Get the free FHA-2447 - hud

Show details

Este documento proporciona requerimientos específicos sobre el mantenimiento de seguros de propiedad para proyectos hipotecarios asegurados por el Comisionado de Vivienda Federal. Incluye información

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha-2447 - hud

Edit your fha-2447 - hud form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha-2447 - hud form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fha-2447 - hud online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

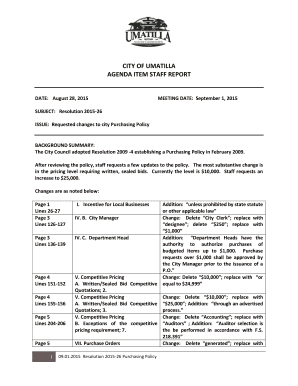

Edit fha-2447 - hud. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha-2447 - hud

How to fill out FHA-2447

01

Obtain the FHA-2447 form from the official HUD website or your lender.

02

Fill in the borrower's name and Social Security number in the designated fields.

03

Provide the property address associated with the FHA loan in question.

04

Indicate the date of the loan default.

05

Complete the sections detailing the reason for the request.

06

Ensure all required signatures are obtained.

07

Double-check all entries for accuracy and completeness.

08

Submit the form to the appropriate FHA office or lender.

Who needs FHA-2447?

01

Homeowners with an FHA loan who are facing financial difficulties.

02

Borrowers seeking a partial claim or loan modification.

03

Individuals applying for assistance with their FHA-insured mortgage.

Fill

form

: Try Risk Free

People Also Ask about

Does an FHA loan require flood insurance?

Flood Insurance is required for any building improvement which contributes to the mortgage value of the property when that improvement is in a "Special Flood Hazard Area" (SFHA). This requirement does not include unimproved land.

What does FHA stand for in healthcare?

The Federal Health Architecture (FHA) is an e-government initiative overseen by the Office of the National Coordinator for Health Information Technology (ONC), which is part of the Department of Health and Human Services (HHS).

What does the FHA stand for in business?

The term Federal Housing Administration (FHA) refers to a U.S. agency that provides mortgage insurance to FHA-approved lenders. The FHA was established in 1934 by the U.S. government and became part of the U.S. Department of Housing and Urban Development (HUD) in 1965.

What did the FHA stand for?

The Federal Housing Administration (FHA) provides mortgage insurance on single-family, multifamily, manufactured home, and hospital loans made by FHA-approved lenders throughout the United States and its territories.

What does FHA stand for Great Depression?

The Federal Housing Administration (FHA) administers a program of loan insurance to expand homeownership opportunities. FHA provides mortgage insurance to FHA-approved lenders to protect these lenders against losses if the homeowner defaults on the loan.

What is the maximum deductible for homeowners insurance on an FHA loan?

Maximum deductible for FHA loans: Unless a higher maximum amount is required by law, the maximum dwelling deductible for homeowners insurance and flood insurance may not exceed the greater of $1,000 or 1% of the face amount of the dwelling coverage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FHA-2447?

FHA-2447 is a form used by the Federal Housing Administration (FHA) to notify the FHA of loan modifications or other changes related to the insured mortgage.

Who is required to file FHA-2447?

Mortgage servicers or lenders who are managing FHA-insured loans and need to report changes or modifications must file FHA-2447.

How to fill out FHA-2447?

To fill out FHA-2447, complete the required fields by providing detailed information about the loan and the changes being reported, ensuring accuracy and compliance with FHA guidelines.

What is the purpose of FHA-2447?

The purpose of FHA-2447 is to ensure that the FHA is informed about significant changes to FHA-insured loans, facilitating proper management and oversight of these loans.

What information must be reported on FHA-2447?

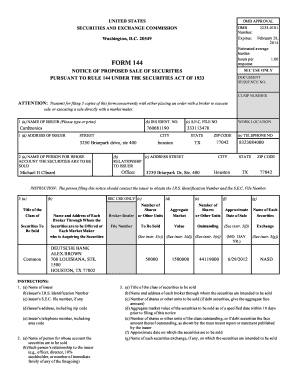

Information that must be reported on FHA-2447 includes the borrower's details, loan number, type of action being reported, and any relevant dates or changes in loan terms.

Fill out your fha-2447 - hud online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha-2447 - Hud is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.