOME CHANGE FORM is a document used to report any changes in an individual's or household's income to relevant authorities, such as housing authorities or social service agencies.

Who is required to file INCOME CHANGE FORM?

Individuals or households that receive certain benefits or assistance programs, and experience a change in income must file the INCOME CHANGE FORM.

How to fill out INCOME CHANGE FORM?

To fill out the INCOME CHANGE FORM, individuals need to provide their current income details, indicate the nature of the income change, and include any necessary supporting documentation.

What is the purpose of INCOME CHANGE FORM?

The purpose of the INCOME CHANGE FORM is to ensure that benefit eligibility and assistance levels accurately reflect an individual's current financial situation.

What information must be reported on INCOME CHANGE FORM?

The information that must be reported includes the date of the income change, the type of income received, the amount of income, and any additional details required by the specific authority or program.

Fill out your income change form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Change Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.