Get the free Direct Expenditure for Personal Services - uscupstate

Show details

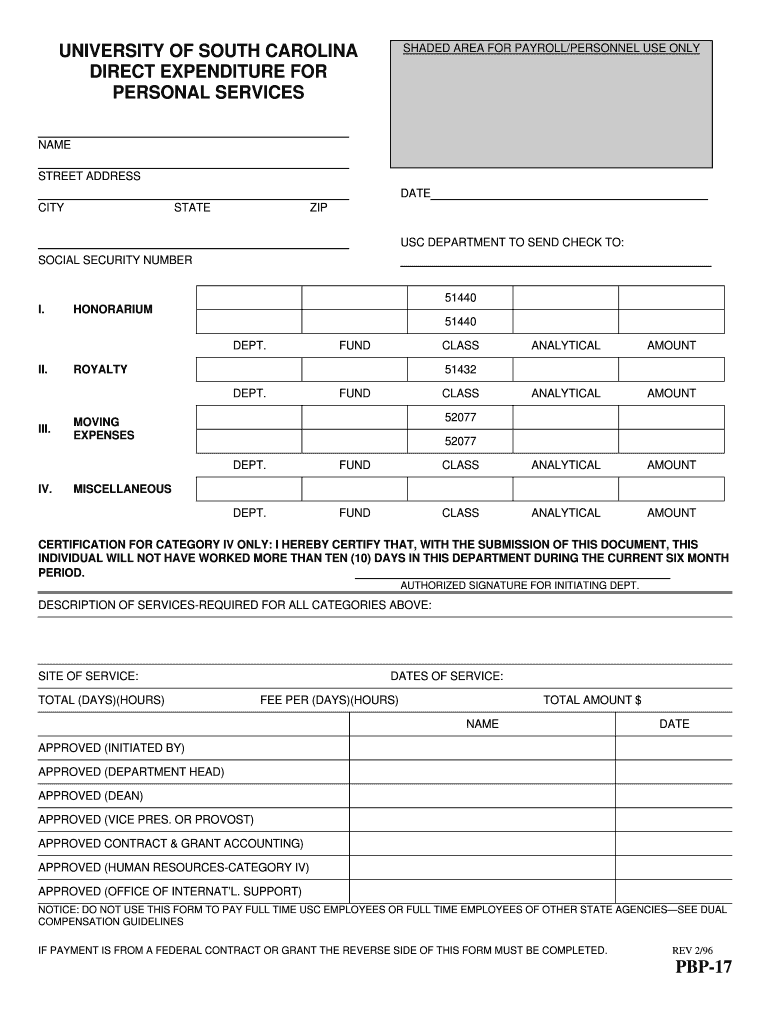

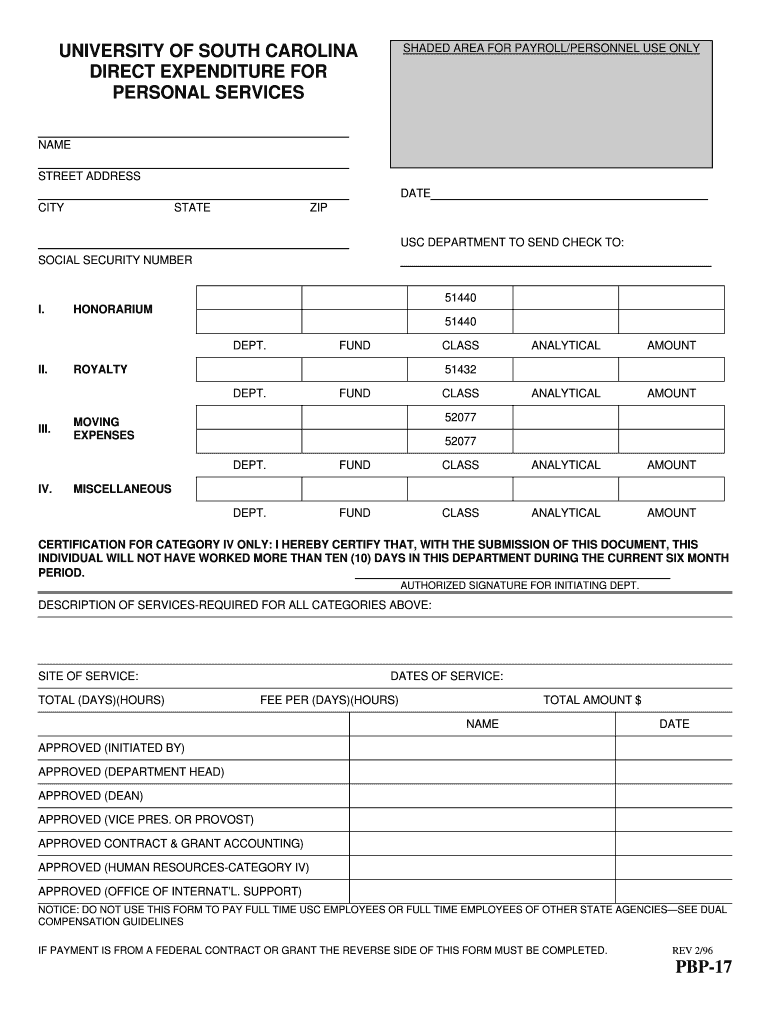

This document is used at the University of South Carolina to record and process payments for personal services such as honoraria, royalties, and moving expenses for individuals who have not worked

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct expenditure for personal

Edit your direct expenditure for personal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct expenditure for personal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct expenditure for personal online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit direct expenditure for personal. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct expenditure for personal

How to fill out Direct Expenditure for Personal Services

01

Gather all relevant payroll data for the personal services you are reporting.

02

Ensure that you have the total number of hours worked and the corresponding wage rate for each employee.

03

Calculate the total expenditure for each employee by multiplying hours worked by the wage rate.

04

Document any additional costs associated with personal services, such as benefits or overtime pay.

05

Organize the data in a clear format, typically in a spreadsheet for easy reference.

06

Complete any required forms or fields specific to the funding agency or organization regarding personal services expenditure.

07

Review all entries for accuracy and compliance with funding guidelines.

08

Submit the completed documentation to the relevant authorities or keep for your records as required.

Who needs Direct Expenditure for Personal Services?

01

Organizations managing projects funded by grants or contracts that require reporting on personal service expenditures.

02

Non-profits seeking reimbursement for employee salaries associated with specific programs.

03

Federal or state agencies needing to account for direct costs in budgeting.

Fill

form

: Try Risk Free

People Also Ask about

What is direct personal expense?

Direct personnel expense (DPE) consists of taxes and fringe benefits paid on behalf of employees. DPE includes benefits such as insurance, taxes, and 401(k) matches. You can use a DPE markup to reflect these additional costs on project reports.

What is an example personal expense?

First, there are probably mortgage payments for a house or monthly rent. Second, budget for food. Next might be car expenses, like monthly car payments, car and house insurance, emergency funds, savings for retirement, and local, state, and federal taxes.

What are direct costs for services?

A direct cost is a price that can be directly tied to the production of specific goods or services. A direct cost can be traced to the cost object, which can be a service, product, or department. Direct costs examples include direct labor and direct materials.

How do you calculate DPE?

Typically, DPE percent is calculated as the total annual staff-related benefits cost divided by the total direct salary costs.

What are indirect personal costs?

Indirect labor costs refer to the expenses associated with employees who are not directly involved in the production process, such as supervisors, maintenance personnel, and support staff. These costs can have a significant impact on a company's bottom line, as they can add up quickly and eat into profits.

What is an example of a direct expense?

Some common examples of direct expenses include the following: Manufacturing supplies and equipment. Direct materials. Labor costs (such as wages for production staff)

What is an example of a direct expense?

Some common examples of direct expenses include the following: Manufacturing supplies and equipment. Direct materials. Labor costs (such as wages for production staff)

What are direct and indirect expenses in English?

Direct expenses are those which rely on the manufacture and sale of products or services by a company. Examples of direct expenses are wages, customs duty and excise duty. Indirect expenses are those that a company must pay to keep its business running smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Expenditure for Personal Services?

Direct Expenditure for Personal Services refers to the costs incurred by an organization for employee salaries, wages, and related expenses, such as benefits and payroll taxes, that are directly related to the provision of services.

Who is required to file Direct Expenditure for Personal Services?

Organizations that employ personnel and incur direct costs for their services, particularly non-profit organizations, government entities, and businesses seeking reimbursements or funding through grants are typically required to file Direct Expenditure for Personal Services.

How to fill out Direct Expenditure for Personal Services?

To fill out Direct Expenditure for Personal Services, organizations should provide detailed information on the expenses, including salaries, benefits, and taxes for each employee, along with the total amounts and relevant supporting documentation as required by the reporting agency.

What is the purpose of Direct Expenditure for Personal Services?

The purpose of Direct Expenditure for Personal Services is to track and report the costs associated with personnel directly contributing to program services, ensuring transparency and accountability in financial reporting and resource allocation.

What information must be reported on Direct Expenditure for Personal Services?

The information that must be reported typically includes employee names, roles, salary or wage rates, total hours worked, benefits provided, payroll taxes, and the total expenditures for each individual that contribute to the services.

Fill out your direct expenditure for personal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Expenditure For Personal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.