Get the free BENEFICIARY DESIGNATION FORM - utsouthwestern

Show details

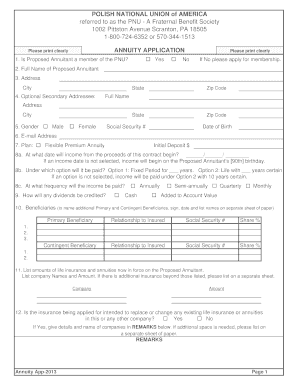

This form allows employees or retired employees of the University of Texas System to designate primary and contingent beneficiaries for their Group Term Life and Accidental Death and Dismemberment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beneficiary designation form

Edit your beneficiary designation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficiary designation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit beneficiary designation form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit beneficiary designation form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary designation form

How to fill out BENEFICIARY DESIGNATION FORM

01

Obtain the Beneficiary Designation Form from your financial institution or insurance provider.

02

Read the instructions carefully to understand the requirements.

03

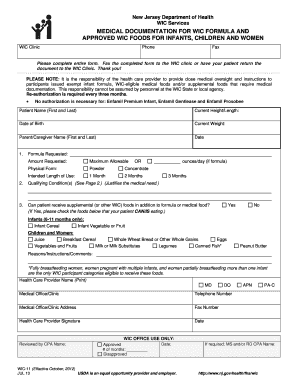

Fill in your personal information, including your name, address, and contact details.

04

Specify the type of account or policy for which you are designating beneficiaries.

05

List the beneficiaries' names, relationships to you, and their contact information.

06

Indicate the percentage or share each beneficiary will receive, ensuring the total equals 100%.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form in the designated areas.

09

Submit the form to the appropriate institution or keep it with your important documents.

Who needs BENEFICIARY DESIGNATION FORM?

01

Individuals who have financial accounts, insurance policies, or retirement plans that require beneficiaries.

02

Those who want to ensure their assets are distributed according to their wishes after their passing.

03

People undergoing life changes, such as marriage, divorce, or having children, who need to update their beneficiaries.

Fill

form

: Try Risk Free

People Also Ask about

Do beneficiary designations override a will?

Under California law, beneficiary designations almost always supersede a will. This means the assets tied to those designations go to the named beneficiary, no matter what your will says. Why? Because the beneficiary designation is a direct agreement between you and the financial institution.

What is an example of a designated beneficiary?

A lot of people name a close relative — like a spouse, brother or sister, or child — as a beneficiary. You can also choose a more distant relative or a friend. If you want to designate a friend as your beneficiary, be sure to check with your insurance company or directly with your state.

What is an SF 2823 form for?

Mail Form To SF 2823, Designation For FEGLI Determines how proceeds from the life insurance are distributed.

What is a sf 1152 form?

SF-1152 Payment of a deceased employee's last pay check to include the payment of earned annual leave and any other miscellaneous monies payable to beneficiaries. The completed original SF-1152 must be submitted to the employee's servicing personnel office for immediate filing in the Official Personnel File (OPF).

What are beneficiary designations examples?

Beneficiary designations are commonly used with life insurance policies, IRAs, 401(k)s, and other types of accounts with death benefits. For example, you may set up a life insurance policy to name your spouse as your primary beneficiary, with your kids as equal contingent beneficiaries if your spouse predeceases you.

What is an example of a beneficiary designation?

For example, the account owner could create a beneficiary designation stating that the funds will be distributed to the owner's Trust upon the death of the owner. The Trustee of the owner's Trust would then receive the funds and distribute the funds ing to the terms of the Trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BENEFICIARY DESIGNATION FORM?

A Beneficiary Designation Form is a legal document that allows an individual to designate specific individuals or entities to receive benefits, assets, or property upon the individual's death.

Who is required to file BENEFICIARY DESIGNATION FORM?

Individuals who have assets or accounts that require a beneficiary designation, such as life insurance policies, retirement accounts, or trust accounts, are required to file a Beneficiary Designation Form.

How to fill out BENEFICIARY DESIGNATION FORM?

Filling out a Beneficiary Designation Form typically involves providing personal information, such as the name and contact details of the primary and contingent beneficiaries, and signing the form to affirm the designations.

What is the purpose of BENEFICIARY DESIGNATION FORM?

The purpose of the Beneficiary Designation Form is to clearly specify who will receive assets or benefits after an individual's death, thereby avoiding potential disputes and ensuring that wishes are honored.

What information must be reported on BENEFICIARY DESIGNATION FORM?

The form must include the beneficiary's full name, relationship to the individual, date of birth, social security number, and any other relevant identifying information, as well as the individual's own personal information.

Fill out your beneficiary designation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Designation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.