Get the free FHA Connection Information - mortgagebankers

Show details

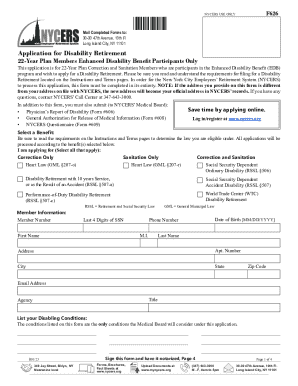

This document provides details about the FHA Connection, including how to authorize employees, obtain user IDs, and access the platform. It outlines the roles of Application Coordinators in managing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha connection information

Edit your fha connection information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha connection information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha connection information online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fha connection information. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha connection information

How to fill out FHA Connection Information

01

Visit the FHA Connection website.

02

Click on 'Login' to access your account.

03

Navigate to 'FHA Connection Information' section.

04

Select the appropriate form you need to fill out.

05

Provide the required personal and business information.

06

Review the information for accuracy.

07

Submit the form for processing.

Who needs FHA Connection Information?

01

Lenders originating FHA-insured loans.

02

Mortgage professionals managing FHA transactions.

03

Real estate agents dealing with FHA buyer clients.

Fill

form

: Try Risk Free

People Also Ask about

What are red flags for an FHA loan?

A red flag is going to be any major defect or safety concern, such as a leaky roof, mold, or structural damage. Remember, FHA appraisers are looking for obvious hazards and structural issues that could impact the home's habitability or long-term value.

What is the FHA connection?

FHA Connection loan processing capabilities and benefits. The FHA Connection is an interactive system on the Internet that gives approved Federal Housing Administration (FHA) lenders and other HUD-approved business partners real-time access to data residing in a number of HUD FHA systems.

What is a credit alert sanction on an FHA connection?

The warning message Borrower(s) Have CAIVRS Alert and/or Mortgage Credit Sanction indicates CAIVRS has found a problem with the borrower's and/or co-borrower's credit history. Use CAIVRS Authorization on the Case Processing menu to get further details.

What disqualifies you from an FHA loan?

You may not qualify for an FHA loan if your credit score or DTI doesn't meet the lender's requirements. It's also possible to be disqualified if you've defaulted on federal debt, such as a tax bill or federal student loan. You'll also have to show you have enough money to cover the down payment.

Is the FHA loan legit?

An FHA loan is a type of mortgage insured by the Federal Housing Administration, which is a part of the U.S. Department of Housing and Urban Development. The FHA loan program was created to expand access to homeownership, and it often makes getting a mortgage more affordable for first-time and lower-income homebuyers.

Is there a catch to an FHA loan?

You won't be able to avoid mortgage insurance: Everyone pays upfront mortgage insurance premiums (MIP) with an FHA loan. If you put down less than 10 percent, you'll pay annual MIP for the life of the loan. If you put down at least 10 percent, you'll pay annual MIP for 11 years, or until you refinance or sell.

Is it hard to get an FHA loan right now?

It's not difficult at all. The biggest issue is the appraisal because it's a government backed loan. They will be tougher on appearance, such as no chipped or peeling paint. It will fail an appraisal because of that issue, so be aware of that. It's great for first-time home buyers. Definitely don't be afraid to go FHA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FHA Connection Information?

FHA Connection Information refers to the data and reports submitted to the Federal Housing Administration (FHA) via the FHA Connection system, which is an online platform for managing FHA loans and related activities.

Who is required to file FHA Connection Information?

Mortgage lenders, servicers, and other entities that participate in FHA programs are required to file FHA Connection Information to ensure compliance with FHA regulations.

How to fill out FHA Connection Information?

To fill out FHA Connection Information, users must access the FHA Connection portal, log in with their credentials, and navigate to the appropriate section to complete the required forms and data fields as per provided guidelines.

What is the purpose of FHA Connection Information?

The purpose of FHA Connection Information is to collect and manage data regarding FHA-insured loans, facilitating the monitoring and administration of the FHA insurance programs.

What information must be reported on FHA Connection Information?

The information that must be reported includes loan details, borrower information, property data, and any updates or changes related to the loan status as required by FHA guidelines.

Fill out your fha connection information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Connection Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.