Get the free Regulation P: Privacy of Consumer Financial Information FAQs - federalreserve

Show details

Este documento contiene preguntas frecuentes sobre cómo las instituciones financieras deben cumplir con las disposiciones de privacidad de la Ley Gramm-Leach-Bliley (GLB Act) y la Regulación P.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation p privacy of

Edit your regulation p privacy of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation p privacy of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit regulation p privacy of online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit regulation p privacy of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulation p privacy of

How to fill out Regulation P: Privacy of Consumer Financial Information FAQs

01

Read through the Regulation P guidelines to understand the requirements.

02

Gather all necessary consumer information that needs to be protected.

03

Identify and document your financial institution's policies regarding consumer privacy.

04

Fill out the FAQ form step by step, providing accurate and clear information.

05

Review your answers to ensure compliance with the regulations.

06

Submit the completed FAQs as part of your consumer privacy documentation.

Who needs Regulation P: Privacy of Consumer Financial Information FAQs?

01

Financial institutions that handle consumer financial information.

02

Businesses that are required to comply with consumer privacy laws.

03

Compliance officers and legal teams in financial organizations.

04

Consumers looking for clarity on how their financial information is protected.

Fill

form

: Try Risk Free

People Also Ask about

What is Regulation P for credit unions?

A standard privacy policy needs to specify the types of personal information you collect from users. Be detailed and explicit in describing the data that is gathered, whether through direct means such as forms or signups, or indirectly through cookies or analytics tools.

What does regulation P apply to?

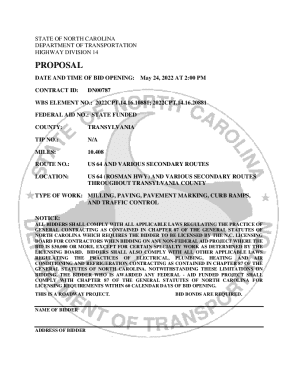

Regulation P governs the treatment of nonpublic personal information about consumers by the financial institutions for which the Board has primary supervisory authority.

What is the P privacy policy?

A privacy policy is a legal document that informs users about how you collect and handle their personal data and can have many different titles, including: Privacy Agreement. Privacy Clause. Privacy Notice.

What is Regulation P also known as?

The Privacy Act of 1974, as amended to present, including Statutory Notes (5 U.S.C. 552a), Protects records about individuals retrieved by personal identifiers such as a name, social security number, or other identifying number or symbol.

How to comply with the privacy of consumer financial information?

A financial institution must provide a notice of its privacy policies and practices with respect to both affiliated and nonaffiliated third parties, and allow the consumer to opt out of the disclosure of the consumer's nonpublic personal information to a nonaffiliated third party if the disclosure is outside of the

What is regulation P privacy of consumer financial information?

The regulation requires a financial institution to disclose its policies and practices for protecting the confidentiality, security, and integrity of nonpub- lic personal information about consumers (whether or not they are customers).

What is the Public law privacy Act?

Regulation P, section 1016.10 prohibits a credit union from disclosing any nonpublic personal information about a consumer to a nonaffiliated third party. What is a nonaffiliated third party? A nonaffiliated third party is any person or company that is not controlled by or under common control with the credit union.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Regulation P: Privacy of Consumer Financial Information FAQs?

Regulation P implements the Gramm-Leach-Bliley Act and establishes rules for financial institutions regarding the disclosure of consumers' nonpublic personal information.

Who is required to file Regulation P: Privacy of Consumer Financial Information FAQs?

Financial institutions, including banks, credit unions, and other entities that provide financial products or services to consumers, are required to comply with Regulation P.

How to fill out Regulation P: Privacy of Consumer Financial Information FAQs?

To fill out Regulation P FAQs, institutions should gather relevant consumer information, assess their privacy policies, and ensure accurate disclosure of how consumer data is used and shared.

What is the purpose of Regulation P: Privacy of Consumer Financial Information FAQs?

The purpose of Regulation P is to protect consumer privacy by ensuring that financial institutions provide clear notices of their information-sharing practices and allow consumers to opt-out of certain disclosures.

What information must be reported on Regulation P: Privacy of Consumer Financial Information FAQs?

Institutions must report information related to their privacy notices, data sharing policies, and the measures taken to protect consumer information under Regulation P.

Fill out your regulation p privacy of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation P Privacy Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.