Flagstar Bank Private Mortgage Insurance (PMI) Waiver Request Form 2015 free printable template

Show details

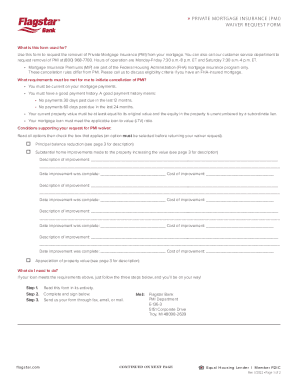

PRIVATE FOR GAGE INSURANCE (PMI) WAIVER REQUEST FORM Use this form to request a waiver of your Private Mortgage Insurance (PMI) on your Flag star Bank Mortgage. Before you begin, Your Loan MUST meet

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign flagstar pmi waiver

Edit your flagstar pmi waiver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flagstar pmi waiver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit flagstar pmi waiver online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit flagstar pmi waiver. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Flagstar Bank Private Mortgage Insurance (PMI) Waiver Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out flagstar pmi waiver

How to fill out Flagstar Bank Private Mortgage Insurance (PMI) Waiver

01

Gather necessary documentation, including loan details and property information.

02

Download the Flagstar Bank PMI Waiver form from their official website or request a copy from your loan officer.

03

Complete the form by filling in your personal information, loan number, and property address.

04

Provide details about your down payment and the current value of your home, if applicable.

05

Attach any required supporting documents, such as proof of income or appraisal reports.

06

Review the completed form for accuracy and completeness.

07

Submit the form and supporting documents to Flagstar Bank as per their submission guidelines.

08

Follow up with Flagstar Bank to confirm receipt of your waiver request and inquire about the processing timeline.

Who needs Flagstar Bank Private Mortgage Insurance (PMI) Waiver?

01

Homebuyers who have taken out a mortgage with a down payment of less than 20%.

02

Borrowers seeking to eliminate or reduce their Private Mortgage Insurance (PMI) costs.

03

Individuals who have appreciated home values and want to waive PMI after refinancing or obtaining a mortgage.

Fill

form

: Try Risk Free

People Also Ask about

What is the PMI cancellation act?

et seq., also known as the “PMI Cancellation Act,” was signed into law on July 29, 1998, became effective on July 29, 1999, and was amended on December 27, 2000, to provide technical corrections and clarification. The HPA addresses homeowners' difficulties in canceling private mortgage insurance (PMI) coverage.

Can I request PMI cancellation?

Request PMI cancellation You have the right to request that your servicer cancel PMI when you have reached the date when the principal balance of your mortgage is scheduled to fall to 80 percent of the original value of your home.

What are the requirements to remove PMI?

If you've owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI to be canceled. If you've owned the home for at least two years, your remaining mortgage balance must be no greater than 75 percent.

How do I remove PMI from escrow?

PMI will automatically be removed from your monthly mortgage payment after your loan amount reaches 78% of the home's appraised value. You can request PMI cancellation as soon as you reach the 80% mark, but your lender will not remove it at this point unless you explicitly ask for it.

Do I have to wait 2 years to remove PMI?

If you've owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI to be canceled. If you've owned the home for at least two years, your remaining mortgage balance must be no greater than 75 percent.

Can PMI be removed if home value increases?

You re-appraise your home after it gains value. Generally, you can request to cancel PMI when you reach at least 20% equity in your home. You might reach the 20% equity threshold by making your payments on time per your amortization schedule for loan repayment.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the flagstar pmi waiver electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your flagstar pmi waiver in seconds.

How do I fill out flagstar pmi waiver using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign flagstar pmi waiver and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit flagstar pmi waiver on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign flagstar pmi waiver. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is Flagstar Bank Private Mortgage Insurance (PMI) Waiver?

The Flagstar Bank Private Mortgage Insurance (PMI) Waiver is a program that allows borrowers to eliminate the requirement for PMI by meeting specific criteria, usually related to the borrower’s equity in the home.

Who is required to file Flagstar Bank Private Mortgage Insurance (PMI) Waiver?

Borrowers who wish to waive their PMI requirement upon meeting the stipulated criteria, such as having a certain amount of equity in their property, are required to file for the Flagstar Bank PMI Waiver.

How to fill out Flagstar Bank Private Mortgage Insurance (PMI) Waiver?

To fill out the PMI Waiver, borrowers should complete the necessary application form provided by Flagstar Bank, providing required information such as property details, loan information, and equity amount.

What is the purpose of Flagstar Bank Private Mortgage Insurance (PMI) Waiver?

The purpose of the Flagstar Bank PMI Waiver is to allow qualified borrowers to eliminate monthly PMI payments, potentially lowering their monthly mortgage costs.

What information must be reported on Flagstar Bank Private Mortgage Insurance (PMI) Waiver?

The information that must be reported includes the borrower’s name, property address, loan amount, current equity in the property, and any required documentation to support the waiver request.

Fill out your flagstar pmi waiver online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flagstar Pmi Waiver is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.