Get the free 2012-13 Federal Direct PLUS (Parent) Loan Override Request - upb pitt

Show details

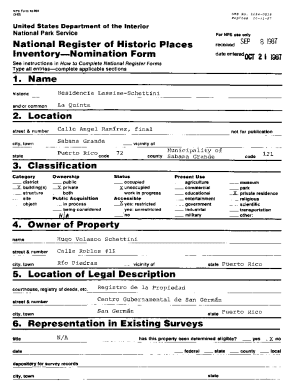

This form is submitted to request an override for the Federal Direct PLUS Loan, detailing reasons for the inability to borrow and providing supporting documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-13 federal direct plus

Edit your 2012-13 federal direct plus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-13 federal direct plus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012-13 federal direct plus online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2012-13 federal direct plus. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

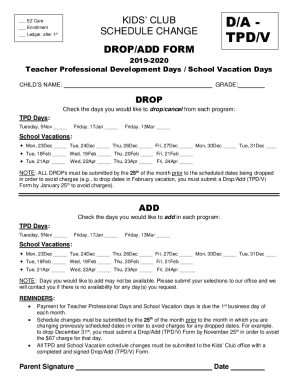

How to fill out 2012-13 federal direct plus

How to fill out 2012-13 Federal Direct PLUS (Parent) Loan Override Request

01

Obtain the 2012-13 Federal Direct PLUS Loan Override Request form from your school's financial aid office or website.

02

Fill out the borrower's personal information, including name, Social Security number, and date of birth.

03

Provide the student's information, including their name and identification number.

04

Indicate the reason for the loan override request on the form.

05

Document any supporting information or circumstances that justify the request.

06

Sign and date the form to certify the accuracy of the provided information.

07

Submit the completed form to the financial aid office by the established deadline.

Who needs 2012-13 Federal Direct PLUS (Parent) Loan Override Request?

01

Parents of students who have had their Direct PLUS Loan applications denied due to adverse credit history or other eligibility issues.

02

Parents who believe they qualify for a Direct PLUS Loan but need to request an override for specific circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is federal direct parent PLUS loan request?

Steps for how to transfer a Parent PLUS loan to your child: Your child must apply for a student loan refinance in their own name. The application is based on your child's information alone. This is why it's important to ensure they have a steady income and meet the lender's criteria.

Is there any way to get out of parent PLUS loans?

Federal Direct PLUS loans are federal loans that graduate or professional students and parents of dependent undergraduate students can use to help pay for college or career school. You must complete a new Direct PLUS Application for each year you wish to receive a parent PLUS loan.

What is the loophole for parent PLUS loans?

One way to have your parent PLUS loans forgiven is by enrolling in an Income-Contingent Repayment plan (ICR). Just like other income-driven repayment plans, this plan calculates your monthly payment based on a percentage of your disposable income and allows you to pay off the loan over a longer period of time.

How does federal direct parent PLUS loan work?

The school will first apply parent PLUS loan funds to the student's school account to pay for tuition, fees, room and board, and other school charges. If any loan funds remain, your child's school will give them to you to help pay other education expenses for the student.

What is the difference between a federal direct loan and a federal direct PLUS loan?

Direct Subsidized/Unsubsidized Loans have a lower fixed interest rate (6.8%) than Direct PLUS Loans (7.9%), and no interest is charged on Direct Subsidized Loans while you are in school at least half-time or during grace and deferment periods. Interest is charged on Direct PLUS Loans during all periods.

Is it a good idea to get a parent PLUS loan?

Parent PLUS loans can be a good alternative to private student loans because they offer more flexible repayment options. But Parent PLUS loans can be costlier than other options, and consequences are harsh for default, including the potential for wage and Social Security garnishment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012-13 Federal Direct PLUS (Parent) Loan Override Request?

The 2012-13 Federal Direct PLUS (Parent) Loan Override Request is a formal application process that allows parents of students enrolled in college to request a review and potential override of the standard eligibility requirements for the Federal Direct PLUS Loan program.

Who is required to file 2012-13 Federal Direct PLUS (Parent) Loan Override Request?

Parents of dependent undergraduate students who do not meet the creditworthiness criteria or have other specific circumstances impacting their eligibility for the Federal Direct PLUS Loan may be required to file this request.

How to fill out 2012-13 Federal Direct PLUS (Parent) Loan Override Request?

To fill out the request, parents need to obtain the appropriate form from their educational institution, provide requested financial information, detail any special circumstances, and submit the completed form along with any required supporting documentation.

What is the purpose of 2012-13 Federal Direct PLUS (Parent) Loan Override Request?

The purpose of this request is to allow parents to appeal to their institution for a reevaluation of their eligibility for the PLUS loan based on individual circumstances that may not be reflected in standard eligibility criteria.

What information must be reported on 2012-13 Federal Direct PLUS (Parent) Loan Override Request?

The request must include the parent's financial information, details about the student's enrollment status, descriptions of any unique financial hardships or circumstances, and any other relevant information requested by the educational institution.

Fill out your 2012-13 federal direct plus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-13 Federal Direct Plus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.