Get the free Biweekly Payment Rider

Show details

This Biweekly Payment Rider amends and supplements the Mortgage, Deed of Trust, or Security Deed by incorporating biweekly loan payments instead of monthly payments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign biweekly payment rider

Edit your biweekly payment rider form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your biweekly payment rider form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing biweekly payment rider online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit biweekly payment rider. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

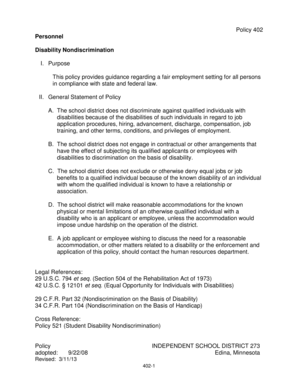

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

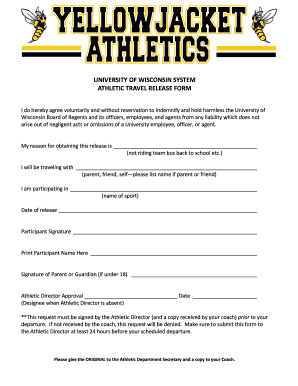

How to fill out biweekly payment rider

How to fill out Biweekly Payment Rider

01

Obtain the Biweekly Payment Rider form from your lender or mortgage provider.

02

Review the terms of your original loan agreement to ensure compatibility.

03

Fill out your personal information, including your name, address, and loan details.

04

Specify the biweekly payment option and the amount to be paid every two weeks.

05

Include any necessary signatures required by your lender.

06

Submit the completed form to your lender for approval.

Who needs Biweekly Payment Rider?

01

Homeowners looking to pay off their mortgage faster.

02

Borrowers seeking to lower the total interest paid over the life of the loan.

03

Individuals who prefer smaller, more manageable payments.

04

Those who receive biweekly paychecks and want to align their mortgage payments accordingly.

Fill

form

: Try Risk Free

People Also Ask about

Is there a downside to biweekly mortgage payments?

Signing a formal agreement to make biweekly mortgage payments has a couple of potential downsides: There are often fees involved and they will eat into the amount you're saving by increasing your annual mortgage payment. You're locking yourself into a commitment to pay a larger amount every year.

Should I make biweekly payments on my car?

Making biweekly payments on your car loan instead of monthly payments can potentially save you money on interest, although the actual savings will depend on the terms of your loan and the specific calculations used by your lender.

Is biweekly car payment a good idea?

Making biweekly payments on your car loan instead of monthly payments can potentially save you money on interest, although the actual savings will depend on the terms of your loan and the specific calculations used by your lender.

How much faster will I pay off my loan with biweekly payments?

Bi-weekly payments will save you 19,834 in interest, and will reduce the term of your loan from 30 years to 26.1 years. Pay off your home 4 years earlier with bi-weekly payments. These calculations are tools for learning more about the mortgage process and are for educational/estimation purposes only.

Do biweekly payments reduce interest on an auto loan?

Most auto loans calculate interest daily using simple interest, which means the interest you pay is based on your remaining principal balance. By splitting the payment into two parts and paying half of your monthly payment every other week, you'll reduce the principal faster and lower the total interest you owe.

What happens if I pay my car payment every 2 weeks?

By paying half of your monthly payment every two weeks, each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12. This simple technique can shave time off your auto loan and could save you hundreds or even thousands of dollars in interest.

What is the biweekly payment method?

Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the equivalent of 13 monthly payments instead of 12. This simple technique can shave years off your mortgage and save you thousands of dollars in interest.

What does biweekly mean in banking?

Instead of making one monthly payment, the borrower makes a payment equal to one-half of the normal monthly payment every two weeks …

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Biweekly Payment Rider?

A Biweekly Payment Rider is an addendum to a loan agreement that allows borrowers to make payments every two weeks instead of monthly. This structure can lead to interest savings and faster loan payoff.

Who is required to file Biweekly Payment Rider?

Typically, borrowers who wish to take advantage of biweekly payment options must file a Biweekly Payment Rider with their lender to ensure that the payment schedule is legally recognized.

How to fill out Biweekly Payment Rider?

To fill out a Biweekly Payment Rider, borrowers should provide their loan details, including loan number, payment amounts, and the lender's information. It may require signatures from both the borrower and the lender to be valid.

What is the purpose of Biweekly Payment Rider?

The purpose of a Biweekly Payment Rider is to facilitate a biweekly payment schedule that can help borrowers pay off their loans faster while potentially reducing interest costs over the life of the loan.

What information must be reported on Biweekly Payment Rider?

The information that must be reported on a Biweekly Payment Rider includes the borrower’s name and contact information, the lender's name and contact information, loan amount, interest rate, payment schedule, and any additional terms specific to the biweekly payment arrangement.

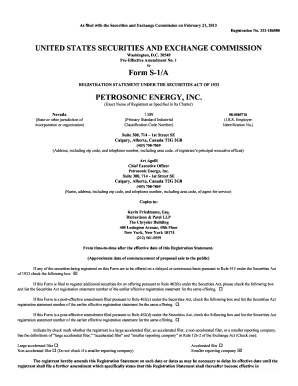

Fill out your biweekly payment rider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Biweekly Payment Rider is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.