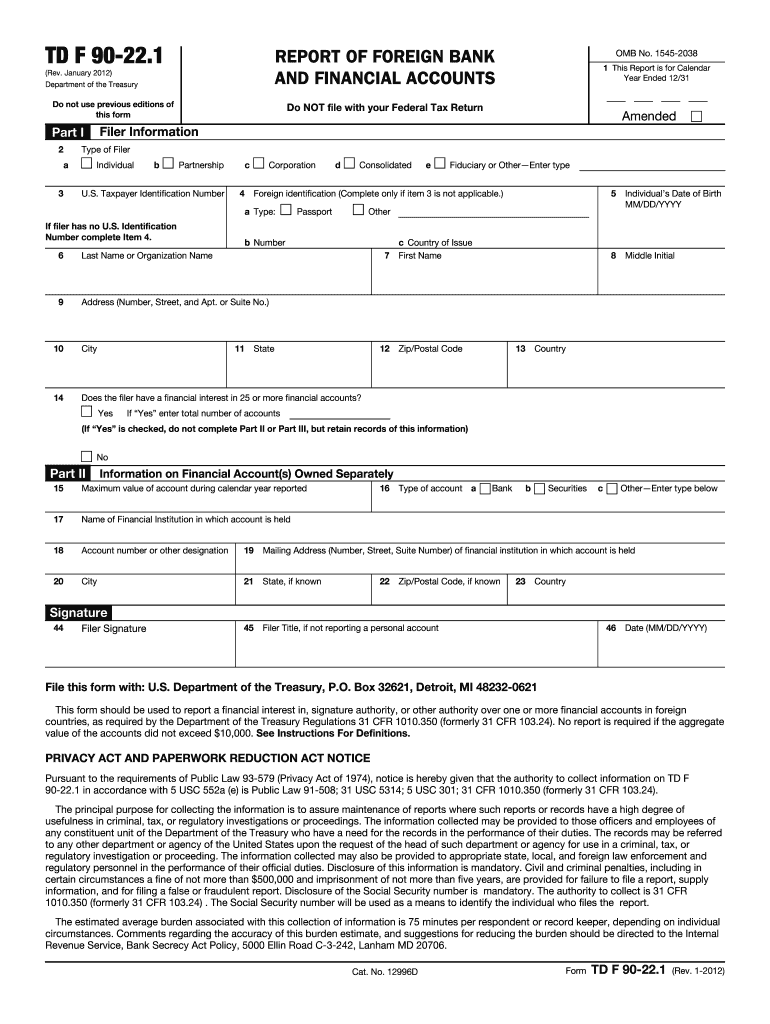

Who needs a Form TD F 90-22.1?

Report of Foreign Bank and Financial Accounts (the FAR) is used by a person or a company representative to report a financial interest in or signature authority over a foreign financial account. This form of the annual report should be filed only when the value of foreign financial accounts exceeds $10,000 at any time during a calendar year.

What is Form TD F 90-22.1 for?

This foreign bank account form provides information on each foreign account a person is interested in. Form TD F 90-22.1 specifies details of each account such as:

- Name of financial institution which holds a reported account;

- Account number or any other designation;

- City, State, Country;

- Account’s Value.

The information presented in the form is used for the preparation of tax portrait of a reported person or company.

Is Form TD F 90-22.1 accompanied by other forms?

This form does not require support of other documents.

When is Form TD F 90-22.1 due?

Form TD F 90-22.1 should be filed to Department of the Treasury on or before June 30th of the year following the year being reported.

How do I fill out Form TD F 90-22.1?

Approximate time for form filling — 75 minutes. Form abounds with financial details that you need to know to properly fill it out. Fortunately, the last three pages of this form contain detailed information about how it should be filled. Make sure that you are familiar with these instructions before starting to complete this fillable TD F 90-22.1.

Where do I send Form TD F 90-22.1?

Completed and signed, this form should be filed by mail to: Department of the Treasury, Post Office Box 32621, Detroit, MI 48232-0621.