Get the free Co-Financing with Foreign Export Credit Agency - gpo

Show details

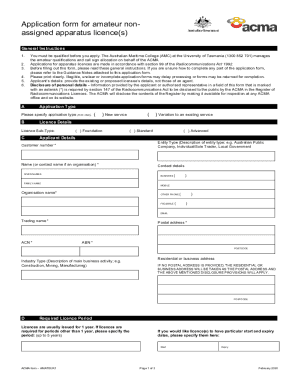

The form enables Ex-Im Bank to identify the details of co-financing transactions between U.S. exporters, the Ex-Im Bank, and foreign export credit agencies, and to assess compliance and creditworthiness

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign co-financing with foreign export

Edit your co-financing with foreign export form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

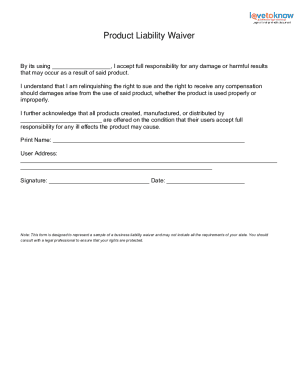

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your co-financing with foreign export form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing co-financing with foreign export online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit co-financing with foreign export. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out co-financing with foreign export

How to fill out Co-Financing with Foreign Export Credit Agency

01

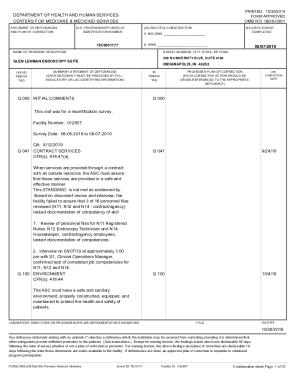

Gather necessary documents including financial statements and export contracts.

02

Identify the eligible foreign export credit agencies based on your export destination.

03

Prepare a detailed project proposal outlining the purpose and anticipated benefits of the financing.

04

Complete the application forms provided by the foreign export credit agency.

05

Submit the application along with all supporting documents to the foreign export credit agency.

06

Await feedback or additional requests for information from the agency.

07

If approved, review the terms and conditions of the financing agreement carefully before signing.

Who needs Co-Financing with Foreign Export Credit Agency?

01

Businesses engaged in international trade who require additional financing for exporting goods.

02

Companies looking to mitigate risks associated with exporting to foreign markets.

03

Exporters needing support for large-scale projects that may not be fully funded through traditional financing.

Fill

form

: Try Risk Free

People Also Ask about

How does an ECA work?

An export credit agency (ECA) is an institution that works to support companies with their international trade. Export credit agencies can be private, quasi-governmental, or entirely run by the government. They offer financing solutions and risk insurance (guarantees) for companies trying to export and import products.

What is an example of ECA financing?

One example would be a bank supporting a domestic company's export and an export credit agency helping the international organization on the receiving end. Similarly to banks, export credits or insurance can be supplied for short-term (up to 2 years), medium-term (2 to 5 years), and long-term (over 5 years).

What is export credit agency financing?

An export credit agency (known in trade finance as an ECA) or investment insurance agency is a private or quasi-governmental institution that acts as an intermediary between national governments and exporters to issue export insurance solutions and guarantees for financing.

What is ECA covered financing?

The basics of ECA-covered finance. The basic requirement for financing is the existence of an export contract, which the exporter signs with the importer and which may include services as well. Furthermore, the importer and exporter agree that part of the contract value is to be financed.

How does ECA cover work?

The ECA Guarantee of Work provides a free benefit to the clients of ECA Members. If, once completed, works covered are discovered to be non-compliant with relevant technical standards, the works will be reinstated to be compliant with the relevant standards.

What does ECA insurance cover?

ECA insures all buildings and contents in the canton of Vaud against fire and natural hazards for individuals, businesses and local authorities, whatever the level of exposure to risks, for greater solidarity.

What is an example of export credit financing?

Examples include Export Packing Credit for production, manufacturing, and packaging of goods for export and Raw Material Financing to purchase raw materials for production. It covers expenses such as raw materials, production costs, manufacturing and packaging.

Who pays the ECA premium?

ECA Premium means the fee payable to the ECA by the Off Shore Facility Agent pursuant to the ECA Cover Documents and by the Equipment Vendor pursuant to any additional cover granted by the ECA to the Equipment Vendor in connection with the Delivery Contract.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Co-Financing with Foreign Export Credit Agency?

Co-Financing with Foreign Export Credit Agency refers to the collaboration between a domestic financing institution and a foreign export credit agency to provide funding for export-related projects, promoting international trade and easing capital access.

Who is required to file Co-Financing with Foreign Export Credit Agency?

Companies or entities that are seeking financing for export projects and are utilizing the services of a foreign export credit agency are required to file for Co-Financing.

How to fill out Co-Financing with Foreign Export Credit Agency?

To fill out the Co-Financing application, applicants must gather relevant project details, financial information, and the terms of the financing arrangement with the foreign agency, then complete the required forms provided by the financing institution.

What is the purpose of Co-Financing with Foreign Export Credit Agency?

The purpose of Co-Financing with Foreign Export Credit Agency is to facilitate international trade by providing additional financial resources to exporters, thereby enhancing their ability to compete in foreign markets.

What information must be reported on Co-Financing with Foreign Export Credit Agency?

The information to be reported includes project specifics, funding amounts, the involved parties, terms of the financing agreement, and any relevant financial projections or impacts on trade.

Fill out your co-financing with foreign export online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Co-Financing With Foreign Export is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.