Get the free INDEPENDENT CONTRACTOR SERVICES FORM - sunyopt

Show details

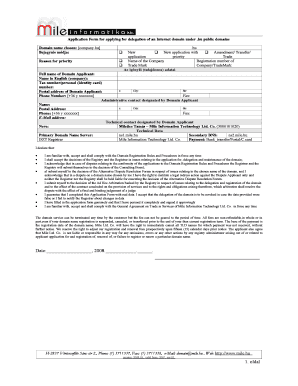

This form is used to document the details and conditions for independent contractor services, including citizenship status, payment details, and certification by the project director.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor services form

Edit your independent contractor services form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor services form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit independent contractor services form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit independent contractor services form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor services form

How to fill out INDEPENDENT CONTRACTOR SERVICES FORM

01

Obtain the INDEPENDENT CONTRACTOR SERVICES FORM from your company's HR or designated department.

02

Begin filling in the contractor's full name in the designated field.

03

Enter the contractor's address including city, state, and ZIP code.

04

Provide the contractor's Social Security Number or Tax Identification Number.

05

Specify the nature of the services to be rendered by the contractor.

06

Include the agreed-upon payment terms (e.g., hourly rate, flat fee).

07

Indicate the duration of the contract or the expected completion date.

08

Ensure all necessary signatures are included, including that of the contractor and an authorized representative from your organization.

09

Review the completed form for accuracy.

10

Submit the form according to your organization’s procedures.

Who needs INDEPENDENT CONTRACTOR SERVICES FORM?

01

Businesses or organizations that engage independent contractors for services.

02

Independent contractors themselves for tax and legal purposes.

03

Human Resources departments for record-keeping and compliance.

Fill

form

: Try Risk Free

People Also Ask about

How do I make my own contract agreement?

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

How do I write an independent contractor agreement?

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

What forms do independent contractors need to fill out?

Generally, if you're an independent contractor you're considered self-employed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

What is independent contractor in English?

The general rule is that an individual is an independent contractor if the person for whom the services are performed has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

How do you structure an independent contractor agreement?

Below are eight important points to consider including in an independent contractor agreement. Define a Scope of Work. Set a Timeline for the Project. Specify Payment Terms. State Desired Results and Agree on Performance Measurement. Detail Insurance Requirements. Include a Statement of Independent Contractor Relationship.

Who writes the independent contractor agreement?

It's important to work with your legal counsel to draft a contractor agreement template that can be easily utilized across your contractor workforce and customized to protect your business from liability when engaging with independent contractors.

How do you write a simple contract agreement?

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Describe how the contract will end. Say which laws apply and how disputes will be resolved. Include space for signatures.

Can I do my own 1099 forms?

First, you can download the form from the IRS website or order an official paper copy if filing by mail. Alternatively, businesses can create 1099 online using trusted tax software. This reduces manual errors and ensures compliance with IRS requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INDEPENDENT CONTRACTOR SERVICES FORM?

The Independent Contractor Services Form is a document used by businesses to report payments made to independent contractors for services rendered. It ensures compliance with tax regulations.

Who is required to file INDEPENDENT CONTRACTOR SERVICES FORM?

Any business or entity that hires independent contractors and pays them $600 or more in a calendar year is required to file the Independent Contractor Services Form.

How to fill out INDEPENDENT CONTRACTOR SERVICES FORM?

To fill out the Independent Contractor Services Form, include the contractor's name, address, social security number or taxpayer identification number, the total amount paid during the year, and any relevant tax information.

What is the purpose of INDEPENDENT CONTRACTOR SERVICES FORM?

The purpose of the Independent Contractor Services Form is to report payments made to independent contractors for tax purposes and to keep accurate records of financial transactions.

What information must be reported on INDEPENDENT CONTRACTOR SERVICES FORM?

The form must report the contractor's name, address, taxpayer identification number, the total payments made during the year, and any applicable deductions or withholdings.

Fill out your independent contractor services form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Services Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.