Get the free 2012-2013 Illinois Residency Verification for Dependent Students - stfrancis

Show details

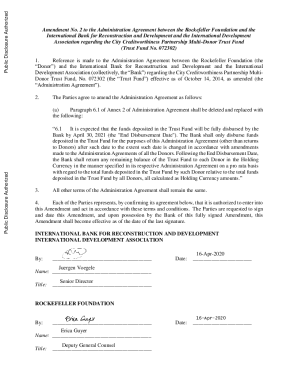

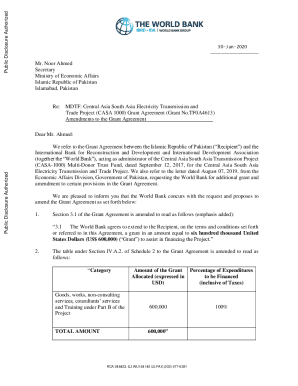

This document is used to verify the residency status of a parent of a dependent student in Illinois to qualify for state financial assistance under the Illinois Student Assistance Commission (ISAC)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-2013 illinois residency verification

Edit your 2012-2013 illinois residency verification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-2013 illinois residency verification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012-2013 illinois residency verification online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012-2013 illinois residency verification. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012-2013 illinois residency verification

How to fill out 2012-2013 Illinois Residency Verification for Dependent Students

01

Obtain the 2012-2013 Illinois Residency Verification for Dependent Students form from the appropriate educational institution or their website.

02

Fill out the student's personal information at the top of the form, including name, address, and student ID number.

03

Provide information about the student's parent(s) or legal guardian(s), including their names, addresses, and relationship to the student.

04

Indicate the resident status of the parent(s) or guardian(s) by checking the appropriate box (indicating whether they are residents of Illinois).

05

If applicable, provide supporting documentation that verifies residency, such as a driver's license, utility bills, or tax returns.

06

Sign and date the form at the bottom, confirming that the information provided is accurate and complete.

07

Submit the completed form to the designated office or department at the educational institution, following their submission guidelines.

Who needs 2012-2013 Illinois Residency Verification for Dependent Students?

01

Dependent students who are applying for financial aid or tuition rates that depend on residency status in Illinois.

02

Students whose parent(s) or legal guardian(s) reside in Illinois and are responsible for their financial support.

Fill

form

: Try Risk Free

People Also Ask about

How to establish residency in Illinois for college?

How can I become a resident for tuition purposes? If you are a dependent: Your family must live in or move to Illinois for at least 12 consecutive months immediately preceding the first day of classes. The in-state tuition rate would begin at the start of the next term.

What qualifies as proof of residency in Illinois?

Illinois driver's license. Tax Return Transcript with Illinois address. Illinois voter's registration card. State of Illinois identification card issued by the Secretary of State.

What is proof of residency for SIUE?

If independent (for FAFSA purposes), we must see proof of your Illinois residency for the past 12 continuous months. Examples of what can be submitted as proof include: - Your/parent's signed 2022 ILLINOIS tax return. - Valid drivers license showing appropriate date range.

What is the 183 day rule in Illinois?

Stay under 183 days: Illinois's tax authorities consider you a resident if you spend 183 days or more in the state during a calendar year. To avoid being classified as a resident, you should spend fewer than 183 days in Illinois each year. This includes any visits back to Illinois, so plan your travel carefully.

How do I prove residency without bills in Illinois?

Examples of Documentation To Prove Illinois Residency Valid State of Illinois tax return or federal tax transcript. Illinois high school or college transcript. Illinois driver's license. Utility or rent bills in the applicant's (or parent's) name. Illinois auto registration card.

Who is eligible for the Illinois map grant?

To be eligible, you must: be a U.S. citizen or an eligible noncitizen or meet the “undocumented student” criteria of the RISE Act. be an Illinois resident (if you are a dependent, the parent whose information is used on the FAFSA must be an Illinois resident) demonstrate financial need.

What is proof of map residency for dependent students in Illinois?

Illinois driver's license; Utility or rent bills in the applicant's (or parent's) name; Illinois auto registration card; Wage and tax statements (IRS Form W-2);

How to prove residency in Illinois for school?

Proof of IL Residency Illinois driver's license. Tax Return Transcript with Illinois address. Illinois voter's registration card. State of Illinois identification card issued by the Secretary of State. Utility or rent bills in the parent's name. Residential lease in the parent's name. Property tax bill.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012-2013 Illinois Residency Verification for Dependent Students?

The 2012-2013 Illinois Residency Verification for Dependent Students is a form that is used to determine the residency status of dependent students in Illinois for eligibility for in-state tuition rates at public universities.

Who is required to file 2012-2013 Illinois Residency Verification for Dependent Students?

Dependent students who are applying for in-state tuition rates at Illinois public universities are required to file the 2012-2013 Illinois Residency Verification.

How to fill out 2012-2013 Illinois Residency Verification for Dependent Students?

To fill out the form, students must provide information regarding their residency status, the residency status of their parents or guardians, and any relevant documentation that supports their claims.

What is the purpose of 2012-2013 Illinois Residency Verification for Dependent Students?

The purpose of the form is to verify the residency status of dependent students to ensure they qualify for in-state tuition rates, which are typically lower than out-of-state rates.

What information must be reported on 2012-2013 Illinois Residency Verification for Dependent Students?

The form requires information such as the student's and parents' names, addresses, dates of residency, and other identifying information necessary to establish residency status.

Fill out your 2012-2013 illinois residency verification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-2013 Illinois Residency Verification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.