Get the free CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP - mn

Show details

Este documento contiene un checklist y formulario para solicitar la autoridad de autoasegurarse en grupo para compensación laboral. Incluye secciones para datos de contacto, información del grupo,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checklist for application for

Edit your checklist for application for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checklist for application for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing checklist for application for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit checklist for application for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checklist for application for

How to fill out CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP

01

Gather all necessary documentation and information related to your business and insurance needs.

02

Review the guidelines provided with the checklist to ensure you understand the requirements.

03

Complete each section of the checklist carefully, providing accurate and detailed information.

04

Ensure that all relevant financial statements, risk assessments, and other required documents are included.

05

Double-check for any missing information or documentation before final submission.

06

Submit the completed checklist to the appropriate authorities or the self-insurance group.

Who needs CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP?

01

Businesses looking to self-insure their risks instead of purchasing traditional commercial insurance.

02

Companies that want to form or join a commercial self-insurance group for better risk management.

03

Entrepreneurs and business owners seeking to understand their obligations and requirements for self-insurance.

Fill

form

: Try Risk Free

People Also Ask about

What is a major disadvantage of a self-insured program?

Cons of Self-Insured Companies: Risk: Large, unexpected claims can strain finances, prompting many businesses to consider stop-loss insurance. Administration: Self-insurance demands administrative effort, either internally or via third-party administrators.

What are the disadvantages of self-insured plans?

Cons of self-funded health insurance Employer assumes the risk. May have to comply with HIPAA regulations. Employer has to keep reserves for incurred but not reported (IBNR) claims if the plan is terminated. There is more work involved for employers, even when they outsource to TPAs. Variable monthly cash flow.

What is commercial self-insurance?

When a business chooses this route, they don't buy a plan from an insurance company. Instead they set aside money and use it to pay for their general liability, commercial auto and property damage claims.

What does it take to be a self-insured trucking company?

The FMCSA will consider and will approve, subject to appropriate and reasonable conditions, the application of a motor carrier to qualify as a self-insurer, if the carrier furnishes a true and accurate statement of its financial condition and other evidence that establishes to the satisfaction of the FMCSA the ability

What are the risks of self-insuring?

Self-insured businesses benefit from cost savings, earning interest on reserved funds, and increased control over their finances. Despite its benefits, the challenges associated with self-insurance include the potential for significant losses, the need for in-house administration, and inconsistent expenses.

How do I become self-insured on a commercial car?

This approach requires meeting specific financial and regulatory requirements set by the FMCSA, which include demonstrating sufficient net worth, maintaining a satisfactory safety rating, and establishing a sound self-insurance plan that assures the public's protection equal to or greater than the minimum federal

What are the advantages and disadvantages of self-insurance?

What is the disadvantage of self-funding? Slower Growth: Without external funding, businesses may find it challenging to grow quickly. Personal Financial Risk: Using personal savings or taking out personal loans can jeopardize your financial stability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

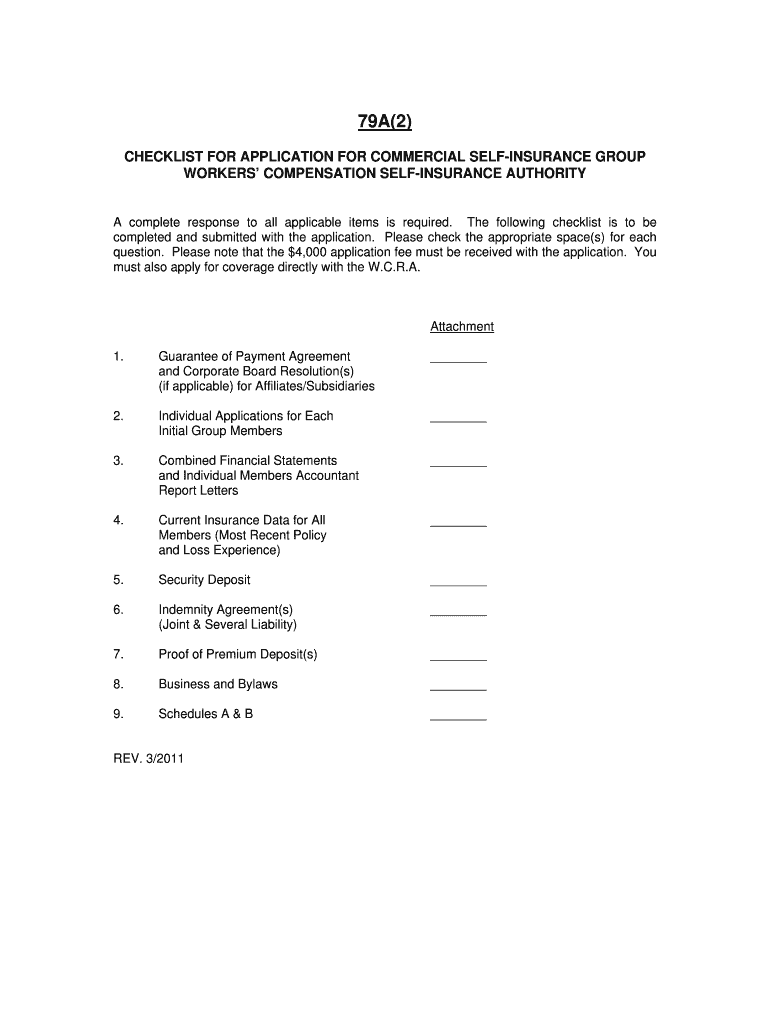

What is CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP?

The CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP is a document used to compile necessary information and verify eligibility for a commercial self-insurance program, ensuring compliance with regulatory requirements.

Who is required to file CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP?

Entities that wish to participate in a commercial self-insurance group, including businesses and organizations looking to self-insure their liabilities, are required to file the checklist.

How to fill out CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP?

The checklist should be filled out by providing accurate and up-to-date information about the organization, financial assessments, insurance history, and any relevant operational details as specified in the form.

What is the purpose of CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP?

The purpose of the checklist is to assess eligibility and ensure that the applying group meets all necessary criteria for participation in a self-insurance program, as well as to aid regulators in reviewing applications.

What information must be reported on CHECKLIST FOR APPLICATION FOR COMMERCIAL SELF-INSURANCE GROUP?

Information that must be reported includes company name, address, type of business, financial statements, loss history, risk management practices, and any additional documentation required by the regulatory body.

Fill out your checklist for application for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checklist For Application For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.