Get the free 504 Loan Application - bhfreebusinesshelp

Show details

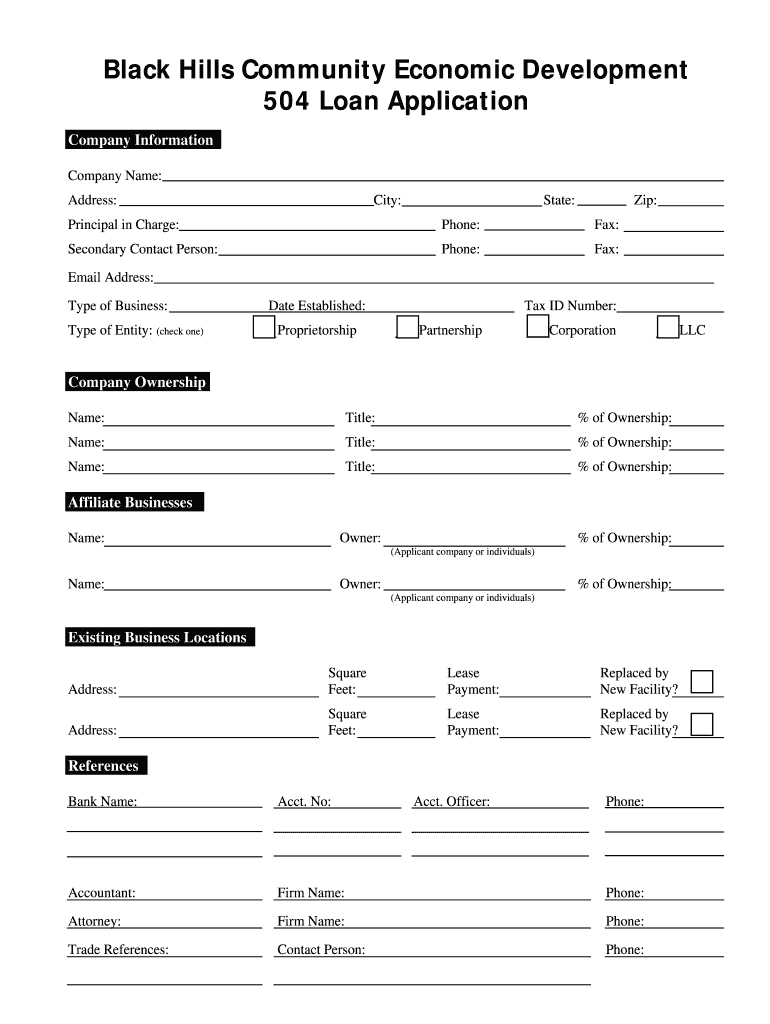

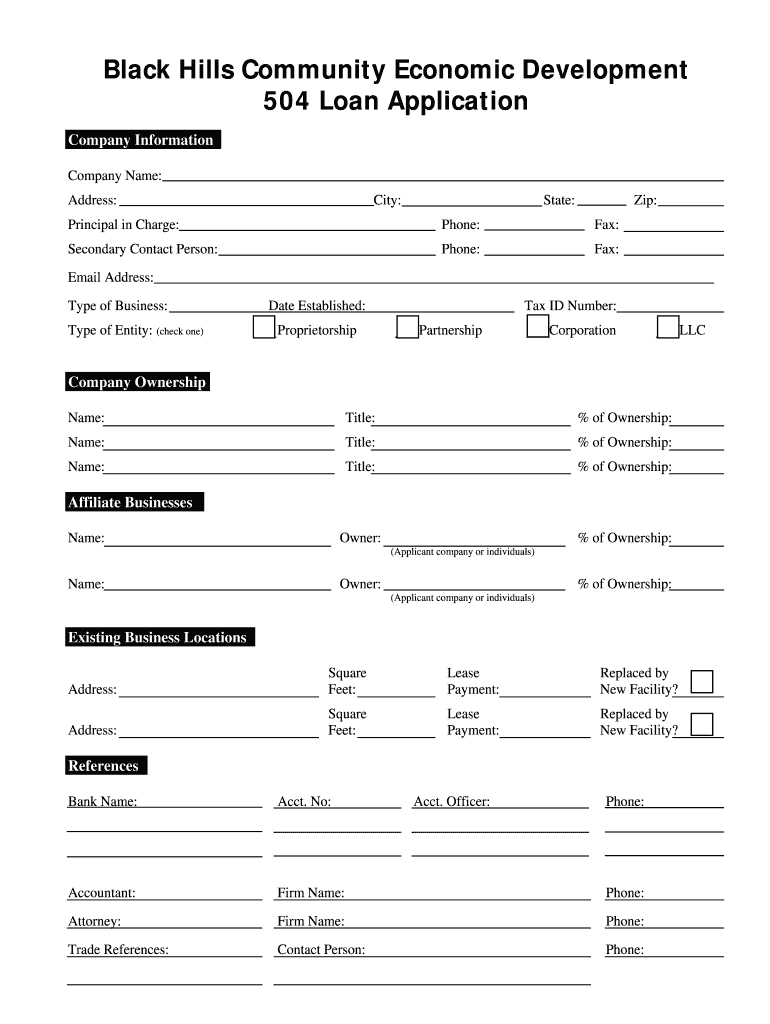

This document is a loan application form for businesses seeking funding through the Black Hills Community Economic Development organization. It gathers essential information about the company, including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 504 loan application

Edit your 504 loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 504 loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 504 loan application online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 504 loan application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 504 loan application

How to fill out 504 Loan Application

01

Gather necessary documents such as financial statements, tax returns, and business plans.

02

Obtain and complete the 504 Loan Application form, available from a Certified Development Company (CDC) or the SBA's website.

03

Provide a detailed project description including the purpose of the loan and how it will be used.

04

Prepare a summary of your business, including its history, services, and market analysis.

05

Include personal financial statements for all business owners, detailing their assets, liabilities, and net worth.

06

Outline your business's projected financial statements, including cash flow and profit and loss statements for the next two years.

07

Submit the completed application and all required documents to the CDC handling your loan.

Who needs 504 Loan Application?

01

Small businesses looking to finance land, buildings, and equipment.

02

Entrepreneurs seeking long-term financing at lower down payment levels.

03

Businesses that need assistance in acquiring fixed assets for expansion or modernization.

Fill

form

: Try Risk Free

People Also Ask about

How do I request a loan from my employer?

Yes, you can ask your employer for a loan with the intention of paying it back with interest. However, there are several factors to consider: Company Policy: Check if your employer has a formal policy regarding employee loans. Some companies may have specific guidelines or programs in place.

How to apply for a 504 loan?

The SBA 504 Loan Application Process Verify Eligibility. Check Your Credit. Find a Lender/CDC. Prequalification. Decide on Your Purchase. Complete the Application. Find a Lender. Get Your Paperwork In Order.

How to politely request for a loan?

Be Respectful and Considerate: Approach the person at a good time when they are not busy or distracted. Make Your Request Clear: Clearly state what you would like to borrow. Express Why You Need It: Briefly explain why you need the item, which can help the person feel more comfortable lending it to you.

Do SBA 504 loans require a down payment?

SBA 504/CDC loan down payments Business owners should expect to pay a minimum down payment of 10% for an SBA 504/CDC loan, with some businesses needing to provide up to 20%.

How to write loan application in English?

A Step-By-Step Guide To Writing A Personal Loan Application Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Highlight Your Creditworthiness. Include Any Collateral (If Applicable) Maintain a Professional and Courteous Tone.

How hard is it to get an SBA 504 loan?

Short Answer: Yes, it is difficult. You must meet the criteria for a program, and get approved by an SBA lender. It is not ``easy money''. Oh yes, the SBA doesn't make the loans, they back a guarantee for a regular approved SBA lender.

How do I write an application for a loan?

Tips For Loan Request Letter Review the loan guidelines and understand how they apply. Describe the reason for the loan in detail. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader. Be sure to include a repayment plan.

How do I write a letter of personal loan?

Dear Sir/Madam, With all due respect, I want to inform you that my name is “mention your name” and I need a personal loan of amount __ from your bank. I need this loan because my son's health is not good and my current financial condition is also not good.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 504 Loan Application?

The 504 Loan Application is a part of the U.S. Small Business Administration's (SBA) loan program designed to provide long-term financing to small businesses for the purchase of fixed assets, such as real estate and equipment.

Who is required to file 504 Loan Application?

Small businesses seeking to finance the purchase of fixed assets through the 504 Loan Program are required to file the 504 Loan Application.

How to fill out 504 Loan Application?

To fill out the 504 Loan Application, businesses must complete the necessary forms, provide financial statements, prepare a detailed project description, and submit any required documentation such as credit scores and business plans.

What is the purpose of 504 Loan Application?

The purpose of the 504 Loan Application is to secure financing for small businesses to acquire fixed assets that promote economic growth and job creation.

What information must be reported on 504 Loan Application?

The information that must be reported on the 504 Loan Application includes the business's financial history, creditworthiness, project costs, use of funds, and the intended impact of the loan on job creation and economic development.

Fill out your 504 loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

504 Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.