Get the free Direct Deposit Reactivation Request - geneseo

Show details

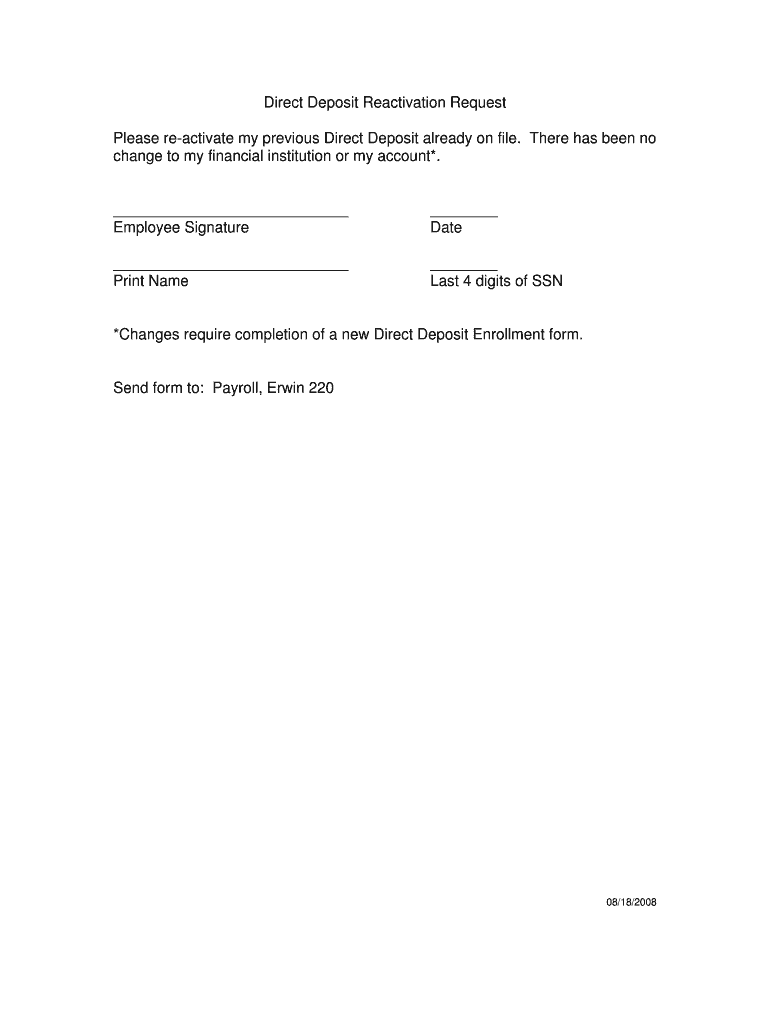

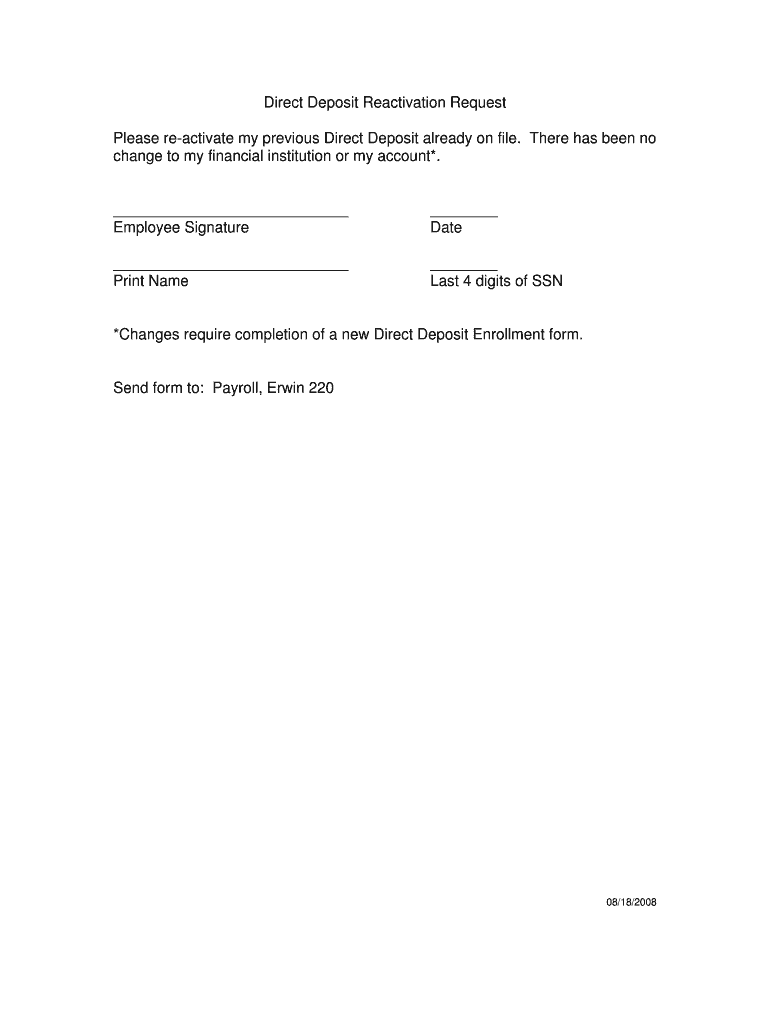

A request form for the reactivation of a previous Direct Deposit account for payroll purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct deposit reactivation request

Edit your direct deposit reactivation request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct deposit reactivation request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct deposit reactivation request online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit direct deposit reactivation request. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct deposit reactivation request

How to fill out Direct Deposit Reactivation Request

01

Obtain the Direct Deposit Reactivation Request form from your employer or the payroll department.

02

Fill in your personal information, including your name, address, and employee ID.

03

Provide your previous bank account details that were used for direct deposit.

04

Enter your new bank account information, including bank name, account number, and routing number.

05

Sign and date the form to confirm the accuracy of the information provided.

06

Submit the completed form to your payroll department for processing.

Who needs Direct Deposit Reactivation Request?

01

Employees who have previously deactivated their direct deposit.

02

Employees who have changed their bank accounts and need to update their direct deposit information.

03

Anyone returning to work after a leave of absence who needs to reactivate direct deposit.

Fill

form

: Try Risk Free

People Also Ask about

What is a direct deposit authorization letter?

Fill in account information If you use your bank's direct deposit form, you'll likely need your employer's address. Bank's routing number. This is the nine-digit number printed on your bank statement or along the bottom left of your checks. Your account number.

How do I get proof of direct deposit?

For personnel where the individual is paid through direct deposit the easiest way to show the correct documentation is through a paystub. The paystub shows the routing and bank account number to prove the individual as paid.

What is a direct deposit in English?

What Is Direct Deposit? The term direct deposit refers to the deposit of funds electronically into a bank account rather than through a physical, paper check. Direct deposit requires the use of an electronic network that allows deposits to take place between banks.

What is a bank direct deposit letter?

What is a Direct Deposit Authorization Form? Direct deposit authorization forms authorize employers to send money directly into an individual's bank account. In times past, employers would print out and distribute physical checks on pay day for each employee to deposit into their bank accounts themselves.

How to get a bank letter from your bank?

To obtain a bank confirmation letter from your bank you may request in-person at a bank branch from one of the bankers, by a phone call to the bank, and depending on the financial institution, through their online platform.

How do I get a letter from my bank for direct deposit?

You'll need to go to the bank and get a letter with your account and routing numbers. You might be able to download a form. Most banks have direct deposit forms on their websites.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Deposit Reactivation Request?

A Direct Deposit Reactivation Request is a formal request submitted to a financial institution or employer to reactivate a previously established direct deposit arrangement that has been canceled or become inactive.

Who is required to file Direct Deposit Reactivation Request?

Individuals who previously had their pay or benefits directly deposited into their bank account but have had this service canceled or deactivated are required to file a Direct Deposit Reactivation Request.

How to fill out Direct Deposit Reactivation Request?

To fill out a Direct Deposit Reactivation Request, you typically need to provide your personal information, including your name, address, Social Security number, account number, and bank routing number. You may also need to specify the reason for reactivation and sign the form.

What is the purpose of Direct Deposit Reactivation Request?

The purpose of the Direct Deposit Reactivation Request is to enable individuals to resume receiving payments directly into their bank accounts after a previous direct deposit arrangement has been terminated or become inactive.

What information must be reported on Direct Deposit Reactivation Request?

The information that must be reported on a Direct Deposit Reactivation Request generally includes personal identification details, account information (such as bank routing and account numbers), the reason for reactivation, and the date of the request.

Fill out your direct deposit reactivation request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Deposit Reactivation Request is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.